MARYLAND 502H Maryland Tax Forms and Instructions

What is the MARYLAND 502H Maryland Tax Forms And Instructions

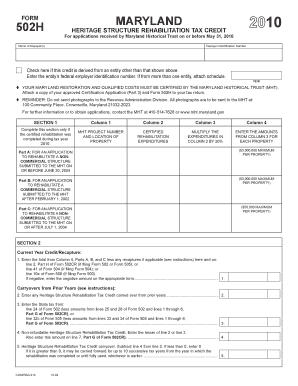

The MARYLAND 502H is a tax form specifically designed for Maryland residents who are filing their state income tax returns. This form is used to report income tax credits related to the Maryland Earned Income Tax Credit (EITC) and the Child and Dependent Care Tax Credit. It provides taxpayers with the necessary instructions and guidelines to accurately complete their tax filings while ensuring they receive any applicable credits. Understanding the purpose of this form is crucial for maximizing tax benefits and ensuring compliance with state regulations.

How to use the MARYLAND 502H Maryland Tax Forms And Instructions

Using the MARYLAND 502H involves several straightforward steps. First, taxpayers should gather all necessary financial documents, including W-2 forms and any other income statements. Next, download the MARYLAND 502H form from the official Maryland state website or obtain a physical copy. Carefully read through the instructions provided with the form to understand the eligibility criteria for the credits being claimed. Complete the form by entering the required information, ensuring accuracy to avoid delays in processing. Finally, submit the completed form along with your state income tax return by the designated deadline.

Steps to complete the MARYLAND 502H Maryland Tax Forms And Instructions

Completing the MARYLAND 502H requires a systematic approach. Start by filling in your personal information, including your name, address, and Social Security number. Next, indicate your filing status and any dependents you are claiming. Follow the instructions to calculate your eligibility for the Earned Income Tax Credit and the Child and Dependent Care Tax Credit. Be sure to include any required documentation that supports your claims, such as proof of income or childcare expenses. Review your completed form for accuracy before submitting it with your Maryland state tax return.

Filing Deadlines / Important Dates

Timely filing of the MARYLAND 502H is essential to avoid penalties. The general deadline for filing state income tax returns in Maryland is April 15. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply if they are unable to file by the standard deadline. Keeping track of these important dates helps ensure compliance and allows for the opportunity to claim any eligible credits.

Required Documents

To complete the MARYLAND 502H, several documents are necessary. Taxpayers should gather their W-2 forms to report earned income, as well as any 1099 forms for additional income sources. Documentation supporting claims for the Earned Income Tax Credit and Child and Dependent Care Tax Credit is also required. This may include receipts for childcare expenses or other relevant financial records. Having these documents organized and accessible can streamline the filing process and help ensure accurate reporting.

Who Issues the Form

The MARYLAND 502H is issued by the Maryland State Comptroller's Office. This office is responsible for overseeing the collection of state taxes and ensuring compliance with tax laws. The Comptroller's Office provides taxpayers with the necessary forms and instructions to facilitate the filing process. It is essential for taxpayers to refer to the official resources provided by this office to ensure they are using the most current version of the form and following the latest guidelines.

Quick guide on how to complete maryland 502h maryland tax forms and instructions

Prepare [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers a superb eco-friendly option to traditional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MARYLAND 502H Maryland Tax Forms And Instructions

Create this form in 5 minutes!

How to create an eSignature for the maryland 502h maryland tax forms and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the MARYLAND 502H Maryland Tax Forms And Instructions?

The MARYLAND 502H Maryland Tax Forms And Instructions are essential documents required for filing certain tax returns in Maryland. They provide detailed guidelines on how to complete your tax forms accurately, ensuring compliance with state regulations. Understanding these forms is crucial for both individuals and businesses to avoid penalties.

-

How can airSlate SignNow help with MARYLAND 502H Maryland Tax Forms And Instructions?

airSlate SignNow simplifies the process of completing and submitting MARYLAND 502H Maryland Tax Forms And Instructions by allowing users to eSign documents securely. Our platform provides templates and easy-to-use tools that streamline the tax filing process, making it more efficient and less stressful. This ensures that you can focus on your business while we handle the paperwork.

-

Are there any costs associated with using airSlate SignNow for MARYLAND 502H Maryland Tax Forms And Instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when dealing with MARYLAND 502H Maryland Tax Forms And Instructions. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for MARYLAND 502H Maryland Tax Forms And Instructions?

airSlate SignNow provides a range of features tailored for MARYLAND 502H Maryland Tax Forms And Instructions, including customizable templates, secure eSigning, and document tracking. These features enhance the user experience by ensuring that all documents are completed accurately and efficiently. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other software for MARYLAND 502H Maryland Tax Forms And Instructions?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage MARYLAND 502H Maryland Tax Forms And Instructions alongside your existing tools. This integration capability enhances workflow efficiency and ensures that all your documents are in one place. You can easily connect with popular accounting and tax software.

-

What are the benefits of using airSlate SignNow for MARYLAND 502H Maryland Tax Forms And Instructions?

Using airSlate SignNow for MARYLAND 502H Maryland Tax Forms And Instructions provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform reduces the risk of errors in tax filings and ensures that your documents are securely stored and easily accessible. This allows you to focus on your core business activities without worrying about paperwork.

-

Is airSlate SignNow suitable for both individuals and businesses handling MARYLAND 502H Maryland Tax Forms And Instructions?

Yes, airSlate SignNow is designed to cater to both individuals and businesses dealing with MARYLAND 502H Maryland Tax Forms And Instructions. Our platform is flexible and scalable, making it suitable for various user needs. Whether you are a freelancer or a large corporation, you can benefit from our efficient document management solutions.

Get more for MARYLAND 502H Maryland Tax Forms And Instructions

- B schedule form 105agreement of purchase and sa

- Fiu online housing agreement form

- Preschool feelings checklist 644821389 form

- Commissions section form

- Jmu secondary school report form

- Instructions graduate readmission applies to students who have attended the university of florida as a graduate student but form

- School of law students can use this form to request a letter that verifies enrollment

- Hkgeac master list form of documents number forms

Find out other MARYLAND 502H Maryland Tax Forms And Instructions

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF