Form 1120 Schedule M 3 KPMG

What is the Form 1120 Schedule M-3 KPMG

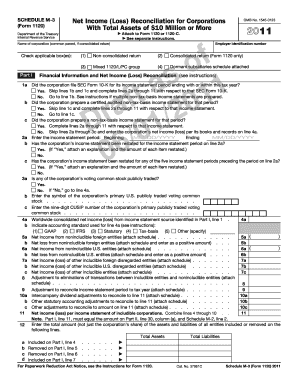

The Form 1120 Schedule M-3 is a tax form used by corporations to provide detailed information regarding their financial activities. This form is particularly relevant for corporations that have total assets of ten million dollars or more. The Schedule M-3 is designed to enhance transparency by requiring corporations to reconcile financial statement income with taxable income. KPMG, a global leader in audit, tax, and advisory services, often assists clients in navigating the complexities associated with this form.

How to use the Form 1120 Schedule M-3 KPMG

Using the Form 1120 Schedule M-3 involves several steps to ensure accurate reporting of financial activities. Corporations must first gather their financial statements, including balance sheets and income statements. Next, they need to complete the necessary sections of the form, which include reconciling book income to taxable income and providing detailed disclosures about various items. KPMG professionals can guide corporations through this process, ensuring compliance with IRS regulations and accuracy in reporting.

Steps to complete the Form 1120 Schedule M-3 KPMG

Completing the Form 1120 Schedule M-3 requires a systematic approach. Here are the essential steps:

- Gather financial statements, including the balance sheet and income statement.

- Identify and categorize income and expenses as reported in the financial statements.

- Complete Part I of the Schedule M-3, which involves reconciling book income to taxable income.

- Fill out Parts II and III, providing additional disclosures and details about specific items.

- Review the completed form for accuracy and ensure all required information is included.

- Submit the form along with the corporate income tax return.

Key elements of the Form 1120 Schedule M-3 KPMG

The Form 1120 Schedule M-3 contains several key elements that are crucial for accurate reporting. These include:

- Reconciliation of financial statement income to taxable income.

- Detailed disclosures about specific income and expense items.

- Information on foreign operations and transactions.

- Data on related party transactions.

Understanding these elements is vital for compliance and for providing a clear picture of a corporation's financial activities.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form 1120 Schedule M-3. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation’s tax year. For corporations operating on a calendar year, this typically falls on April fifteenth. It is essential to be aware of these deadlines to avoid penalties and interest charges for late submissions.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Form 1120 Schedule M-3. These guidelines outline the requirements for reconciliation, disclosure, and the types of information that must be reported. Corporations should refer to the latest IRS instructions for the Schedule M-3 to ensure compliance with current tax laws and regulations. Consulting with KPMG can also provide valuable insights into these guidelines and how they apply to specific corporate situations.

Quick guide on how to complete form 1120 schedule m 3 kpmg

Finish [SKS] effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and electronically sign your files quickly without delays. Manage [SKS] on any gadget using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to initiate.

- Use the tools we offer to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 Schedule M 3 KPMG

Create this form in 5 minutes!

How to create an eSignature for the form 1120 schedule m 3 kpmg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 Schedule M 3 KPMG?

Form 1120 Schedule M 3 KPMG is a tax form used by corporations to report their financial information to the IRS. It provides detailed information about a corporation's income, deductions, and tax liability. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with Form 1120 Schedule M 3 KPMG?

airSlate SignNow simplifies the process of preparing and submitting Form 1120 Schedule M 3 KPMG by allowing users to easily eSign and send documents. Our platform ensures that all necessary signatures are collected efficiently, reducing the time spent on paperwork. This streamlines your tax filing process and enhances compliance.

-

What features does airSlate SignNow offer for managing Form 1120 Schedule M 3 KPMG?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Form 1120 Schedule M 3 KPMG. These tools help ensure that your documents are completed accurately and on time. Additionally, our platform provides reminders and notifications to keep you organized.

-

Is airSlate SignNow cost-effective for businesses handling Form 1120 Schedule M 3 KPMG?

Yes, airSlate SignNow is a cost-effective solution for businesses managing Form 1120 Schedule M 3 KPMG. Our pricing plans are designed to fit various business sizes and needs, ensuring you get the best value for your investment. By reducing paperwork and streamlining processes, you can save both time and money.

-

Can I integrate airSlate SignNow with other software for Form 1120 Schedule M 3 KPMG?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage Form 1120 Schedule M 3 KPMG. This connectivity allows for smooth data transfer and enhances your overall workflow, ensuring that all your documents are in sync.

-

What are the benefits of using airSlate SignNow for Form 1120 Schedule M 3 KPMG?

Using airSlate SignNow for Form 1120 Schedule M 3 KPMG provides numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows for quick document turnaround and reduces the risk of errors. This ensures that your tax filings are accurate and submitted on time.

-

How secure is airSlate SignNow when handling Form 1120 Schedule M 3 KPMG?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including Form 1120 Schedule M 3 KPMG. Our platform complies with industry standards to ensure that your sensitive information remains confidential. You can trust us to keep your data safe.

Get more for Form 1120 Schedule M 3 KPMG

- Title awesome area nsa form

- Classifying triangles nsa form

- Title geometric petting zoo brief overview students will apply their nsa form

- The collected concept development units of the form

- Title inching along nsa form

- Title pool time form

- Quilting exploration with polygons and tessellations form

- 39round n 39round we go a math adventure with circles form

Find out other Form 1120 Schedule M 3 KPMG

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF