Traditional to Roth Conversion Form New Direction IRA Inc

What is the Traditional To Roth Conversion Form New Direction IRA Inc

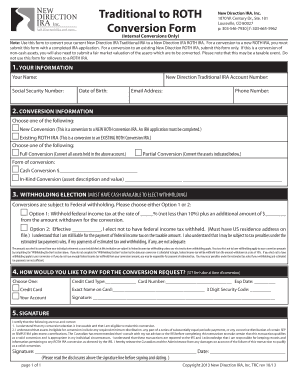

The Traditional To Roth Conversion Form from New Direction IRA Inc is a specific document used by individuals wishing to convert their traditional IRA funds into a Roth IRA. This form is essential for initiating the conversion process, allowing account holders to transfer their retirement savings from a tax-deferred account to a tax-free account. The conversion can provide long-term tax benefits, as qualified withdrawals from a Roth IRA are tax-free in retirement. Understanding the purpose of this form is crucial for anyone considering a conversion to ensure compliance with IRS regulations and to maximize the potential benefits of their retirement savings.

Steps to complete the Traditional To Roth Conversion Form New Direction IRA Inc

Completing the Traditional To Roth Conversion Form involves several key steps. First, gather all necessary personal information, including your Social Security number and account details. Next, indicate the amount you wish to convert from your traditional IRA to a Roth IRA. It's important to understand the tax implications of the conversion, as the amount converted will be subject to income tax in the year of conversion. After filling out the form, review all information for accuracy before signing. Finally, submit the completed form according to the instructions provided by New Direction IRA Inc, ensuring you adhere to any specific submission methods outlined.

Legal use of the Traditional To Roth Conversion Form New Direction IRA Inc

The Traditional To Roth Conversion Form is legally recognized as a valid document for initiating a conversion between retirement accounts. It adheres to IRS guidelines, ensuring that individuals comply with federal regulations regarding IRA conversions. Proper completion and submission of this form are essential to avoid potential penalties or tax complications. It's advisable to consult with a tax professional to understand the legal implications fully and to ensure that the conversion aligns with your overall financial strategy.

Eligibility Criteria

To utilize the Traditional To Roth Conversion Form, individuals must meet specific eligibility criteria set forth by the IRS. Primarily, there are no income limits for converting a traditional IRA to a Roth IRA, making it accessible to a wide range of taxpayers. However, individuals should consider their current tax situation, as the amount converted will be added to their taxable income for the year. It's also important to ensure that the funds being converted are eligible for transfer and that any required waiting periods have been observed if applicable.

Required Documents

When completing the Traditional To Roth Conversion Form, certain documents are typically required to ensure a smooth conversion process. Key documents may include proof of identity, such as a driver's license or Social Security card, and any relevant account statements from the traditional IRA. Additionally, having recent tax returns on hand can help assess the tax implications of the conversion. Gathering these documents in advance can streamline the process and reduce the likelihood of delays.

Form Submission Methods

The Traditional To Roth Conversion Form can be submitted through various methods as specified by New Direction IRA Inc. Common submission options include online submission through the company’s secure portal, mailing the completed form to their designated address, or delivering it in person to a local office. Each method has its own processing times, so individuals should choose the option that best fits their needs while ensuring that the form is submitted before any relevant deadlines.

Quick guide on how to complete traditional to roth conversion form new direction ira inc

Easily Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related operation today.

How to Modify and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Traditional To Roth Conversion Form New Direction IRA Inc

Create this form in 5 minutes!

How to create an eSignature for the traditional to roth conversion form new direction ira inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What happens when you convert traditional IRA to Roth?

By converting to a Roth IRA, you'll have assets that won't be taxed when withdrawn, potentially allowing you to better manage your tax brackets and enable more personalized tax planning during retirement.

-

What is the downside of Roth conversion?

Since a Roth conversion increases taxable income in the conversion year, drawbacks can include a higher tax bracket, more taxes on Social Security benefits, higher Medicare premiums, and lower college financial aid.

-

Can you transfer traditional IRA to Roth IRA without paying taxes?

When you convert a traditional IRA to a Roth IRA, you pay taxes on the money you convert in order to secure tax-free withdrawals as well as several other benefits, including no required minimum distributions, in the future.

-

What form do I need to convert IRA to Roth?

Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs. Distributions from traditional, SEP, or SIMPLE IRAs, if you have ever made nondeductible contributions to traditional IRAs. Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs.

-

Should I receive a 1099-R for a Roth conversion?

A taxpayer who converted a traditional IRA to a Roth IRA will be issued Form 1099-R showing the total distribution from the traditional IRA. A Roth IRA conversion must be reported on Form 8606.

-

How to enter traditional IRA to Roth conversion in TurboTax?

Enter the information from your 1099-R. Answer questions until you get to “What Did You Do With The Money” and choose “I moved it to another retirement account” Then choose “I did a combination of rolling over, converting, or cashing out money.” and enter the amount next to "Amount converted to a Roth IRA account"

-

What form do I use to convert traditional IRA to Roth IRA?

Conversions from a traditional IRA to a Roth IRA are reported on Form 1099‑R.

-

How do you convert a traditional IRA to a Roth IRA?

Tell your traditional IRA provider that you'd like to transfer the money directly to your Roth IRA provider. If both IRAs are at the same firm, you can ask your financial institution to transfer a specific amount from your traditional IRA to your Roth IRA. This method is called a same-trustee or direct transfer.

Get more for Traditional To Roth Conversion Form New Direction IRA Inc

- 010 bona fide establishment place of business sos mo form

- Duran indictment department of justice justice form

- Required to submit a health insurance claim form to medicare justice

- Post payment review cms form

- Maritime administration u s department of marad dot form

- Form 5500 ez annual return of a one participant owners

- Form 6765 rev december credit for increasing research activities

- Psa to tx agents there is a new contract mandatory for form

Find out other Traditional To Roth Conversion Form New Direction IRA Inc

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document