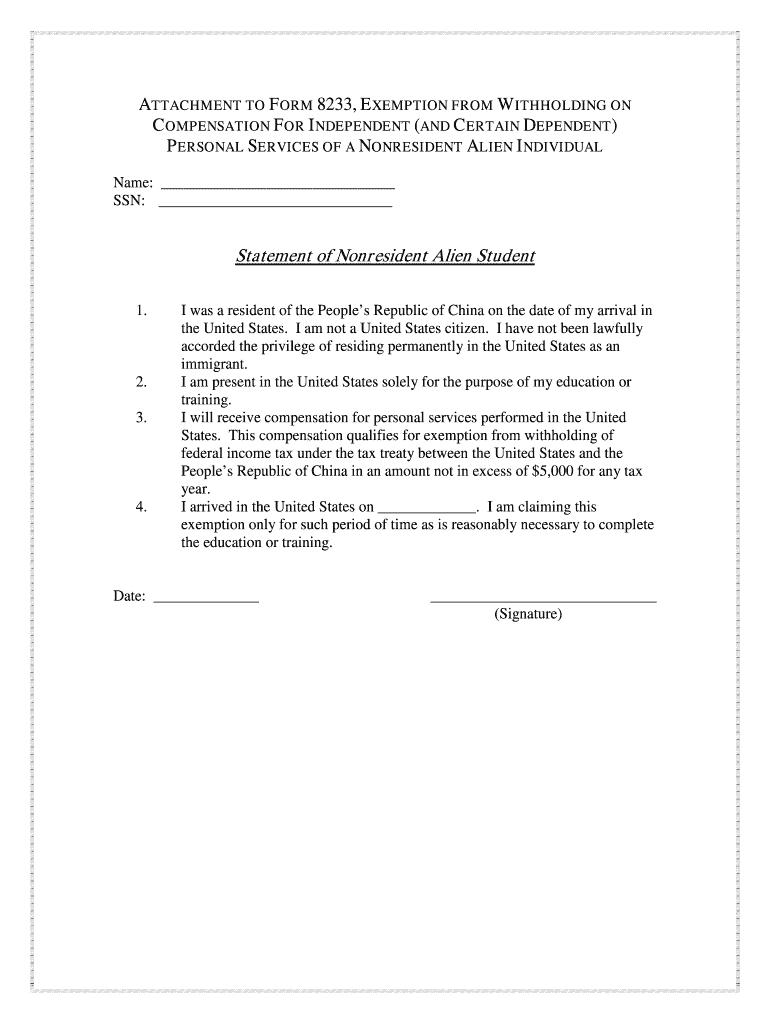

Statement of Nonresident Alien Student Form

What is the Statement Of Nonresident Alien Student

The Statement Of Nonresident Alien Student is a crucial document for international students studying in the United States. It serves to clarify the tax status of nonresident alien students, who may be subject to different tax regulations compared to U.S. citizens or resident aliens. This statement helps educational institutions and tax authorities determine the appropriate tax treatment for tuition, scholarships, and other financial aid received by these students.

How to use the Statement Of Nonresident Alien Student

This statement is primarily used to inform educational institutions about a student's nonresident status for tax purposes. Students must provide accurate information regarding their visa status, duration of stay in the U.S., and any income earned while studying. The completed statement is often submitted to the school’s financial aid office or the relevant tax authority to ensure compliance with U.S. tax laws.

Steps to complete the Statement Of Nonresident Alien Student

Completing the Statement Of Nonresident Alien Student involves several key steps:

- Gather necessary documents, including your visa, passport, and any relevant tax forms.

- Provide personal information such as your name, address, and student identification number.

- Indicate your current visa status and the duration of your stay in the U.S.

- Detail any income earned while in the U.S., including scholarships and stipends.

- Review the completed statement for accuracy before submission.

Legal use of the Statement Of Nonresident Alien Student

The legal use of this statement is essential for compliance with U.S. tax regulations. Nonresident alien students must accurately report their status to avoid potential penalties or complications with tax authorities. Educational institutions rely on this statement to ensure that they are withholding the correct amount of taxes from any payments made to the student, such as scholarships or stipends.

Key elements of the Statement Of Nonresident Alien Student

Several key elements are included in the Statement Of Nonresident Alien Student:

- Personal Information: Name, address, and student identification number.

- Visa Status: Current visa type and duration of stay in the U.S.

- Income Details: Any income earned in the U.S. during the study period.

- Certification: A declaration confirming the accuracy of the provided information.

Required Documents

To complete the Statement Of Nonresident Alien Student, students typically need to provide several documents, including:

- Passport and visa documentation.

- Form I-20 or DS-2019, which verifies student status.

- Any relevant tax documents, such as W-2 or 1099 forms.

- Proof of enrollment at an accredited institution in the U.S.

Quick guide on how to complete statement of nonresident alien student

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Statement Of Nonresident Alien Student

Create this form in 5 minutes!

How to create an eSignature for the statement of nonresident alien student

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do I claim 0 or 1 on my W4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

-

Do F-1 students file 1040 or 1040NR?

The tax return you must file is Form 1040NR, the Federal Tax Return for Nonresidents. If you have any earned income, your tax return is due by April 15; otherwise the filing deadline is June 15. If you owe more tax than was withheld, you must pay it by the appropriate date.

-

What is a nonresident alien student?

For immigration purposes, a “nonresident alien” is a foreign national who is in the U.S. on a non-immigration visa. For U.S. tax purposes, a “nonresident alien” is a foreign national visa holder with certain U.S. tax filing requirements and U.S. tax withholding requirements.

-

What do I put for Are you a nonresident alien?

You are considered a nonresident alien if you are not a US citizen and do not meet either the green card test or the substantial presence test for the calendar year (January 1 - December 31).

-

What do I put for Are you a nonresident alien?

You are considered a nonresident alien if you are not a US citizen and do not meet either the green card test or the substantial presence test for the calendar year (January 1 - December 31).

-

How to fill W-4 form for non-resident alien?

A nonresident alien cannot write "exempt" on line 7 of Form W-4, Employee's Withholding Allowance Certificate. A nonresident alien may claim only "single" filing status on line 3 of Form W-4, even if he is married. With certain exceptions, a nonresident alien cannot claim more than one personal exemption on Form W-4.

-

What is a nonresident alien on a W4?

A nonresident alien is an alien who has not passed the green card test or the substantial presence test.

Get more for Statement Of Nonresident Alien Student

- Coastal virginia spine and pain center virginia beach va form

- Conversion factors for controlled substances form

- Part xiv form

- Health screening form optima health website

- Cardiology intake form veterinary emergency services of nm

- Microsoft powerpoint roth 28 vertical score sheet ceppt form

- Referral form obgyn albuquerque

- Foster care respite information sheet ifapa

Find out other Statement Of Nonresident Alien Student

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later