Iht100d Form

What is the Iht100d

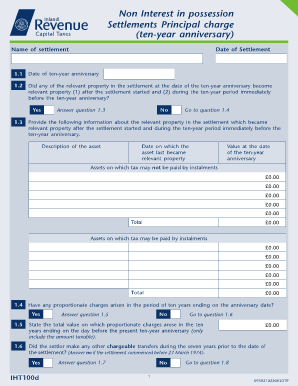

The Iht100d is a specific form used in the United Kingdom for reporting and managing inheritance tax. It is primarily utilized by individuals who are responsible for settling the estate of a deceased person. This form is crucial for declaring the value of the estate and calculating any inheritance tax that may be owed. Understanding the purpose of the Iht100d is essential for ensuring compliance with tax regulations and for the proper administration of the estate.

How to use the Iht100d

Using the Iht100d involves several steps to ensure accurate completion. First, gather all necessary information regarding the deceased's estate, including assets, liabilities, and any applicable exemptions. Next, fill out the form by providing detailed information about the estate's value and any deductions that may apply. It is important to ensure that all figures are accurate and that the form is signed and dated before submission. If assistance is needed, consulting a tax professional can provide valuable guidance.

Steps to complete the Iht100d

Completing the Iht100d requires a systematic approach. Follow these steps:

- Gather all relevant financial documents, including bank statements, property deeds, and insurance policies.

- Calculate the total value of the estate, including all assets and liabilities.

- Fill out the Iht100d form, ensuring that all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to HMRC, either online or by mail, as per the guidelines.

Required Documents

When completing the Iht100d, several documents are necessary to support the information provided. These documents typically include:

- Death certificate of the deceased.

- Proof of ownership for all assets, such as property deeds and vehicle titles.

- Financial statements that detail the deceased's liabilities and assets.

- Any relevant tax returns from previous years.

Legal use of the Iht100d

The Iht100d is legally required for the proper management of an estate and the calculation of inheritance tax. Failing to submit this form can result in penalties and interest on unpaid taxes. It is important to ensure that the form is filled out accurately and submitted within the specified time frame to comply with legal obligations. Consulting with a legal professional can help clarify any complex issues related to estate management and tax compliance.

Form Submission Methods

The Iht100d can be submitted through various methods, providing flexibility for users. The primary submission methods include:

- Online submission via the HMRC website, which is often the quickest method.

- Mailing a paper copy of the completed form to the appropriate HMRC address.

- In-person submission at designated HMRC offices, although this option may be less common.

Quick guide on how to complete iht100d

Effortlessly Prepare Iht100d on Any Device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without complications. Manage Iht100d across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The Easiest Way to Modify and Electronically Sign Iht100d

- Locate Iht100d and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about missing or lost files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Iht100d and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht100d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht100d and how does it relate to airSlate SignNow?

The iht100d is a specific document type that can be easily managed using airSlate SignNow. This platform allows users to send, sign, and store iht100d documents securely, streamlining the entire process for businesses.

-

How much does airSlate SignNow cost for managing iht100d documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those focused on iht100d documents. You can choose from monthly or annual subscriptions, ensuring you find a plan that fits your budget while accessing all necessary features.

-

What features does airSlate SignNow provide for iht100d document management?

With airSlate SignNow, users can easily create, send, and eSign iht100d documents. Key features include customizable templates, real-time tracking, and secure storage, all designed to enhance your document workflow.

-

What are the benefits of using airSlate SignNow for iht100d?

Using airSlate SignNow for iht100d offers numerous benefits, including increased efficiency and reduced turnaround times. The platform's user-friendly interface ensures that even those unfamiliar with digital signing can navigate the process with ease.

-

Can I integrate airSlate SignNow with other tools for managing iht100d?

Yes, airSlate SignNow supports integrations with various third-party applications, making it easy to manage iht100d documents alongside your existing tools. This flexibility allows for a seamless workflow across different platforms.

-

Is airSlate SignNow secure for handling iht100d documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your iht100d documents. You can trust that your sensitive information is safe while using the platform.

-

How can I get started with airSlate SignNow for iht100d?

Getting started with airSlate SignNow for iht100d is simple. You can sign up for a free trial to explore the features and functionalities, allowing you to see firsthand how it can streamline your document management process.

Get more for Iht100d

- Director disclosure form

- How to fill out application form fsm

- Trends and prospects of mobile payment industry in china form

- Notice of commencement of paternity proceeding utah health utah form

- To download term sheet acceptance form cleveland mining

- National fuel reminds customers of the importance form

- Lsc cyfair student services form

- Refrigeration service agreement template form

Find out other Iht100d

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe