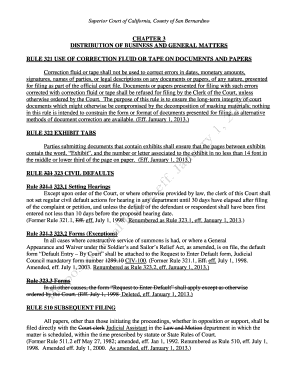

DISTRIBUTION of BUSINESS and GENERAL MATTERS Form

What is the Distribution of Business and General Matters

The Distribution of Business and General Matters is a formal document used primarily in legal and business contexts. It outlines the allocation of responsibilities, assets, and decision-making processes within a business entity. This form is essential for ensuring clarity and compliance among partners, shareholders, and stakeholders, particularly in limited liability companies (LLCs) and corporations. By defining the distribution of roles and resources, the document helps mitigate disputes and enhances operational efficiency.

How to Use the Distribution of Business and General Matters

Utilizing the Distribution of Business and General Matters involves several key steps. First, gather all relevant stakeholders to discuss and agree on the terms of distribution. Next, draft the document, ensuring it clearly outlines the roles, responsibilities, and distribution of assets. Once the draft is complete, review it for accuracy and compliance with applicable laws. Finally, have all parties sign the document to formalize the agreement. This process not only clarifies expectations but also serves as a reference point for future business operations.

Key Elements of the Distribution of Business and General Matters

Several critical elements should be included in the Distribution of Business and General Matters. These include:

- Roles and Responsibilities: Clearly define each party's duties to avoid confusion.

- Asset Distribution: Specify how assets will be divided among stakeholders.

- Decision-Making Processes: Outline how decisions will be made, including voting rights.

- Conflict Resolution: Include mechanisms for resolving disputes that may arise.

- Amendment Procedures: Detail how changes to the agreement can be made in the future.

Steps to Complete the Distribution of Business and General Matters

Completing the Distribution of Business and General Matters involves a systematic approach:

- Identify all parties involved in the business.

- Hold a meeting to discuss the distribution of roles and assets.

- Draft the document, incorporating agreed-upon terms.

- Review the draft with legal counsel to ensure compliance.

- Distribute the draft for feedback and make necessary adjustments.

- Finalize and obtain signatures from all parties.

Legal Use of the Distribution of Business and General Matters

The legal use of the Distribution of Business and General Matters is crucial for businesses operating in the United States. This document serves as a binding agreement that can be referenced in legal disputes or audits. It is important to ensure that the document complies with state laws, as regulations may vary. Additionally, having this document in place can protect the interests of all parties involved and provide a clear framework for business operations.

Filing Deadlines / Important Dates

While the Distribution of Business and General Matters does not typically require formal filing with government agencies, it is essential to keep track of relevant deadlines. For businesses, this may include annual meetings or updates to the document if significant changes occur. Maintaining an updated version ensures that all stakeholders are aware of their roles and responsibilities, which is particularly important during tax season or when preparing for audits.

Quick guide on how to complete distribution of business and general matters

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the needed form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information thoroughly and click the Done button to confirm your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DISTRIBUTION OF BUSINESS AND GENERAL MATTERS

Create this form in 5 minutes!

How to create an eSignature for the distribution of business and general matters

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS in document management?

The DISTRIBUTION OF BUSINESS AND GENERAL MATTERS is crucial for ensuring that all stakeholders are informed and involved in the decision-making process. By utilizing airSlate SignNow, businesses can streamline the distribution of important documents, ensuring that everyone has access to the necessary information in a timely manner.

-

How does airSlate SignNow facilitate the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS?

airSlate SignNow simplifies the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS by allowing users to send, sign, and manage documents electronically. This not only speeds up the process but also reduces the risk of errors and miscommunication, making it easier for teams to collaborate effectively.

-

What are the pricing options for airSlate SignNow related to the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS?

airSlate SignNow offers flexible pricing plans that cater to various business needs, especially concerning the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing essential features for document management.

-

Can airSlate SignNow integrate with other tools for managing the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS. This allows businesses to connect their existing workflows and tools, ensuring a smooth transition and improved efficiency in document handling.

-

What features does airSlate SignNow offer to improve the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking, all designed to enhance the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS. These tools help businesses manage their documents more effectively, ensuring that all parties are kept in the loop.

-

How can airSlate SignNow benefit my business in terms of the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS?

By using airSlate SignNow, businesses can signNowly improve the efficiency of the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS. The platform's user-friendly interface and robust features allow for quicker document turnaround times, leading to faster decision-making and increased productivity.

-

Is airSlate SignNow secure for handling sensitive documents related to the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents related to the DISTRIBUTION OF BUSINESS AND GENERAL MATTERS are protected. With advanced encryption and compliance with industry standards, businesses can trust that their sensitive information is safe.

Get more for DISTRIBUTION OF BUSINESS AND GENERAL MATTERS

Find out other DISTRIBUTION OF BUSINESS AND GENERAL MATTERS

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement