Profit Sharing Plan Sole Trustee New Account Package Form

Understanding the Profit Sharing Plan Sole Trustee New Account Package

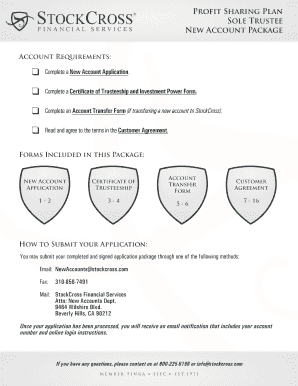

The Profit Sharing Plan Sole Trustee New Account Package is a comprehensive document set designed for establishing a profit-sharing plan under the sole trusteeship of an individual or entity. This package typically includes essential forms and guidelines that outline the structure, contributions, and distributions of the profit-sharing plan. It is crucial for businesses looking to provide retirement benefits to employees while ensuring compliance with IRS regulations.

How to Complete the Profit Sharing Plan Sole Trustee New Account Package

To effectively complete the Profit Sharing Plan Sole Trustee New Account Package, follow these steps:

- Gather necessary information about the business and its employees.

- Fill out the primary forms included in the package, ensuring accuracy in all entries.

- Review the eligibility criteria for participants to ensure compliance.

- Consult IRS guidelines to confirm that all aspects of the plan meet regulatory requirements.

- Submit the completed package to the designated financial institution or trustee.

Required Documents for the Profit Sharing Plan Sole Trustee New Account Package

When preparing the Profit Sharing Plan Sole Trustee New Account Package, several documents are essential:

- Employer identification number (EIN) for the business.

- Detailed plan description outlining the profit-sharing structure.

- Employee eligibility criteria and enrollment forms.

- Trustee agreement if applicable.

- Any additional documents required by the financial institution managing the plan.

Legal Considerations for the Profit Sharing Plan Sole Trustee New Account Package

Establishing a profit-sharing plan involves several legal considerations. The plan must comply with the Employee Retirement Income Security Act (ERISA) and IRS regulations. This includes adhering to specific rules regarding contributions, distributions, and reporting requirements. It is advisable to consult with a legal or financial advisor to ensure that all legal obligations are met and that the plan is structured appropriately to avoid potential penalties.

Eligibility Criteria for the Profit Sharing Plan Sole Trustee New Account Package

Eligibility for participation in the Profit Sharing Plan Sole Trustee New Account Package typically includes:

- Employees who meet minimum age and service requirements.

- Full-time employees, as defined by the employer.

- Employees who have not been excluded due to specific reasons outlined in the plan.

It is essential to clearly define these criteria in the plan documents to avoid confusion and ensure compliance.

Steps to Submit the Profit Sharing Plan Sole Trustee New Account Package

Submitting the Profit Sharing Plan Sole Trustee New Account Package involves a few key steps:

- Review all forms for completeness and accuracy.

- Compile the required documents as outlined in the package.

- Choose a submission method: online, mail, or in-person, depending on the financial institution's requirements.

- Keep a copy of the submitted documents for your records.

IRS Guidelines for the Profit Sharing Plan Sole Trustee New Account Package

The IRS provides specific guidelines that govern the establishment and maintenance of profit-sharing plans. Key points include:

- Contribution limits for both employer and employee contributions.

- Requirements for annual reporting and disclosures.

- Tax implications for contributions and distributions.

Staying informed about IRS guidelines is crucial for maintaining compliance and ensuring the plan's tax advantages.

Quick guide on how to complete profit sharing plan sole trustee new account package

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-centric operation today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure smooth communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Profit Sharing Plan Sole Trustee New Account Package

Create this form in 5 minutes!

How to create an eSignature for the profit sharing plan sole trustee new account package

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Is a profit-sharing plan a good idea?

It allows you to choose how much to contribute to the plan (out of profits or otherwise) each year, including making no contribution for a year. Profit sharing plans have additional advantages: Can help attract and keep talented employees. Benefit rank-and-file employees and owners/managers.

-

What are the disadvantages of profit-sharing plans?

Cons. As with any group incentive plan, profit sharing may result in some workers gaining from the effort of others with no greater effort on their part (“free rider problem”). Workers cannot see strong links between their effort and their organization's performance (profits).

-

What are the three types of profit-sharing plans?

Generally, there are three types of profit-sharing plans: pro-rata, new comparability, and age-weighted.

-

Are profit-sharing plans worth it?

Is Profit Sharing Worth It? It depends on what your priorities are. A profit-sharing plan is a great way for a business to give its employees a sense of ownership in the company, but there are typically restrictions as to when and how an employee can withdraw these funds without penalties.

-

How much do employees usually get from profit-sharing?

Contributions vary widely from business to business, and there's no specifically required percentage for employers to contribute. Some businesses may contribute 2-10% of company profits, while more generous PSPs may offer 20% to employees.

-

What is the 25 percent rule for profit-sharing?

If an employer makes little or no profit during a year, no contribution is required, although an employer is permitted to make contributions even if the company is not profitable. An employer's maximum deduction is limited to 25% of the annual compensation paid to eligible employees.

-

Who benefits from a profit-sharing plan?

Profit-sharing plans allow employers to distribute their discretionary profit to their employees, thereby boosting their motivation and improving employee retention in the process. Employer contributions are tax-deferred and taxable at the time of withdrawal.

-

Can a sole proprietor set up a profit-sharing plan?

Now a full retirement contribution, including salary deferral as well as a profit-sharing contribution, can be made. As a result, a sole proprietor may be able to make larger (retroactive) contributions using an Individual 401(k).

Get more for Profit Sharing Plan Sole Trustee New Account Package

- Student pre registration form please complete this form before engr psu

- Change of graduate status request schoolcollege of gradschool wayne form

- Sagemvolunteernjaps2v4 doc form

- 11 teacher evaluation udallas form

- Changes take effect on the date manulife financial head office receives this form

- Web marketing watch form

- Denver best waterwise landscaping made easy center for conservationcenter form

- H 1b request form part b to be wayne state university oiss wayne

Find out other Profit Sharing Plan Sole Trustee New Account Package

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile