740 42A740 Department of Revenue *1100030001* B Revenue Ky Form

What is the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky

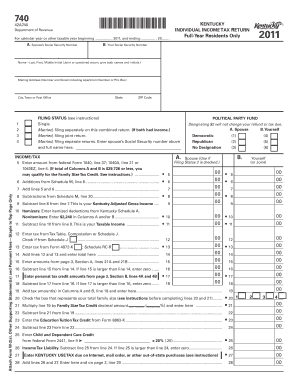

The 740 42A740 form is a tax document issued by the Kentucky Department of Revenue. This specific form is used primarily for individual income tax filing in the state of Kentucky. It captures essential information regarding a taxpayer's income, deductions, and credits, allowing the state to assess tax liabilities accurately. The form is crucial for residents and non-residents earning income in Kentucky, ensuring compliance with state tax laws.

How to use the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky

Using the 740 42A740 form involves several steps to ensure accurate completion. Taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and other income statements. After collecting the required information, individuals can fill out the form, detailing their income, deductions, and any applicable credits. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference and eligibility.

Steps to complete the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky

Completing the 740 42A740 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and deduction records.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income accurately, ensuring all figures are correct.

- Claim deductions and credits as applicable, referencing the instructions provided with the form.

- Review the completed form for accuracy before submission.

- Submit the form either electronically through the Kentucky Department of Revenue website or via mail to the designated address.

Required Documents

To complete the 740 42A740 form, taxpayers need to prepare several documents:

- W-2 forms from employers showing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or dividends.

- Documentation for deductions, including receipts for medical expenses or charitable contributions.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 740 42A740 form. Typically, the deadline for filing individual income tax returns in Kentucky aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also keep track of any extensions or changes announced by the Kentucky Department of Revenue.

Penalties for Non-Compliance

Failure to file the 740 42A740 form by the deadline can result in penalties. These penalties may include late fees and interest on any unpaid taxes. The Kentucky Department of Revenue imposes these penalties to encourage timely compliance with tax laws. Taxpayers should be aware that repeated non-compliance can lead to more severe consequences, including legal action or liens against property.

Quick guide on how to complete 740 42a740 department of revenue 1100030001 b revenue ky

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly prevalent among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, adjust, and eSign your documents quickly without delays. Manage [SKS] on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Adjust and eSign [SKS] to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 740 42A740 Department Of Revenue *1100030001* B Revenue Ky

Create this form in 5 minutes!

How to create an eSignature for the 740 42a740 department of revenue 1100030001 b revenue ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky. form?

The 740 42A740 Department Of Revenue *1100030001* B Revenue Ky. form is a tax document used for reporting income and calculating tax liabilities in Kentucky. It is essential for individuals and businesses to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky. form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky. form. This streamlines the process, ensuring that your documents are securely signed and submitted on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a basic plan to more advanced options. Each plan provides access to features that can assist with the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky. form and other document management tasks.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSignature, document templates, and real-time collaboration. These tools are particularly useful for managing the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky. form efficiently and effectively.

-

Is airSlate SignNow compliant with legal standards for eSignatures?

Yes, airSlate SignNow complies with the ESIGN Act and UETA, ensuring that eSignatures are legally binding. This compliance is crucial when dealing with important documents like the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky. form.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This flexibility allows you to manage the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky. form alongside your existing workflows.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly enhance your business's efficiency by reducing the time spent on document management. With features tailored for forms like the 740 42A740 Department Of Revenue *1100030001* B Revenue Ky., you can streamline processes and improve compliance.

Get more for 740 42A740 Department Of Revenue *1100030001* B Revenue Ky

- Fiscal implications of the administrations proposed base force cbo form

- The budget and economic outlook congressional budget office cbo form

- This contract expressly limits acceptance to terms and conditions stated herein form

- August08 taofinal2 doc apps cbp form

- Ace dueno de cuenta comercial apps cbp form

- Forms cbp

- Categorization and compound form

- Nj 1040 v resident income tax payment voucher form

Find out other 740 42A740 Department Of Revenue *1100030001* B Revenue Ky

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe