Tax Form 1099 B Reporting Instructions

Understanding Tax Form 1099 B Reporting Instructions

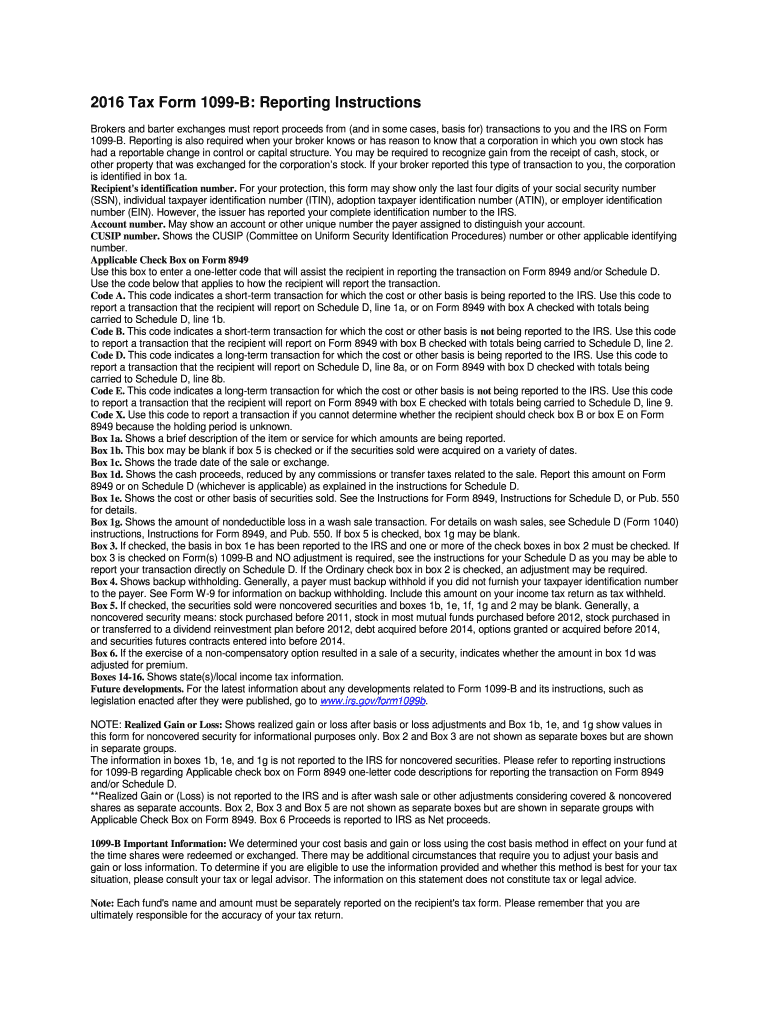

The Tax Form 1099 B is essential for reporting proceeds from broker and barter exchange transactions. This form provides a summary of gains and losses from the sale of securities, commodities, and other investments. It is crucial for taxpayers to accurately report this information to the IRS to ensure compliance with tax regulations. Understanding the details of this form helps individuals and businesses navigate their tax obligations effectively.

Steps to Complete the Tax Form 1099 B Reporting Instructions

Completing the Tax Form 1099 B involves several key steps:

- Gather all necessary documents, including transaction records and brokerage statements.

- Identify the type of transactions that need to be reported, such as sales of stocks or mutual funds.

- Fill out the form by entering the required information, including the payer's details and the amounts received.

- Calculate any gains or losses based on the information provided.

- Review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

Timely filing of the Tax Form 1099 B is crucial to avoid penalties. The IRS typically requires that this form be submitted by the end of February if filed on paper, or by the end of March if filed electronically. Additionally, recipients of the form must receive their copies by January 31. Keeping track of these deadlines helps ensure compliance and avoid unnecessary fines.

Who Issues the Form

The Tax Form 1099 B is issued by brokers or barter exchanges that facilitate transactions on behalf of taxpayers. These entities are responsible for providing accurate information regarding the transactions conducted during the tax year. Taxpayers should expect to receive this form from their broker, typically by the end of January, to assist in their tax preparation.

IRS Guidelines for Tax Form 1099 B

The IRS has established specific guidelines for the completion and submission of the Tax Form 1099 B. Taxpayers must ensure that all reported amounts are accurate and reflect the actual proceeds from transactions. The IRS requires that any discrepancies be addressed promptly to avoid penalties. Familiarity with these guidelines is essential for maintaining compliance and ensuring that all tax obligations are met.

Penalties for Non-Compliance

Failure to file the Tax Form 1099 B accurately or on time can result in significant penalties. The IRS may impose fines based on the severity and duration of the non-compliance. It is important for taxpayers to understand these potential consequences and take proactive steps to ensure that their reporting is accurate and timely. Engaging with tax professionals can provide additional support in navigating these requirements.

Quick guide on how to complete tax form 1099 b reporting instructions

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documentation, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without interruptions. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize key sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to record your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Form 1099 B Reporting Instructions

Create this form in 5 minutes!

How to create an eSignature for the tax form 1099 b reporting instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Tax Form 1099 B Reporting Instructions?

The Tax Form 1099 B Reporting Instructions provide guidelines on how to report proceeds from broker and barter exchange transactions. Understanding these instructions is crucial for accurate tax reporting and compliance. airSlate SignNow can help streamline the process of preparing and signing these forms electronically.

-

How can airSlate SignNow assist with Tax Form 1099 B Reporting Instructions?

airSlate SignNow offers an intuitive platform that simplifies the process of completing and eSigning Tax Form 1099 B Reporting Instructions. With our solution, you can easily fill out the necessary fields, ensuring that all information is accurate and compliant. This saves time and reduces the risk of errors in your tax reporting.

-

Is there a cost associated with using airSlate SignNow for Tax Form 1099 B Reporting Instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution ensures that you can manage your Tax Form 1099 B Reporting Instructions without breaking the bank. You can choose a plan that fits your budget while still benefiting from our robust features.

-

What features does airSlate SignNow provide for Tax Form 1099 B Reporting Instructions?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the process of handling Tax Form 1099 B Reporting Instructions. These features ensure that your documents are completed accurately and efficiently. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other software for Tax Form 1099 B Reporting Instructions?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage your Tax Form 1099 B Reporting Instructions. This integration allows for automatic data transfer, reducing manual entry and potential errors. You can streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for Tax Form 1099 B Reporting Instructions?

Using airSlate SignNow for Tax Form 1099 B Reporting Instructions provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents quickly, ensuring timely submission. Additionally, the electronic format helps keep your documents organized and easily accessible.

-

How secure is airSlate SignNow when handling Tax Form 1099 B Reporting Instructions?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage to protect your Tax Form 1099 B Reporting Instructions and sensitive information. Our platform complies with industry standards, ensuring that your documents are safe from unauthorized access.

Get more for Tax Form 1099 B Reporting Instructions

- Form 8822 rev december the mail archive

- Tax preparation united way of the wine country form

- Form it 203 x amended nonresident and part year tax ny

- New york state department of taxation and finance claim for city of new york school tax credit nyc 210 important you must enter form

- New york state department of taxation and finance nonresident and part year resident for office use only income tax return form

- This is a scannable form tax ny

- This is a scannable form tax ny 5996646

- Enter the line 15 amount on form it 203 line 32 and mark an x in the itemized box next to line 32 tax ny

Find out other Tax Form 1099 B Reporting Instructions

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien