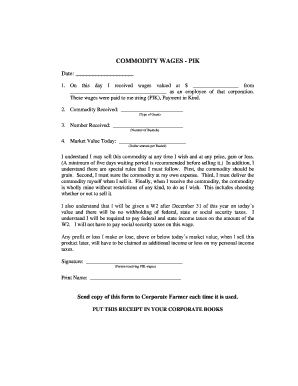

Commodity Wages Form

What is the Commodity Wages

Commodity wages refer to the payment structure that compensates workers based on the value of the goods or services they produce. This system is often used in industries where the output is easily quantifiable, such as agriculture or manufacturing. Instead of a fixed hourly rate, workers may receive payment based on the amount of product they deliver or the specific tasks they complete. This model can incentivize productivity and efficiency, aligning workers' earnings with their contributions to the overall output.

How to use the Commodity Wages

Using commodity wages involves establishing a clear framework for compensation based on output. Employers should define the specific commodities or services that will be measured and the corresponding wages for each unit produced. This requires transparent communication with employees about how their performance will be evaluated and compensated. Regular assessments and adjustments may be necessary to ensure that wage rates remain competitive and fair, reflecting market conditions and the cost of living.

Key elements of the Commodity Wages

Several key elements are essential for effectively implementing commodity wages:

- Measurement Criteria: Clearly define how output will be measured, whether by quantity, quality, or both.

- Payment Structure: Establish a transparent payment system that outlines how wages are calculated based on the measured output.

- Performance Standards: Set clear expectations for performance to ensure that workers understand what is required to earn their wages.

- Regular Reviews: Implement a system for regular reviews and adjustments to wage rates based on market trends and employee feedback.

Legal use of the Commodity Wages

Employers must ensure that the use of commodity wages complies with federal and state labor laws. This includes adhering to minimum wage requirements and ensuring that workers are not unfairly compensated based on their output. It is important to maintain accurate records of production and payments to avoid disputes. Employers should also be aware of any industry-specific regulations that may affect how commodity wages can be implemented.

Examples of using the Commodity Wages

Commodity wages can be seen in various industries. For example:

- Agriculture: Farmers may pay workers based on the number of bushels harvested, incentivizing higher productivity during peak seasons.

- Manufacturing: Factories may compensate assembly line workers based on the number of units produced, rewarding efficiency and speed.

- Construction: Contractors might pay workers based on the completion of specific tasks or projects, aligning pay with project milestones.

Eligibility Criteria

Eligibility for commodity wages typically depends on the nature of the work and the specific agreements made between employers and employees. Workers in roles where output can be easily quantified are generally more suited for this wage structure. Employers should also consider factors such as job performance, skill level, and the economic conditions of the industry when determining eligibility for commodity wages.

Quick guide on how to complete commodity wages

Prepare Commodity Wages effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed papers, enabling you to access the correct form and safely store it online. airSlate SignNow equips you with all the essential tools to create, amend, and eSign your documents quickly without delays. Manage Commodity Wages across any platform using airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Commodity Wages with ease

- Find Commodity Wages and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to store your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Commodity Wages and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the commodity wages

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are commodity wages and how do they relate to airSlate SignNow?

Commodity wages refer to the standard pay rates for specific job roles within an industry. With airSlate SignNow, businesses can streamline their document processes related to payroll and contracts, ensuring that all agreements regarding commodity wages are efficiently managed and securely signed.

-

How does airSlate SignNow help in managing contracts related to commodity wages?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning contracts that outline commodity wages. This ensures that all parties have a clear understanding of payment terms, reducing disputes and enhancing compliance with industry standards.

-

What pricing options does airSlate SignNow offer for businesses focusing on commodity wages?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you are a small startup or a large corporation dealing with commodity wages, you can choose a plan that fits your budget while providing essential features for document management.

-

Can airSlate SignNow integrate with payroll systems to manage commodity wages?

Yes, airSlate SignNow integrates seamlessly with various payroll systems, allowing businesses to manage commodity wages efficiently. This integration ensures that all signed documents are automatically updated in your payroll system, streamlining the payment process.

-

What features does airSlate SignNow offer to enhance the management of commodity wages?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning to enhance the management of commodity wages. These tools help businesses save time and reduce errors in their documentation processes.

-

How can airSlate SignNow improve compliance related to commodity wages?

By using airSlate SignNow, businesses can ensure that all documents related to commodity wages are signed and stored securely. This helps maintain compliance with labor laws and regulations, as all agreements are easily accessible and verifiable.

-

Is airSlate SignNow suitable for businesses of all sizes dealing with commodity wages?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from freelancers to large enterprises. Its scalability makes it an ideal solution for managing commodity wages efficiently, regardless of your organization's size.

Get more for Commodity Wages

- Peace and good behaviour complaint form

- Authorized hazardous waste manifest signers form

- Collateral assignment form axa com

- Registration form for quiz competition

- Lien waiver form 77015150

- Form it 203 tm group return for nonresident athletic team members tax year

- Employee payment agreement template form

- Employee payback agreement template form

Find out other Commodity Wages

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy