BAE Systems Pension Scheme 'the Form

Understanding the BAE Systems Pension Scheme

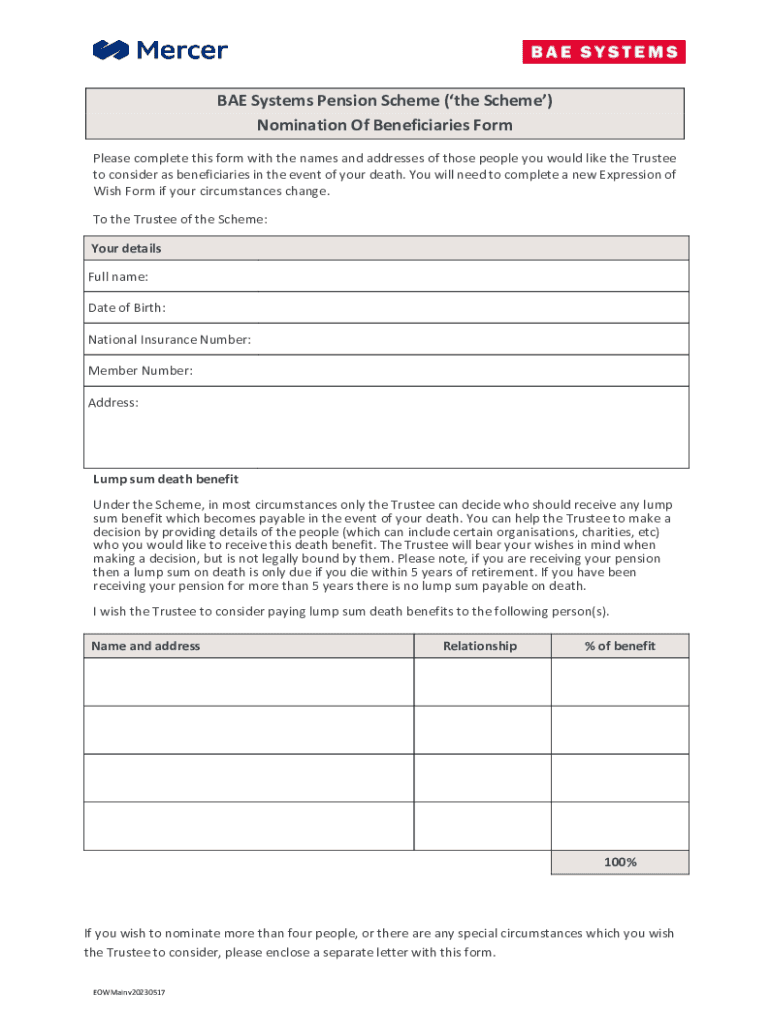

The BAE Systems Pension Scheme is a retirement plan designed to provide financial security for employees of BAE Systems. This scheme typically includes defined benefits, which means that the retirement income is calculated based on factors such as salary history and years of service. Understanding the specifics of this pension scheme is crucial for employees to make informed decisions regarding their retirement planning.

Key features often include contributions from both the employee and employer, with the latter typically matching or exceeding employee contributions. The scheme may also offer options for early retirement, survivor benefits, and various payout methods, such as lump-sum distributions or annuities.

Steps to Utilize the BAE Systems Pension Scheme

To effectively utilize the BAE Systems Pension Scheme, employees should follow a series of steps:

- Review Eligibility: Confirm eligibility based on employment status and tenure with BAE Systems.

- Understand Contribution Rates: Familiarize yourself with the contribution rates set by both the employee and employer.

- Select Investment Options: Choose from available investment options if the scheme allows for self-directed investments.

- Monitor Your Account: Regularly check your pension account statements to track contributions and growth.

- Plan for Retirement: Consider your retirement goals and how the pension scheme fits into your overall financial strategy.

Obtaining Information on the BAE Systems Pension Scheme

Employees can obtain information regarding the BAE Systems Pension Scheme through several channels:

- Company Resources: Access internal company portals or human resources departments for official documentation and guidance.

- Employee Handbooks: Review the employee handbook for detailed explanations of the pension scheme's structure and benefits.

- Financial Advisors: Consult with financial advisors who specialize in retirement planning to understand how the pension scheme fits into your financial landscape.

Key Elements of the BAE Systems Pension Scheme

Several key elements define the BAE Systems Pension Scheme:

- Defined Benefits: The scheme typically offers a guaranteed payout based on specific criteria.

- Contribution Matching: Employers often match employee contributions, enhancing the overall retirement savings.

- Vesting Period: Employees may need to meet a vesting period to qualify for full benefits.

- Survivor Benefits: Options may be available for beneficiaries in the event of the employee's passing.

Legal Considerations for the BAE Systems Pension Scheme

Understanding the legal framework surrounding the BAE Systems Pension Scheme is essential for compliance and protection of rights:

The scheme must adhere to federal regulations, including the Employee Retirement Income Security Act (ERISA), which sets standards for pension plans in private industry. Employees should be aware of their rights regarding disclosure of plan information, participation, and benefits. Additionally, any changes to the scheme must be communicated transparently to all members.

Eligibility Criteria for the BAE Systems Pension Scheme

Eligibility for the BAE Systems Pension Scheme generally depends on several factors:

- Employment Status: Typically, only full-time employees are eligible.

- Tenure: Employees may need to complete a certain period of service before qualifying for benefits.

- Age Requirements: Some plans may have minimum age requirements for participation.

Quick guide on how to complete bae systems pension scheme the

Complete BAE Systems Pension Scheme 'the effortlessly on any device

Managing documents online has surged in popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle BAE Systems Pension Scheme 'the on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign BAE Systems Pension Scheme 'the with ease

- Obtain BAE Systems Pension Scheme 'the and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign BAE Systems Pension Scheme 'the and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bae systems pension scheme the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who has the best pension system?

What country has the best retirement system? Netherlands (score of 84.8/100) No. Iceland (83.4) No. Denmark (81.6)

-

Which pension pays the most?

Top 10 performing pension funds (Growth) Pension fundInvestment optionReturn Hostplus Balanced 9.2% AustralianSuper Balanced 8.8% Australian Retirement Trust Balanced (ART – Super Savings) 8.7% UniSuper Balanced 8.6%6 more rows

-

How much is a BAE pension?

Base Pension Level is either 1.25%, 1.67%, 1.87% or 2.00% and is the basis upon which your pension builds up each year. The rate, together with your Contribution Earnings and Basic Salary, determines the value of the Individual Pension Percentage you accrue each year.

-

How good is the Bae pension?

BAE Systems Pension Plan The pension seems reasonable and largely generic compared to other companies. The days of the 'final pension' are gone. It's not fantastic but not awful. For base you contribute 4% they do 6%.

-

What is level 200 of the BAE Systems pension scheme?

Level 200: Earns pension based on a target rate of 2.00% a year Employee contribution of 12.59% of Contribution Earnings Page 2 © 2023 BAE Systems. All Rights Reserved 2 Your member contributions are automatically paid through SMART Pensions (not including any Additional Voluntary Contributions you may pay).

-

What company pays the best pension?

Many employers offer 401(k) plans to their employees. However, quality varies: some plans are more generous, and some are less so. ConocoPhillips, Boeing, Amgen, Philip Morris, and Citigroup have some of the best plans available.

-

How do I contact the BAE Systems pension scheme?

Members of the MMT – BAE Systems Retirement Savings Plan should contact Scottish Widows on 0800 015 2038. For all other BAE System Pension scheme members you will need to contact the Aptia on +44 (0) 3308 187 282. Please refer to the Contact Us page.

-

What is the Bae pension scheme?

The BAE Systems Pension Scheme is a valuable. part of your remuneration package from the. Company. The Scheme provides you with a. range of benefits to support you and your family both now and in the future.

Get more for BAE Systems Pension Scheme 'the

- City of lakeland building inspection divisionally form

- Inside the vault entrepreneurship lesson plan financeintheclassroom form

- Missouri department of transportation instructions for completing a blanket permit application form

- Notice of intent to obtain title state nj form

- Swimmer registration packet home city swim project form

- Lettervote yes for the si view metropolitan parks district form

- Bpersonal financialb affairs bstatementb public disclosure commission pdc wa form

- Automobile insurance acceptance formpub read only

Find out other BAE Systems Pension Scheme 'the

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed