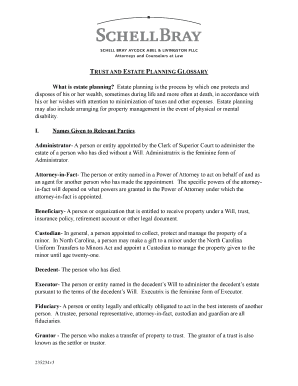

TRUST and ESTATE PLANNING GLOSSARY Form

Understanding the Trust and Estate Planning Glossary

The Trust and Estate Planning Glossary serves as a comprehensive resource for individuals navigating the complexities of estate planning. It includes definitions of key terms, concepts, and processes that are essential for understanding how to effectively manage and distribute assets after death. This glossary helps demystify legal jargon, making it accessible for everyone, regardless of their prior knowledge of estate planning.

Key Elements of the Trust and Estate Planning Glossary

Several critical components are included in the Trust and Estate Planning Glossary. These elements provide clarity on various aspects of estate planning:

- Trust: A legal arrangement where one party holds property for the benefit of another.

- Will: A legal document that outlines how a person's assets should be distributed after their death.

- Executor: An individual appointed to carry out the terms of a will.

- Beneficiary: A person or entity entitled to receive assets from a trust or estate.

- Probate: The legal process of validating a will and distributing assets under court supervision.

How to Use the Trust and Estate Planning Glossary

Utilizing the Trust and Estate Planning Glossary effectively can enhance your understanding of estate planning. Start by identifying specific terms or concepts you wish to learn more about. Use the glossary to find definitions and explanations that clarify these terms. This approach not only aids in comprehending your own estate planning documents but also empowers you to communicate more effectively with legal professionals.

Examples of Using the Trust and Estate Planning Glossary

Practical examples can illustrate how the Trust and Estate Planning Glossary can be applied:

- A person preparing their will may refer to the glossary to understand terms like "executor" and "beneficiary" to ensure they appoint the right individuals.

- Individuals exploring trust options can use the glossary to differentiate between revocable and irrevocable trusts, aiding in their decision-making process.

- When discussing estate planning with a lawyer, referencing the glossary can help clarify any confusing terms that arise during conversations.

Legal Use of the Trust and Estate Planning Glossary

The Trust and Estate Planning Glossary is not just a tool for education; it also has legal implications. Understanding the terminology used in estate planning can prevent misunderstandings and errors in legal documents. Accurate use of terms ensures that all parties involved have a clear understanding of their rights and responsibilities, which is crucial in legal contexts.

State-Specific Rules for the Trust and Estate Planning Glossary

Estate planning laws vary significantly by state, making it essential to consult state-specific resources alongside the Trust and Estate Planning Glossary. Each state may have unique requirements regarding wills, trusts, and probate processes. Familiarizing yourself with these rules can help ensure compliance and avoid legal complications.

Quick guide on how to complete trust and estate planning glossary

Prepare [SKS] effortlessly on any device

Online document management has become widespread among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents promptly without holdups. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to alter and eSign [SKS] without any hassle

- Locate [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from your preferred device. Alter and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to TRUST AND ESTATE PLANNING GLOSSARY

Create this form in 5 minutes!

How to create an eSignature for the trust and estate planning glossary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5 or 5 rule in estate planning?

The “5 by 5 Power” is simply a way to provide some parameters around the access a beneficiary has to the funds in a trust. It basically means that in each calendar year, they have access to $5,000 or 5% of the trust assets, whichever is greater.

-

What is the biggest mistake parents make when setting up a trust fund?

If you don't put the right protections in place upfront, your children's inheritance could evaporate, get wasted, or be tied up in legal battles. Of all the mistakes we see parents make when creating trusts, none wreaks more havoc than appointing an unqualified trustee to manage the fund.

-

What is the biggest mistake parents make when setting up a trust fund?

If you don't put the right protections in place upfront, your children's inheritance could evaporate, get wasted, or be tied up in legal battles. Of all the mistakes we see parents make when creating trusts, none wreaks more havoc than appointing an unqualified trustee to manage the fund.

-

What is the best trust to avoid estate tax?

One type of trust that helps protect assets is an intentionally defective grantor trust (IDGT). Any assets or funds put into an IDGT aren't taxable to the grantor (owner) for gift, estate, generation-skipping transfer tax, or trust purposes.

-

What is the 5 by 5 rule in estate planning?

A 5 by 5 power clause in a trust document gives the beneficiary the right to withdraw either $5,000 or 5% of the fair market value of the trust account per year, whichever is greater. This is in addition to the regular income payout benefit of the trust.

-

What happens if a trustee refuses to give beneficiary money?

A beneficiary can sue a trustee for bsignNow of fiduciary duty if the trustee fails to distribute trust assets as required by the trust instrument. When a trustee accepts an appointment, a “fiduciary” relationship is created between the trustee and the trust's beneficiaries.

-

What are the 7 steps in the estate planning process?

How to Tackle Estate-Planning Basics in 7 Steps Step 1: Find a Qualified Attorney. ... Step 2: Take Stock of Your Assets. ... Step 3: Identify Key Individuals. ... Step 4: Know the Key Documents You Need. ... Step 5: Manage Your Documents. ... Step 6: Don't Neglect the Softer Side of Estate Planning. ... Step 7: Plan to Keep Your Plan Current.

-

What is the difference between estate planning and a trust?

Trusts and estates are the two main legal structures for transferring assets to your heirs and beneficiaries. Each works in critically different ways. Estates make a one-time transfer of your assets after death. Trusts, meanwhile, allow you to create an ongoing transfer of assets both before and after death.

Get more for TRUST AND ESTATE PLANNING GLOSSARY

- Parent s approval and student waiver form

- Our lady of fatima edge registration form olfchurch

- Sunburst youth academy reviews form

- 9025 balboa ave suite 130 san diego ca ipsb form

- Www uslegalforms comform library310402 arthurarthur f mcintyre scholarship program packet us legal forms

- Owner supplied material disclaimer form

- Application for ada paratransit service access alameda form

- Musical performances awards ampampamp honors the bands of

Find out other TRUST AND ESTATE PLANNING GLOSSARY

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter