Ga Dept of Revenue Att 15 Form

What is the Ga Dept Of Revenue Att 15 Form

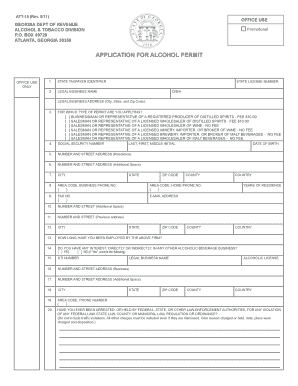

The Ga Dept Of Revenue Att 15 Form is a document used primarily for tax purposes in the state of Georgia. This form is part of the process for taxpayers to report certain information related to their income and deductions. It is particularly relevant for individuals and businesses that need to provide additional details that are not included in the standard tax forms. The form helps ensure compliance with state tax regulations and facilitates accurate tax reporting.

How to obtain the Ga Dept Of Revenue Att 15 Form

The Ga Dept Of Revenue Att 15 Form can be obtained through the Georgia Department of Revenue's official website. Taxpayers can access the form in a downloadable PDF format, which can be printed and filled out manually. Additionally, some tax preparation software may include the form as part of their offerings, allowing users to complete it digitally. It is important to ensure that you are using the most current version of the form to comply with state requirements.

Steps to complete the Ga Dept Of Revenue Att 15 Form

Completing the Ga Dept Of Revenue Att 15 Form involves several key steps:

- Download the form from the Georgia Department of Revenue website or access it through tax software.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the necessary financial information as required by the form, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Ga Dept Of Revenue Att 15 Form

The Ga Dept Of Revenue Att 15 Form is legally binding and must be completed truthfully and accurately. Filing this form is a requirement for certain taxpayers in Georgia, and failure to do so can result in penalties or legal repercussions. It is essential to use the form in accordance with the guidelines provided by the Georgia Department of Revenue to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Ga Dept Of Revenue Att 15 Form typically align with the state's tax return deadlines. Taxpayers should be aware of these important dates to avoid late submissions. Generally, individual income tax returns are due on April fifteenth, but it is advisable to check the Georgia Department of Revenue website for any updates or changes to deadlines, especially for specific circumstances that may affect filing dates.

Form Submission Methods

The Ga Dept Of Revenue Att 15 Form can be submitted through various methods, including:

- Online submission via the Georgia Department of Revenue's e-filing system, if applicable.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local Georgia Department of Revenue offices, which may be available for certain taxpayers.

Quick guide on how to complete ga dept of revenue att 15 form

Prepare Ga Dept Of Revenue Att 15 Form effortlessly on any device

The management of digital documents has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Ga Dept Of Revenue Att 15 Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to modify and electronically sign Ga Dept Of Revenue Att 15 Form with ease

- Obtain Ga Dept Of Revenue Att 15 Form and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ga Dept Of Revenue Att 15 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ga dept of revenue att 15 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ga Dept Of Revenue Att 15 Form?

The Ga Dept Of Revenue Att 15 Form is a document used for specific tax-related purposes in Georgia. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. Using airSlate SignNow can simplify the process of filling out and submitting the Ga Dept Of Revenue Att 15 Form.

-

How can airSlate SignNow help with the Ga Dept Of Revenue Att 15 Form?

airSlate SignNow provides an intuitive platform for electronically signing and sending the Ga Dept Of Revenue Att 15 Form. With its user-friendly interface, you can easily fill out the form, add signatures, and send it securely. This streamlines the process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Ga Dept Of Revenue Att 15 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that enhance the management of documents like the Ga Dept Of Revenue Att 15 Form. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for the Ga Dept Of Revenue Att 15 Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the Ga Dept Of Revenue Att 15 Form. These features ensure that your documents are completed accurately and efficiently, saving you time and effort.

-

Can I integrate airSlate SignNow with other applications for the Ga Dept Of Revenue Att 15 Form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Ga Dept Of Revenue Att 15 Form. This means you can connect it with your existing tools for a more efficient document management process.

-

What are the benefits of using airSlate SignNow for the Ga Dept Of Revenue Att 15 Form?

Using airSlate SignNow for the Ga Dept Of Revenue Att 15 Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are handled securely while allowing for quick and easy access to necessary forms.

-

Is airSlate SignNow secure for submitting the Ga Dept Of Revenue Att 15 Form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for submitting the Ga Dept Of Revenue Att 15 Form. The platform uses advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for Ga Dept Of Revenue Att 15 Form

Find out other Ga Dept Of Revenue Att 15 Form

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF