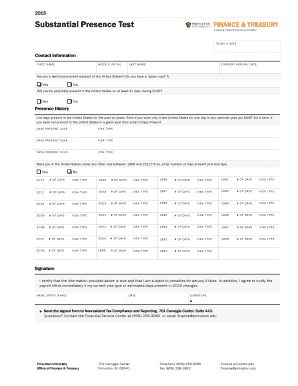

Substantial Presence Test PRINCETON UNIVERSITY Office of Form

What is the substantial presence test?

The substantial presence test is a method used by the Internal Revenue Service (IRS) to determine if an individual qualifies as a resident alien for tax purposes. This test is based on the number of days an individual is physically present in the United States during a specific period. To meet the criteria, an individual must be present in the U.S. for at least thirty-one days during the current year and a total of one hundred eighty-three days over the current year and the two preceding years, calculated with a specific formula.

Key elements of the substantial presence test

Understanding the key elements of the substantial presence test is crucial for accurate tax reporting. The test considers:

- Days present in the current year.

- Days present in the previous year, counted as one-third of those days.

- Days present in the year before that, counted as one-sixth of those days.

These calculations help determine if an individual meets the residency requirements set by the IRS.

Steps to complete the substantial presence test

To complete the substantial presence test, follow these steps:

- Count the number of days you were physically present in the U.S. during the current year.

- Count the number of days you were present in the U.S. during the previous year and divide that number by three.

- Count the number of days you were present in the U.S. during the year before the previous year and divide that number by six.

- Add these three totals together. If the sum is one hundred eighty-three days or more, you meet the substantial presence test.

Examples of using the substantial presence test

Examples can clarify how the substantial presence test is applied:

- If an individual is present in the U.S. for one hundred days in the current year, one hundred days in the previous year, and fifty days in the year before that, the calculation would be:

- Current year: 100 days

- Previous year: 100 / 3 = 33.33 days

- Year before that: 50 / 6 = 8.33 days

- The total would be 100 + 33.33 + 8.33 = 141.66 days, which does not meet the test.

Legal use of the substantial presence test

The substantial presence test plays a vital role in determining tax obligations. Individuals who meet the test are subject to U.S. income tax on their worldwide income. Understanding its legal implications ensures compliance with IRS regulations and helps avoid potential penalties.

Eligibility criteria

Eligibility for the substantial presence test is based on specific criteria. Individuals must:

- Be physically present in the U.S. for the required number of days.

- Not fall under certain exemptions, such as being a foreign government-related individual or a student under specific visa categories.

Meeting these criteria is essential for determining residency status for tax purposes.

Quick guide on how to complete what is substantial presence test

Execute what is substantial presence test seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage what is substantial presence test on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign what is the substantial presence test effortlessly

- Obtain what is substantial presence test and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature utilizing the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign what is the substantial presence test and guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to what is substantial presence test

Create this form in 5 minutes!

How to create an eSignature for the what is the substantial presence test

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask what is the substantial presence test

-

What is the federal ID number for Princeton University?

The University's tax ID number (EIN) is 21-0634501.

-

How do you calculate your substantial presence test?

Substantial Presence Test ALL of the days physically present in the U.S. in the current calendar year. PLUS 1/3 the number of days physically present in the U.S. during the first preceding year. PLUS 1/6 the number of days physically present in the U.S. during the second preceding year.

-

What does it mean to pass the substantial presence test?

Number of days in the U.S. in 2021) divided by 6. = Total Days of Presence. If your "Total Days of Presence" is 183 or greater, then you pass the Substantial Presence Test and are a resident alien for tax purposes.

-

Do F-1 students qualify for the substantial presence test?

F1 and J1 student visa holders may exempt 5 calendar years of presence for purposes of the substantial presence test.

-

How does the IRS verify physical presence test?

Generally, to meet the physical presence test, you must be physically present in a foreign country or countries for at least 330 full days during a 12-month period including some part of the year at issue. You can count days you spent abroad for any reason, so long as your tax home is in a foreign country.

-

How do you pass a Substantial Presence Test?

IRS Substantial Presence Test generally means that you were present in the United States for at least 31 days in the current year and a minimum total of 183 days over 3 years, using the following equation: 1 day = 1 day in the current year. 1 day = 1/3 day in the prior year. 1 day = 1/6 day two years prior.

-

Does Princeton University pay property taxes?

The University is the largest property taxpayer in the municipality and the second largest in Mercer County, paying $7.7 million in property and sewer taxes for properties in the Municipality of Princeton in 2023.

-

What is the Substantial Presence Test?

The Substantial Presence Test is a calculation that determines the resident or nonresident status of a foreign national for tax purposes in the United States. The Substantial Presence Test must be applied on a yearly basis.

Get more for what is substantial presence test

- Specify information to be disclosed entire record

- Patient history form for non invasive prenatal testing nipt

- Fibromyalgia impact questionnaire online form

- Return to school formnote for lvhs

- Application for rental rentprep com form

- Triad mls coming soon seller authorization form final version 3 28 docx

- Hafa short sale agreement form form 184 short sale shop

- Please wait if message is not replaced adobe reader error form

Find out other what is the substantial presence test

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form