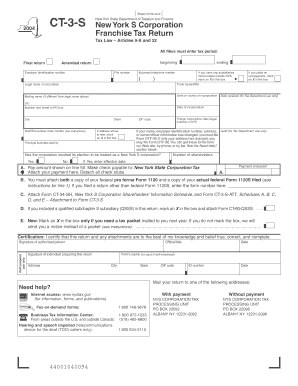

NAICS Business Code Number See Instructions Tax Ny Form

What is the NAICS Business Code Number?

The NAICS Business Code Number, or North American Industry Classification System code, is a six-digit code used to classify businesses based on their primary economic activity. This system is essential for various regulatory and tax purposes, including the completion of tax forms in New York. Each code corresponds to a specific industry, allowing for consistent data collection and analysis across federal and state agencies.

How to use the NAICS Business Code Number

To use the NAICS Business Code Number, identify your business's primary activity and locate the corresponding code. This code is often required on tax forms, business applications, and permits. When filling out forms, ensure you enter the correct code to avoid delays or complications with your submissions. The code helps government agencies understand the nature of your business for statistical and regulatory purposes.

Steps to complete the NAICS Business Code Number

Completing the NAICS Business Code Number involves a few straightforward steps:

- Determine your primary business activity by evaluating the services or products you provide.

- Consult the official NAICS code list to find the code that best matches your business activity.

- Enter the code accurately on the required forms, ensuring it is aligned with your business's classification.

- Review your submission for accuracy before finalizing it to prevent any issues.

Legal use of the NAICS Business Code Number

The NAICS Business Code Number is legally recognized and required for various business-related filings. It is used by federal and state agencies to categorize businesses for tax purposes, compliance, and economic analysis. Accurate use of the code is crucial, as misclassification can lead to penalties or complications in tax reporting and business operations.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the NAICS Business Code Number. Businesses must ensure they select the correct code that reflects their primary business activity when filing tax returns. The IRS uses these codes to analyze industry trends and enforce tax compliance. It is advisable to consult the IRS website or a tax professional for detailed instructions related to your specific situation.

Filing Deadlines / Important Dates

Filing deadlines for tax forms that require the NAICS Business Code Number vary based on the type of business entity and the specific tax form being submitted. Generally, businesses must file their annual tax returns by April fifteenth, unless an extension is requested. It is crucial to stay informed about these deadlines to ensure timely submissions and avoid penalties.

Required Documents

When preparing to file forms that include the NAICS Business Code Number, businesses typically need several documents. These may include:

- Previous tax returns

- Financial statements

- Business licenses and permits

- Payroll records

Gathering these documents in advance can streamline the filing process and ensure compliance with all requirements.

Quick guide on how to complete naics business code number see instructions tax ny

Effortlessly Prepare [SKS] on Any Device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without interruption. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most efficient method to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NAICS Business Code Number see Instructions Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the naics business code number see instructions tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I find my NAICS code for my business?

To identify the NAICS Code being used for a specific company, visit the US Company Lookup Tool by NAICS.com. To identify the proper code for your company, use the NAICS SEARCH TOOLS to identify the code that best reflects your primary business activity (revenue producing activity.)

-

How do I know what my NAICS code is?

541213 - Tax Preparation Services.

-

How do I find my NAICS number on my taxes?

To identify the NAICS Code being used for a specific company, visit the US Company Lookup Tool by NAICS.com. To identify the proper code for your company, use the NAICS SEARCH TOOLS to identify the code that best reflects your primary business activity (revenue producing activity.)

-

What is NAICS code 811110?

NAICS 811110 - Automotive Mechanical and Electrical Repair and Maintenance.

-

How do I find my NAICS code on my taxes?

You are able to find your NAICS code on the upper righthand side of your tax return, or by visiting the US Company Lookup Tool by NAISC.com. In some cases, you may have more than one NAICS code.

-

What is instruction NAICS code?

NAICS 611600 - Other Schools and Instruction is part of: NAICS 611000 - Educational Services. SOC Major Groups in NAICS 611600 - Other Schools and Instruction: 00-0000 All Occupations. 11-0000 Management Occupations.

Get more for NAICS Business Code Number see Instructions Tax Ny

- Visa app dec app vonsefcu form

- Youth summer camp application longislandtu form

- Friday december 7 at 5 pm nuf form

- 090359 check app xavier start 3 12 moreheadstate form

- December to potential camp counselors and cit39s we are delaware osu form

- Com is an engaged online community featuring live form

- Cvs patch diff stylesen stylesen form

- Owner and contractor attestation as city of chicago cityofchicago form

Find out other NAICS Business Code Number see Instructions Tax Ny

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure