Form 706 CE Rev May Fill in Capable

What is the Form 706 CE Rev May Fill In Capable

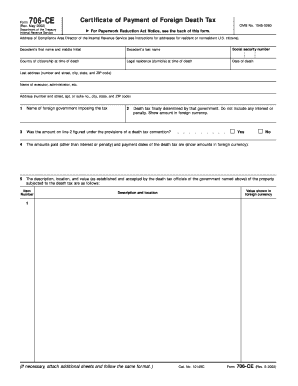

The Form 706 CE Rev May Fill In Capable is a crucial document used in the United States for estate tax purposes. This form is specifically designed for reporting the estate of a deceased individual, allowing executors or administrators to detail the value of the estate and calculate any taxes owed. It is an essential component for ensuring compliance with federal estate tax regulations. The form is structured to capture various assets, liabilities, and deductions, providing a comprehensive overview of the estate's financial situation.

How to use the Form 706 CE Rev May Fill In Capable

Using the Form 706 CE Rev May Fill In Capable involves several key steps. First, gather all necessary documentation related to the deceased's assets, including real estate, bank accounts, and investments. Next, carefully fill out the form, ensuring that all sections are completed accurately. This includes providing information on the decedent's identity, the date of death, and a detailed inventory of the estate's assets and liabilities. Once completed, the form must be submitted to the IRS as part of the estate tax return process.

Steps to complete the Form 706 CE Rev May Fill In Capable

Completing the Form 706 CE Rev May Fill In Capable requires a systematic approach. Start by entering the decedent's information, including name, Social Security number, and date of death. Next, list all assets, categorizing them by type, such as real estate, personal property, and financial accounts. For each asset, provide the fair market value as of the date of death. After listing liabilities, such as debts and funeral expenses, calculate the total value of the estate. Finally, review the form for accuracy before submitting it to the IRS.

Legal use of the Form 706 CE Rev May Fill In Capable

The legal use of the Form 706 CE Rev May Fill In Capable is governed by federal estate tax laws. Executors or administrators are legally required to file this form if the decedent's estate exceeds a certain value threshold. Failure to file the form can result in penalties and interest on unpaid taxes. It is essential to understand the legal implications of the information provided on the form, as inaccuracies can lead to audits or legal disputes. Consulting with a tax professional or attorney is advisable to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 706 CE Rev May Fill In Capable are critical to avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. However, an extension may be requested if more time is needed to gather information. It is important to note that interest and penalties may accrue on unpaid taxes if the form is not filed by the deadline. Keeping track of these dates is essential for compliance with IRS regulations.

Required Documents

To complete the Form 706 CE Rev May Fill In Capable, several documents are required. These include the decedent's death certificate, a list of assets and their fair market values, any outstanding debts, and documentation of funeral expenses. Additionally, any prior gift tax returns may be necessary to accurately report the estate's value. Having these documents organized and readily available can streamline the process of completing the form.

Quick guide on how to complete form 706 ce rev may fill in capable

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary template and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form: via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious searching for forms, or errors that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706 CE Rev May Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form 706 ce rev may fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do all estates have to file federal estate income tax returns?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

-

Do I have to report the sale of inherited property to the IRS?

Report the sale on Schedule D (Form 1040), Capital Gains and Losses and on Form 8949, Sales and Other Dispositions of Capital Assets: If you sell the property for more than your basis, you have a taxable gain. For information on how to report the sale on Schedule D, see Publication 550, Investment Income and Expenses.

-

What triggers an estate tax return?

An estate tax return is required if the gross value of the estate is over a certain threshold. For individuals who die in 2025, the threshold is $13.99 million (up from $13.61 million in 2024). Almost anything belonging to the deceased with a tangible cash value is included in the value of the estate.

-

What is the penalty for not filing form 706?

Pursuant to Revenue and Taxation Code section 13510, the penalty for failure to file a California Estate Tax Return is five percent (5%) per month or portion thereof, not to exceed 25%.

-

Who is required to file form 706?

Do all estates have to file Form 706? No, not all estates need to file Form 706. Only estates with gross assets and prior taxable gifts exceeding the annually determined exemption amount are required to file this form. For 2023, this threshold is set at $12.92 million, or $13.61 million in 2024.

-

What is form 706 CE?

About Form 706-CE, Certification of Payment of Foreign Death Tax | Internal Revenue Service.

-

What is filing requirement form 706?

Form 706 must be filed by the executor of the estate of every U.S. citizen or resident: Whose gross estate, adjusted taxable gifts, and specific exemptions total more than the exclusion amount: $12.92 million for decedents who died in 2023 ($13.61 million in 2024), or3.

-

Who fills out form 706?

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.

Get more for Form 706 CE Rev May Fill In Capable

- First set interrogatories 495578905 form

- Sample language for a qualifying retirement benefits court order court order tsp form

- Complaint sample template form

- Exhibit list for trial form

- Examples of a civil complaint form

- Requests defendant form

- Birth abroad certificate helena montana form

- Corrective deed california pdf 495565902 form

Find out other Form 706 CE Rev May Fill In Capable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors