NEVADA BUSINESS REGISTRATION FORM Clark County Nevada Clarkcountynv

What is the NEVADA BUSINESS REGISTRATION FORM Clark County Nevada Clarkcountynv

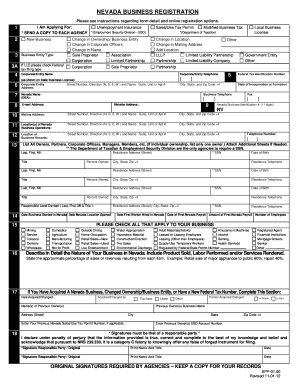

The NEVADA BUSINESS REGISTRATION FORM is a crucial document for businesses operating in Clark County, Nevada. This form serves as an official application for businesses to register with the state, ensuring compliance with local laws and regulations. It is designed for various business entity types, including corporations, limited liability companies (LLCs), and partnerships. Completing this form is essential for obtaining necessary permits and licenses to operate legally within the county.

How to obtain the NEVADA BUSINESS REGISTRATION FORM Clark County Nevada Clarkcountynv

To obtain the NEVADA BUSINESS REGISTRATION FORM, individuals can visit the Clark County Clerk's office or access the form through the official Clark County website. The form is typically available in both digital and paper formats. For those preferring online access, downloading the form directly from the website is a convenient option. Ensure that you have the latest version of the form to avoid any compliance issues.

Steps to complete the NEVADA BUSINESS REGISTRATION FORM Clark County Nevada Clarkcountynv

Completing the NEVADA BUSINESS REGISTRATION FORM involves several key steps:

- Gather necessary information about your business, including the business name, address, and type of entity.

- Provide details regarding the owners or partners, including names and contact information.

- Indicate the nature of your business activities and any applicable licenses or permits.

- Review all information for accuracy before submitting the form.

- Submit the completed form either online, by mail, or in person at the designated office.

Key elements of the NEVADA BUSINESS REGISTRATION FORM Clark County Nevada Clarkcountynv

The NEVADA BUSINESS REGISTRATION FORM includes several key elements that must be accurately filled out:

- Business Name: The official name under which the business will operate.

- Business Address: The physical location of the business.

- Entity Type: The legal structure of the business, such as LLC, corporation, or partnership.

- Owner Information: Names and contact details of the business owners or partners.

- Business Activities: A brief description of the services or products offered.

Legal use of the NEVADA BUSINESS REGISTRATION FORM Clark County Nevada Clarkcountynv

Using the NEVADA BUSINESS REGISTRATION FORM legally is essential for businesses to operate within the law. This form must be filed with the appropriate local authorities to establish the business's legal existence. Failure to register can lead to penalties, fines, and potential legal issues. It is important to ensure that all information provided is truthful and complete to avoid complications during the registration process.

Form Submission Methods (Online / Mail / In-Person)

The NEVADA BUSINESS REGISTRATION FORM can be submitted through various methods, providing flexibility for business owners:

- Online Submission: Many jurisdictions allow for electronic filing through official government websites.

- Mail Submission: Completed forms can be mailed to the appropriate office, ensuring that all necessary documents are included.

- In-Person Submission: Business owners may also choose to submit the form directly at the Clark County Clerk's office for immediate processing.

Quick guide on how to complete nevada business registration form clark county nevada clarkcountynv

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely preserve it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any platform via airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from whatever device you prefer. Alter and electronically sign [SKS] to facilitate excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NEVADA BUSINESS REGISTRATION FORM Clark County Nevada Clarkcountynv

Create this form in 5 minutes!

How to create an eSignature for the nevada business registration form clark county nevada clarkcountynv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do I need a county business license in Nevada?

In the State of Nevada, all businesses are required to obtain a business license within the city / county in which they operate. Visit your county's website to download the appropriate forms. Some cities may charge additional fees depending on your business type.

-

Do I need a business license in Clark County Nevada?

NRS 76 requires all business, corporations, and partnerships operating in the state of Nevada to register have a state business license. Please visit the Secretary of State's website for more information. You may apply and register online at nvsilverflume.gov.

-

Does Nevada County require a business license?

Nevada County does not require business licenses, however, some of the cities within the county to. Common requirements include licenses, permits, taxes, inspections and clearances.

-

Who needs a Clark County business license?

Any person who wishes to operate a business in Unincorporated Clark County is required by Clark County Code to obtain a business license. A general license is a term used to describe a basic application.

-

Does a Nevada LLC need a business license?

Annual report and business license requirement. Nevada requires LLCs to file an Annual List of Members/Managers and Business License. It is due by the last day of the month marking the LLC's incorporation anniversary. The filing fee is $150 for the Annual List and $200 for the business license registration.

-

How much does it cost to register a business in Nevada?

What is the cost of a State Business License, and when is it due? The State Business License Fee is $500 for Corporations, and $200 for all other business types. The State Business License must be renewed annually.

-

Do I need a business license to be self employed in Nevada?

Sole Proprietorships are not required to file formation documents with the Secretary of State's office. However, a Nevada State Business License or Notice of Exemption is required before conducting business in the state of Nevada. For immediate service file online and avoid processing delays at no additional cost.

-

Who is exempt from a Nevada business license?

Other types of organizations and companies are exempt from filing for a business license, including government entities, non-profit organizations (religious groups, fraternal organizations, and charitable organizations), a person who is a natural citizen and operates a business from their home if the business does make ...

Get more for NEVADA BUSINESS REGISTRATION FORM Clark County Nevada Clarkcountynv

- Kitsap aikido registration form kitsapaikido

- Adult enrollment form english pdf 4 h youth development cesanbenito ucdavis

- Student organization and class travel casper college caspercollege form

- Student forms packet student rotation saas byu

- California 4 h youth development program celosangeles ucdavis form

- Application application application application application application form

- Experience bayview application form

- Download stm application christian chiropractors association christianchiropractors form

Find out other NEVADA BUSINESS REGISTRATION FORM Clark County Nevada Clarkcountynv

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free