1 Kind of Business 2 3 Date of Charter in Massachusetts 3 3 Average Number of Employees in Mass Form

Understanding the Business Type and Charter Date in Massachusetts

The form related to the "1 Kind Of Business 2 3 Date Of Charter In Massachusetts 3 3 Average Number Of Employees In Mass" is essential for businesses operating in Massachusetts. It typically requires the identification of the business type, which can range from sole proprietorships to corporations. The date of charter is crucial as it marks the official establishment of the business entity in the state. This information is vital for legal compliance and organizational records.

Steps to Complete the Business Form

Completing the form involves several key steps. First, gather necessary information about your business, including its legal name, type, and the date of charter. Next, accurately fill out the form, ensuring that all details match your official documents. It is advisable to double-check for any errors before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, depending on state requirements.

Legal Considerations for Business Registration

When registering a business in Massachusetts, it is essential to understand the legal implications of the information provided on the form. The date of charter establishes the legal existence of the business, while the type of business affects liability and taxation. Compliance with state regulations is crucial to avoid penalties. Therefore, consulting with a legal professional may be beneficial to ensure all aspects of the registration are properly addressed.

Required Documents for Business Registration

To complete the form successfully, specific documents are typically required. These may include proof of identity, business licenses, and any existing partnership agreements. Additionally, documentation that verifies the business type and its charter date should also be included. Having these documents ready will streamline the registration process and help prevent delays.

Examples of Business Types in Massachusetts

In Massachusetts, various business types may be registered, including Limited Liability Companies (LLCs), corporations, partnerships, and sole proprietorships. Each type has distinct legal and tax implications. For instance, an LLC offers personal liability protection, while a sole proprietorship does not. Understanding these differences is key to selecting the appropriate business structure for your needs.

Average Number of Employees in Massachusetts Businesses

The average number of employees in Massachusetts businesses can vary significantly based on the industry and business type. For small businesses, the average might range from one to ten employees, while larger corporations may have hundreds or thousands. This information can be useful for understanding the business landscape in the state and for making informed decisions regarding staffing and resource allocation.

Quick guide on how to complete 1 kind of business 2 3 date of charter in massachusetts 3 3 average number of employees in mass

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new document prints. airSlate SignNow fulfills your needs in document management in just a few clicks from the device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1 kind of business 2 3 date of charter in massachusetts 3 3 average number of employees in mass

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

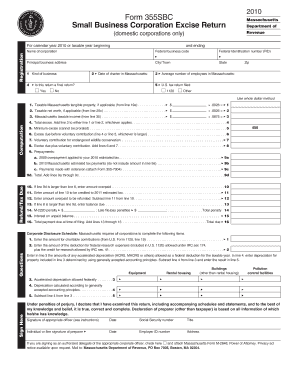

Who has to pay MA corporate excise tax?

Interstate and International Aspects: All domestic corporations are subject to the corporate excise by reason of corporate existence at any time during the taxable year. Foreign corporations doing business within the state or owning property in the state are also subject to the excise.

-

Who must file a Massachusetts corporate tax return?

Each entity registered with the Massachusetts Secretary of the Commonwealth (the “Secretary”) may be required to register for corporate excise and file an annual corporate return with the Massachusetts Department of Revenue (the “DOR”).

-

What is the minimum tax in Massachusetts form 355?

The minimum tax is $456.

-

How much does it cost to register a small business in Massachusetts?

Massachusetts LLC Cost. The main cost to start a Massachusetts LLC is the $500 state fee to file the Massachusetts Certificate of Organization ($520 online or by fax).

-

What is the Massachusetts Manufacturing Investment Tax Credit?

The Massachusetts Investment Tax Credit is available to businesses that purchase qualifying tangible personal property used in manufacturing, research and development, or any other trade or business. Small businesses investing in new equipment or property can claim a credit of up to 3% of the cost.

-

What is MA form 355SBC?

A Massachusetts corporation must file federal Form 1120, and Form 355. If your income is under $100,000 and not subject to a corporate tax in another state, you must file Form 355SBC (small business corporation) instead of Form 355.

Get more for 1 Kind Of Business 2 3 Date Of Charter In Massachusetts 3 3 Average Number Of Employees In Mass

- For multi family rfp applications minnesota housing mnhousing form

- Illinois chapter american concrete aci illinois form

- How to switch your accounts to california coast calcoastcu form

- Examination preregistration form north carolina department of ncagr

- Standard bid document reference intraweb stockton form

- Workforce solutions alamo application for employment workforcesolutionsalamo form

- Instructions for the writing sample required hsu form

- Or superintendent application university of alaska anchorage uaa alaska form

Find out other 1 Kind Of Business 2 3 Date Of Charter In Massachusetts 3 3 Average Number Of Employees In Mass

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF