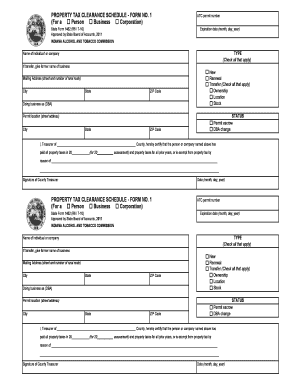

Property Tax Clearance Schedule Double Co Putnam in Form

Understanding the Property Tax Clearance Form

The property tax clearance form is a crucial document that certifies an individual or business has paid all property taxes owed to the local government. This form is often required during real estate transactions, ensuring that the property is free from tax liens. In Indiana, for example, the Indiana property tax clearance form 1 is a specific version used to fulfill these requirements. It serves as proof that the property owner is in good standing with tax obligations, which can facilitate smoother transactions in both sales and refinancing situations.

Steps to Complete the Property Tax Clearance Form

Filling out the property tax clearance form involves several key steps:

- Gather necessary information, including property details and tax identification numbers.

- Obtain the correct version of the form, such as the Indiana state form 1462, if applicable.

- Complete the form accurately, ensuring all required fields are filled out.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate local tax authority.

Following these steps can help ensure that the form is processed efficiently, reducing the likelihood of delays in property transactions.

Required Documents for the Property Tax Clearance Form

To successfully complete the property tax clearance form, certain documents are typically required. These may include:

- Proof of property ownership, such as a deed or title.

- Recent tax statements or receipts demonstrating payment of property taxes.

- Identification, such as a driver's license or social security number.

Having these documents ready can streamline the process and help avoid potential issues during submission.

Who Issues the Property Tax Clearance Form

The property tax clearance form is generally issued by local tax authorities or county treasurers. In Indiana, for instance, the county auditor's office typically handles the issuance of the Indiana property tax clearance form 1. It is essential to contact the relevant local office to obtain the correct form and understand any specific requirements or procedures that may apply.

Legal Use of the Property Tax Clearance Form

The legal implications of the property tax clearance form are significant. This document serves as a legal affirmation that all property taxes have been paid, protecting both buyers and sellers in real estate transactions. Failure to provide a valid clearance form can result in delays, penalties, or complications in the transfer of property ownership. It is advisable for all parties involved in a transaction to ensure that the form is obtained and verified before proceeding with any sale or purchase.

Penalties for Non-Compliance

Not obtaining or submitting the property tax clearance form can lead to various penalties. These may include:

- Fines imposed by local tax authorities.

- Increased interest on unpaid taxes.

- Delays in property transactions, which can affect financing and ownership transfer.

Understanding these potential consequences highlights the importance of timely compliance with property tax obligations and the proper completion of the clearance form.

Quick guide on how to complete property tax clearance schedule double co putnam in

Effortlessly prepare Property Tax Clearance Schedule Double Co Putnam In on any gadget

Digital document management has grown increasingly favored by companies and individuals alike. It serves as an excellent environmentally-friendly substitute for conventional printed and signed papers, as you can easily access the right form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Property Tax Clearance Schedule Double Co Putnam In on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Property Tax Clearance Schedule Double Co Putnam In with ease

- Find Property Tax Clearance Schedule Double Co Putnam In and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal authority as a standard ink signature.

- Verify the details and hit the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Property Tax Clearance Schedule Double Co Putnam In to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax clearance schedule double co putnam in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What county in Indiana has the highest property tax rate?

Eighteen of the 20 highest property tax rates are in Lake and St. Joseph counties, led by the Gary-Calumet Township–Gary Schools district at 8.3101 percent. At the other end of the spectrum, 15 of the 20 lowest property tax rates are found in Steuben and Kosciusko counties, with rates below 1.5 percent.

-

What will the property taxes be in 2024 in Indiana?

Indiana's Gateway system has already reported net assessed values for 2024. For all property, net assessments will rise 6 percent, less than half of last year's increase. The statewide increase for homesteads is just 4 percent, way less than last year's 21 percent.

-

At what age do seniors stop paying property taxes in Indiana?

Over 65 or Surviving Spouse Deduction The lower the assessed value of your home, the smaller your property tax bill. You must meet these requirements to receive the deduction: Turned 65 or older by December 31 of the prior year.

-

Are taxes changing in 2024?

Other 2024 tax changes Alternative minimum tax (AMT): The Alternative Minimum Tax exemption amount for 2024 is $85,700 (up from $81,300) and begins to phase out at $609,350. The AMT exemption for married couples filing jointly is $133,300 (up from $126,500) and begins to phase out at $1,218,700.

-

Have property taxes increased in Indiana?

In 2023, experts say Indiana homeowners were hit with a signNow property tax increase, up 17% on average.

-

How long can you go without paying property taxes in Indiana?

For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property, the penalty is 5 percent of the unpaid tax. If you fail to pay your taxes and the penalty within 30 days, the penalty increases to 10 percent of the unpaid tax.

-

What is the property tax rate in Putnam County Indiana?

The median property tax rate in Putnam County is 0.77%, which is lower than both the national median of 0.99% and the Indiana state median of 0.99%.

-

What county in Indiana has the highest property tax rate?

Eighteen of the 20 highest property tax rates are in Lake and St. Joseph counties, led by the Gary-Calumet Township–Gary Schools district at 8.3101 percent. At the other end of the spectrum, 15 of the 20 lowest property tax rates are found in Steuben and Kosciusko counties, with rates below 1.5 percent.

Get more for Property Tax Clearance Schedule Double Co Putnam In

- Bank of america forms 3rd party authorization

- Bank draft form

- Custodial statement and agreement third party custody form

- Embry riddle letter recommendation form

- Zanesville ohio building code form

- Mentee application sample form

- Prince georges county third party inspection program 2005 form

- Georgia athlete agent form

Find out other Property Tax Clearance Schedule Double Co Putnam In

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile