Joint Account Supplement to the Family of First Investors Funds Form

What is the Joint Account Supplement To The Family Of First Investors Funds

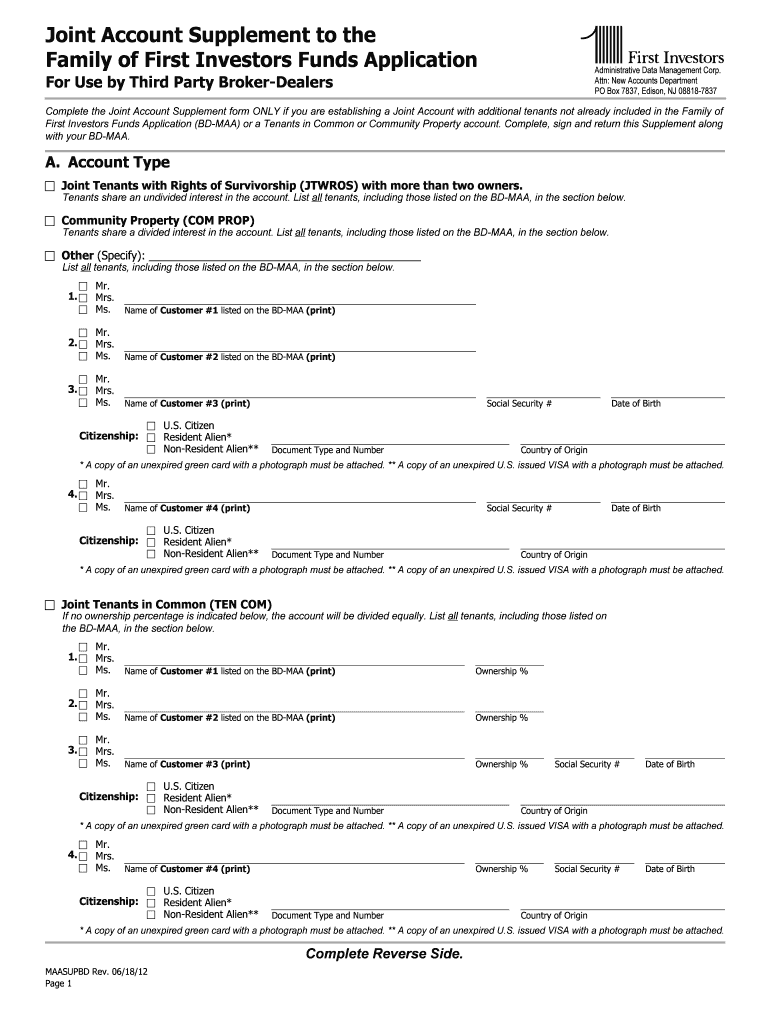

The Joint Account Supplement To The Family Of First Investors Funds is a specific form designed for individuals who wish to open a joint investment account within the First Investors Funds family. This supplement allows multiple parties to manage and invest funds collectively, facilitating shared financial goals. It outlines the responsibilities and rights of each account holder, ensuring clarity in ownership and management of the account. Understanding this supplement is crucial for anyone considering joint investments, as it lays the groundwork for cooperation and mutual benefit among account holders.

How to use the Joint Account Supplement To The Family Of First Investors Funds

Using the Joint Account Supplement involves several straightforward steps. First, gather all necessary personal information for each account holder, including names, addresses, and Social Security numbers. Next, complete the supplement form by providing the required details, ensuring that all information is accurate and up-to-date. It's important to review the terms and conditions outlined in the supplement, as these govern how the joint account will operate. Finally, submit the completed form to the appropriate financial institution managing the First Investors Funds, either online or via traditional mail, depending on their submission guidelines.

Steps to complete the Joint Account Supplement To The Family Of First Investors Funds

Completing the Joint Account Supplement requires careful attention to detail. Follow these steps for a successful submission:

- Collect all necessary personal information for each account holder.

- Fill out the supplement form accurately, ensuring all sections are completed.

- Review the completed form for any errors or omissions.

- Sign the form where required, ensuring all parties have provided their signatures.

- Submit the form according to the instructions provided by the financial institution.

Key elements of the Joint Account Supplement To The Family Of First Investors Funds

The Joint Account Supplement includes several key elements that are essential for its proper function:

- Account Holder Information: Details for each individual involved in the joint account.

- Investment Objectives: A section that outlines the shared goals of the account holders.

- Signatures: Required signatures from all parties to validate the agreement.

- Terms and Conditions: A clear explanation of the rights and responsibilities of each account holder.

Eligibility Criteria

To be eligible for the Joint Account Supplement, all parties must meet specific criteria. Each account holder should be a legal adult, typically at least eighteen years old. Additionally, all parties must provide valid identification and Social Security numbers. It is also important that all account holders have a mutual understanding of the investment objectives and agree to the terms outlined in the supplement. This ensures that all parties are committed to managing the account responsibly and collaboratively.

Form Submission Methods

The Joint Account Supplement can be submitted through various methods, depending on the policies of the financial institution managing the First Investors Funds. Common submission methods include:

- Online Submission: Many institutions offer a secure online portal for submitting forms electronically.

- Mail Submission: Completed forms can often be sent via postal service to the designated address provided by the institution.

- In-Person Submission: Some institutions may allow account holders to submit forms directly at a branch location.

Quick guide on how to complete joint account supplement to the family of first investors funds

Complete [SKS] effortlessly on any device

Digital document management has gained widespread adoption among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] without effort

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of the documents or blackout confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Joint Account Supplement To The Family Of First Investors Funds

Create this form in 5 minutes!

How to create an eSignature for the joint account supplement to the family of first investors funds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What happens to a joint investment account when a spouse dies?

Usually, joint bank accounts and investment accounts pass automatically to the surviving spouse. Jointly held financial accounts often come with what is called the “right of survivorship.” This means that when one of the account holders passes away, the survivor is presumed to own the entire account.

-

Can I add my spouse to my investment account?

A joint brokerage account is shared by two or more individuals. Joint brokerage accounts are most commonly held by spouses, but are also opened between family members, such as a parent and child, or two individuals with mutual financial goals, such as business partners.

-

Can I add my wife to my Vanguard account?

Your spouse can be your beneficiary on any type of account. If you have an IRA, you may designate the person you're married to as your beneficiary by name or you can designate by relationship by selecting “the person I am married to at the time of my death.”

-

Who pays tax on a joint investment account?

Tax Implications Joint account holders must divide this income based on their ownership share. If ownership is split 50/50, then each person reports half the income on their tax returns.

-

Should I add my wife to my brokerage account?

Pros of Joint Brokerage Accounts Access is particularly important if one of the account holders dies, since the other one can continue using the funds without having to wait for probate, which could take a year or longer. A joint brokerage account can also simplify estate planning.

-

Can I add my husband to my investment account?

Joint brokerage accounts are beneficial if you're looking to pool your investments with another person, such as a spouse or family member, and can be a way to simplify investment management and/or estate planning.

-

How do I add a joint account holder to my mutual fund?

In other words, an investor who wishes to add a name/ joint holder in an existing mutual fund folio / account may do so by transferring the units held in demat mode, from the demat account of the sole holder to the desired demat account held in multiple names through an off-market transaction.

-

Can husband and wife have a joint investment account?

Each joint accountholder generally has an equal undivided interest in the account. Where the joint tenancy is between spouses, upon the death of one spouse, the deceased's ownership interest in the account automatically passes to the surviving spouse.

Get more for Joint Account Supplement To The Family Of First Investors Funds

- Application for student employment university of southern california www rcf usc form

- Exceptions statement form

- Helen giddings great start grant form

- Updated 050818 form

- Solution auburn serology virology favn form

- The nevada unemployment insurance claim filing system form

- D 39 form dirweb state nv

- Blood donor eligibility criteriared cross blood services form

Find out other Joint Account Supplement To The Family Of First Investors Funds

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple