Sale, Financing, Settlement or Lease of Other Real Estate Form

Understanding the Maryland Conventional Financing Addendum

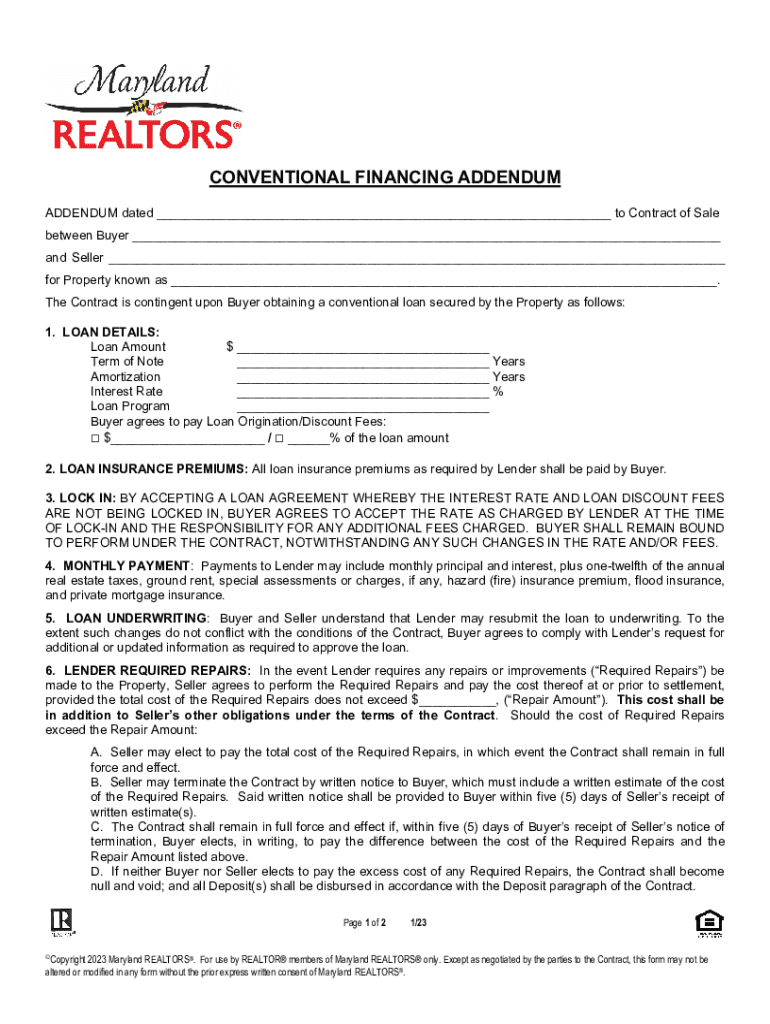

The Maryland conventional financing addendum is a crucial document used in real estate transactions. It outlines the terms and conditions related to financing when purchasing property. This addendum is typically attached to the main sales contract and provides clarity on the financing method chosen by the buyer. By specifying details such as loan types, interest rates, and contingencies, it helps both buyers and sellers understand their obligations and rights throughout the transaction process.

Key Elements of the Maryland Conventional Financing Addendum

Several key elements are included in the Maryland conventional financing addendum. These elements ensure that all parties involved are aware of the financing terms. Important components often include:

- Loan type: Specifies whether the financing is through a conventional loan, FHA, VA, or other types.

- Loan amount: Details the specific amount being financed.

- Interest rate: Indicates the agreed-upon interest rate for the loan.

- Contingencies: Outlines any conditions that must be met for the financing to proceed.

- Closing date: States when the financing must be finalized.

Steps to Complete the Maryland Conventional Financing Addendum

Completing the Maryland conventional financing addendum involves several steps to ensure accuracy and compliance. The following steps are typically recommended:

- Review the main sales contract to understand the context of the financing.

- Gather necessary financial information, including loan type and amount.

- Fill out the addendum with accurate details regarding the financing terms.

- Ensure all parties review the addendum for accuracy and clarity.

- Sign and date the addendum to make it legally binding.

Legal Use of the Maryland Conventional Financing Addendum

The Maryland conventional financing addendum is legally binding once signed by all parties involved. It is important to ensure that the document complies with state laws and regulations. This addendum protects the interests of both the buyer and seller by clearly defining the financing arrangement. Failure to adhere to the terms outlined in the addendum may result in legal disputes or complications during the closing process.

State-Specific Rules for the Maryland Conventional Financing Addendum

Maryland has specific rules governing the use of the conventional financing addendum. These rules may include requirements for disclosures, timelines for financing approval, and the necessity of including certain clauses within the addendum. It is essential for both buyers and sellers to be aware of these regulations to avoid potential pitfalls in their real estate transactions.

Examples of Using the Maryland Conventional Financing Addendum

Real-world scenarios illustrate the importance of the Maryland conventional financing addendum. For instance, if a buyer is securing a conventional loan for a home purchase, the addendum will specify the loan amount and terms. In another case, if a seller is considering multiple offers, having a clear addendum can help them evaluate the financial readiness of potential buyers. These examples highlight how the addendum serves as a vital tool in facilitating smooth real estate transactions.

Quick guide on how to complete sale financing settlement or lease of other real estate

Finalize Sale, Financing, Settlement Or Lease Of Other Real Estate seamlessly on any platform

Web-based document management has gained traction among companies and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Sale, Financing, Settlement Or Lease Of Other Real Estate on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign Sale, Financing, Settlement Or Lease Of Other Real Estate effortlessly

- Obtain Sale, Financing, Settlement Or Lease Of Other Real Estate and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that function.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Sale, Financing, Settlement Or Lease Of Other Real Estate to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sale financing settlement or lease of other real estate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HOA contingency in Maryland?

6. Homeowners Association (HOA) Contingency. If the property is part of an HOA, this contingency allows the buyer to review the HOA's rules, regulations, and financial health. If they find any issues that they cannot accept, they may withdraw from the contract.

-

What are the normal contingencies for home purchase?

Some of the most common real estate contingencies include appraisal, mortgage, title and home inspection contingencies. Many home buyers also include a sale of prior home contingency, which allows them to withdraw an offer if they are unable to sell their current home within a specified timeframe.

-

What is the seller's home of choice addendum in Maryland?

Seller's Home of Choice Addendum This Addendum allows the Seller to make the Contract contingent upon the Seller's purchase, financing, settlement, or lease of a new property.

-

What is a home of choice contingency?

A Home of Choice contingency allows you to sell your home to a buyer with the option to back out of the agreement and stay in your home if you're unable to find a new home within your Home of Choice contingency period.

-

What is the difference between for lease and for sale?

A sale involves the transfer of ownership of goods for a price, while a lease involves giving someone the right to use the property for a specific period of time in return for payment.

-

What is the home of choice contingency in Maryland?

What is a home of choice contingency in a real estate contract? A home of choice contingency is a contingency that protects a seller from having to sell their current home if they haven't found their next home. This way a seller can sell their home and just in case they can't find a new home they like and be protected.

-

What is a 48 hour contingency in real estate?

If a second buyer submits an acceptable offer, buyer #1 has 48 hours to either remove their home sale contingency and move forward or step aside, allowing buyer #2 to purchase the home.

-

What is a settlement contingency in real estate?

With a settlement contingency, the buyer already has a contract in hand and an agreed settlement date. Since the home sale isn't final until the closing or settlement occurs, the settlement contingency protects the buyer if the agreement falls through.

Get more for Sale, Financing, Settlement Or Lease Of Other Real Estate

- Ncbe character report 2014 form

- Cms pub 100 04 medicare claims processing transmittal 2435 form

- Nj first report of injury form fillable

- Application to board of appeals for variance incorporated village form

- Provider eft form for tricare west

- Humana warrant office us army form

- Tricare for life eft authorization form

- Moaa claim form

Find out other Sale, Financing, Settlement Or Lease Of Other Real Estate

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe