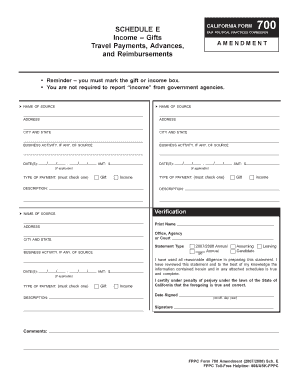

700 CALIFORNIA FORM Schedule E Income Gifts Travel Payments, Advances, and Reimbursements Fair Political Practices Commission a

Understanding the 700 California Form Schedule E

The 700 California Form Schedule E is a crucial document for individuals involved in political activities in California. This form is used to report income, gifts, travel payments, advances, and reimbursements received by public officials and candidates. It ensures transparency and compliance with the Fair Political Practices Commission (FPPC) regulations. Understanding the details of this form is essential for accurate reporting and adherence to legal requirements.

Steps to Complete the 700 California Form Schedule E

Filling out the 700 California Form Schedule E involves several key steps:

- Gather all necessary information regarding gifts, travel payments, and reimbursements.

- Determine whether each item qualifies as a gift or income.

- Fill out the form accurately, marking the appropriate boxes for gifts or income.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to ensure compliance.

Legal Use of the 700 California Form Schedule E

The 700 California Form Schedule E is legally required for public officials and candidates to disclose financial interests. Failure to file this form or inaccurate reporting can lead to penalties imposed by the FPPC. It is essential to understand the legal implications of the information reported on this form to avoid potential legal issues.

Key Elements of the 700 California Form Schedule E

Several key elements must be included when completing the 700 California Form Schedule E:

- Identification of the filer: Include the name and position of the individual filing the form.

- Details of gifts or income: Clearly specify the nature and value of each item reported.

- Disclosure of reimbursements: Report any travel payments or advances received.

- Signature: The form must be signed to validate the information provided.

Filing Deadlines for the 700 California Form Schedule E

It is important to be aware of the filing deadlines associated with the 700 California Form Schedule E. Typically, the form must be submitted annually or upon specific events, such as a change in office or financial situation. Keeping track of these deadlines helps ensure compliance with FPPC regulations and avoids potential penalties.

Examples of Using the 700 California Form Schedule E

Examples of when to use the 700 California Form Schedule E include:

- When a public official receives a gift valued over the specified threshold.

- When a candidate receives travel reimbursements for campaign-related activities.

- When there are advances for expenses related to public duties.

Quick guide on how to complete 700 california form schedule e income gifts travel payments advances and reimbursements fair political practices commission a m

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals alike. It offers a seamless eco-friendly solution to conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents rapidly and efficiently. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then hit the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 700 california form schedule e income gifts travel payments advances and reimbursements fair political practices commission a m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 700 CALIFORNIA FORM Schedule E?

The 700 CALIFORNIA FORM Schedule E is a document used to report income from gifts, travel payments, advances, and reimbursements as required by the Fair Political Practices Commission. It is essential for ensuring compliance with political contribution regulations. Understanding this form helps you accurately report your financial activities.

-

How can airSlate SignNow assist with the 700 CALIFORNIA FORM Schedule E?

airSlate SignNow provides an easy-to-use platform for eSigning and sending documents, including the 700 CALIFORNIA FORM Schedule E. Our solution streamlines the process, ensuring that you can complete and submit your forms efficiently while maintaining compliance with the Fair Political Practices Commission.

-

What features does airSlate SignNow offer for managing the 700 CALIFORNIA FORM Schedule E?

With airSlate SignNow, you can easily create, edit, and eSign the 700 CALIFORNIA FORM Schedule E. Our platform includes features like templates, automated reminders, and secure storage, making it simple to manage your documents and ensuring you never miss marking the gift or income box.

-

Is airSlate SignNow cost-effective for handling the 700 CALIFORNIA FORM Schedule E?

Yes, airSlate SignNow offers a cost-effective solution for managing the 700 CALIFORNIA FORM Schedule E. Our pricing plans are designed to fit various budgets, allowing you to access essential features without overspending while ensuring compliance with the Fair Political Practices Commission.

-

Can I integrate airSlate SignNow with other tools for the 700 CALIFORNIA FORM Schedule E?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for the 700 CALIFORNIA FORM Schedule E. This allows you to connect with your existing tools, making it easier to manage your documents and stay compliant with the Fair Political Practices Commission.

-

What are the benefits of using airSlate SignNow for the 700 CALIFORNIA FORM Schedule E?

Using airSlate SignNow for the 700 CALIFORNIA FORM Schedule E offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform simplifies the eSigning process, ensuring you can focus on your core activities while meeting the requirements of the Fair Political Practices Commission.

-

How secure is airSlate SignNow when handling the 700 CALIFORNIA FORM Schedule E?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents, including the 700 CALIFORNIA FORM Schedule E. You can trust that your sensitive information is safe while you comply with the Fair Political Practices Commission.

Get more for 700 CALIFORNIA FORM Schedule E Income Gifts Travel Payments, Advances, And Reimbursements Fair Political Practices Commission A

- Corona ny employer dol form

- Customs amp border patrol dol form

- Postal service post office fort worth tx employer appearances appellant pro se office of solicitor for the director docket no form

- Fayetteville nc employer dol form

- Center bath ny employer dol form

- On september 7 appellant filed a timely appeal from the june 28 merit form

- 12 0135 doc dol form

- 80105248 form

Find out other 700 CALIFORNIA FORM Schedule E Income Gifts Travel Payments, Advances, And Reimbursements Fair Political Practices Commission A

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later