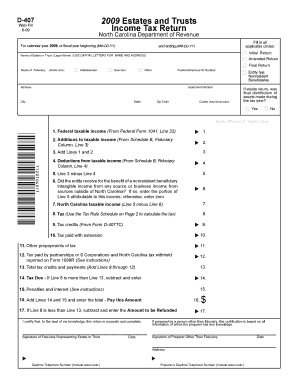

Federal Taxable Income from Federal Form 1041, Line 22

Understanding Federal Taxable Income From Federal Form 1041, Line 22

The Federal Taxable Income from Federal Form 1041, Line 22, represents the net income of an estate or trust after deductions. This figure is crucial for determining the tax liability of the entity. It is calculated by taking the total income reported on the form and subtracting allowable deductions, which may include administrative expenses, distributions to beneficiaries, and other relevant costs. Understanding this line is essential for accurate tax reporting and compliance.

Steps to Complete Federal Form 1041, Line 22

To accurately fill out Line 22 of Federal Form 1041, follow these steps:

- Gather all income sources for the estate or trust, including interest, dividends, and rental income.

- Compile all allowable deductions, such as expenses related to managing the estate, distributions to beneficiaries, and any other applicable costs.

- Calculate the total income and total deductions separately.

- Subtract the total deductions from the total income to arrive at the Federal Taxable Income, which you will enter on Line 22.

Legal Use of Federal Taxable Income From Federal Form 1041, Line 22

The Federal Taxable Income reported on Line 22 is used to determine the tax obligations of estates and trusts under U.S. tax law. This income is subject to specific tax rates applicable to estates and trusts, which can differ from individual tax rates. Accurate reporting is necessary to avoid penalties and ensure compliance with IRS regulations. The taxable income also impacts the amount that beneficiaries may receive after taxes are accounted for.

IRS Guidelines for Federal Form 1041

The IRS provides specific guidelines for completing Federal Form 1041, including how to report income and deductions. These guidelines outline what constitutes taxable income and the types of deductions that can be claimed. It is important to refer to the latest IRS instructions for Form 1041 to ensure compliance and accuracy. Following these guidelines helps mitigate the risk of errors that could lead to audits or penalties.

Examples of Federal Taxable Income From Federal Form 1041, Line 22

Understanding how to calculate Federal Taxable Income can be aided by examples. For instance, if an estate has total income of $50,000 and allowable deductions of $20,000, the taxable income reported on Line 22 would be $30,000. Another example could involve an estate with $100,000 in income and $40,000 in deductions, resulting in a taxable income of $60,000. These examples illustrate the straightforward calculation process and the importance of accurate reporting.

Required Documents for Filing Federal Form 1041

When preparing to file Federal Form 1041, it is essential to gather necessary documentation, including:

- Income statements for the estate or trust, such as Form 1099s and K-1s.

- Records of all deductions, including receipts for administrative expenses and distributions.

- Prior year tax returns, if applicable, to ensure consistency and accuracy.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Quick guide on how to complete federal taxable income from federal form 1041 line 22

Complete [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an optimal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate template and safely store it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and eSign your documents promptly without delays. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to adjust and eSign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over misplaced or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Adjust and eSign [SKS] and guarantee exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal Taxable Income From Federal Form 1041, Line 22

Create this form in 5 minutes!

How to create an eSignature for the federal taxable income from federal form 1041 line 22

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do you have to pay federal income tax on a trust?

Trusts owe taxes and are subject to tax rates established at the federal, state, and local levels.

-

What is the IRS form 1041 for dummies?

It shows the taxpayer's share of income as the beneficiary of an estate or trust. The electronic/magnetic media filing of Forms 1041 includes returns filed on magnetic media (magnetic tape or floppy diskette) or electronically.

-

What is considered taxable income for form 1041?

What is considered income for Form 1041? Income generated between the estate owner's death and the transfer of assets to the beneficiary can come from stocks, bonds, rented property, mutual funds, final paychecks, or savings accounts.

-

How to avoid taxes on trust distributions?

Typically this comes in the form of income taxes which either the trust pays or your heirs pay when they receive distributions. You can mitigate that through the use of an intentionally defective grantor trust, or IDGT. This is an irrevocable trust into which you place assets, again shielding them from estate taxes.

-

Can trusts deduct federal income tax?

Most deductions and credits allowed to individuals are also allowed to estates and trusts. However, there is one major distinction. A trust or decedent's estate is allowed an income distribution deduction for distributions to beneficiaries. To figure this deduction, the fiduciary must complete Schedule B.

-

What is line 22 on IRS Form 1040?

Adjusted gross income (AGI) is defined as total income (line 22, Form 1040) minus statutory adjustments (line 36, Form 1040).

-

How is federal income taxed in trusts?

Federal trust income tax rates for 2023 were: For trust income between $0 to $2,900: 10% of income over $0. For trust income between $2,901 to $10,550: $290 + 24% of the amount over $2,901. For trust income between $10,551 to $14,450: $2,126 + 35% of the amount over $10,551.

-

What is the trust tax loophole?

The trust fund loophole lets you transfer assets to your heirs without paying the capital gains tax. High-income earners pay the highest capital gains tax rate.

Get more for Federal Taxable Income From Federal Form 1041, Line 22

- Reports ampamp formsbakersfield ca official website

- Changes to california business entity filings effective form

- International diploma verification form pdf

- Application to change contractor business name form

- San francisco flower mart badge renewal form

- Tsp loan application 958089 form

- Indianapolis airport authority work permit application form

- Monthly payroll report for electrical bb form

Find out other Federal Taxable Income From Federal Form 1041, Line 22

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online