Refund Request for B&O Tax Paid on Civilian Health and Medical Program of the Uniformed ServicesTRICARE Income Refund Reques

Understanding the Refund Request for B&O Tax

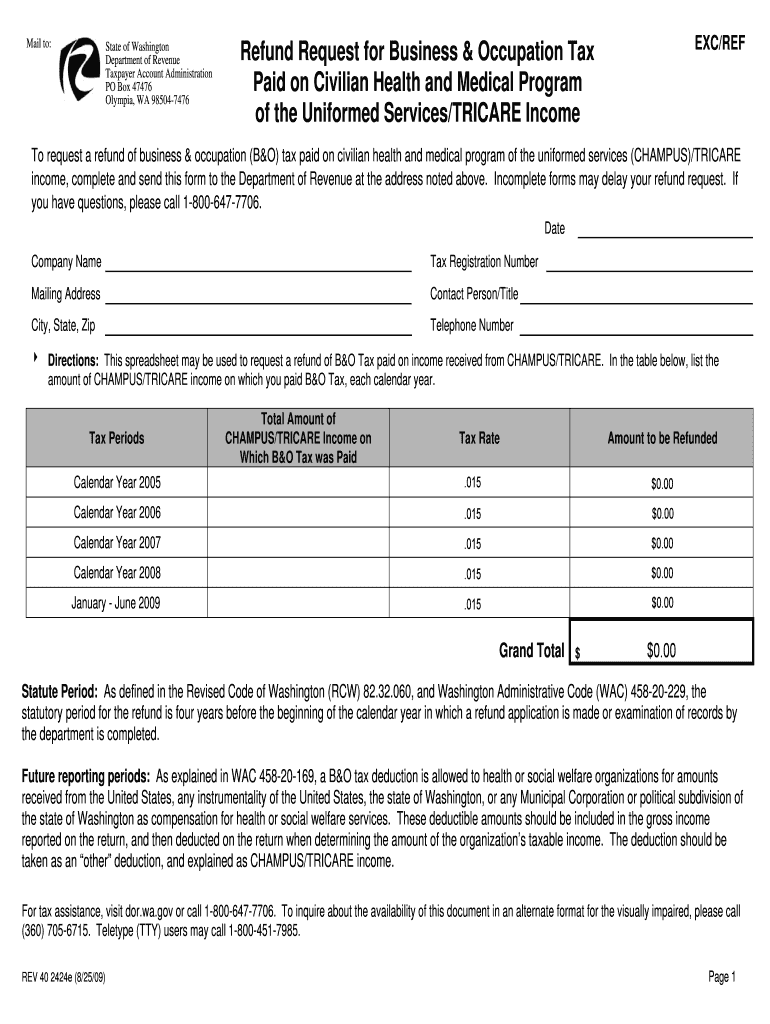

The Refund Request for B&O Tax Paid on the Civilian Health and Medical Program of the Uniformed Services (TRICARE) is a formal process that allows eligible individuals to reclaim taxes that may have been overpaid. This tax is typically levied on certain business activities and services. Understanding this process is crucial for service members and their families who have utilized TRICARE services and wish to ensure they are not financially burdened by unnecessary tax payments.

How to Use the Refund Request Form

To effectively use the Refund Request for B&O Tax Paid on TRICARE, individuals must first gather all necessary documentation, including proof of payment and any relevant tax records. The form itself can be completed digitally, which streamlines the process. Users should fill out each section carefully, ensuring that all information is accurate to avoid delays in processing. Once completed, the form can be submitted as directed in the accompanying instructions.

Steps to Complete the Refund Request

Completing the Refund Request for B&O Tax involves several key steps:

- Gather required documents, including payment receipts and tax records.

- Access the refund request form, available in a digital format for ease of use.

- Carefully fill out all sections of the form, ensuring accuracy in personal and financial information.

- Review the completed form for any errors or omissions.

- Submit the form according to the provided instructions, either electronically or by mail.

Required Documents for Submission

When submitting the Refund Request for B&O Tax, it is essential to include specific documents to support your claim. These may include:

- Proof of payment for the B&O tax.

- Tax returns or filings that show the paid amount.

- Any correspondence related to the tax payment.

Having these documents ready will facilitate a smoother review process by the tax authority.

Eligibility Criteria for Refund Requests

To qualify for a refund of the B&O tax paid on TRICARE, individuals must meet certain eligibility criteria. Generally, this includes being a service member or a dependent who has utilized TRICARE services. Additionally, the request must pertain to taxes that were erroneously paid or overpaid. It is important to review the specific eligibility requirements outlined in the refund request guidelines to ensure compliance.

Filing Deadlines for Refund Requests

Timeliness is crucial when submitting a Refund Request for B&O Tax. There are specific deadlines that must be adhered to for the request to be considered valid. Typically, requests should be filed within a certain time frame following the tax payment. It is advisable to check the latest guidelines to confirm the exact filing deadlines to avoid missing the opportunity for a refund.

Quick guide on how to complete refund request for bampo tax paid on civilian health and medical program of the uniformed servicestricare income refund request

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the features you need to create, edit, and eSign your documents quickly and efficiently. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-driven process today.

The easiest way to edit and eSign [SKS] with ease

- Acquire [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Produce your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to finalize your changes.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure smooth communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income Refund Reques

Create this form in 5 minutes!

How to create an eSignature for the refund request for bampo tax paid on civilian health and medical program of the uniformed servicestricare income refund request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income?

The Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income is a formal process that allows eligible individuals to reclaim business and occupation taxes paid on specific health and medical services. This refund can help alleviate financial burdens for those who qualify under the TRICARE program.

-

How can I submit a Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income?

To submit a Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income, you need to fill out the appropriate forms and provide necessary documentation. This process can typically be completed online or through your local tax office, ensuring a streamlined experience.

-

What documents are required for the Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income?

When filing a Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income, you will need to provide proof of payment, identification, and any relevant medical service documentation. Ensuring all documents are accurate and complete will help expedite the refund process.

-

How long does it take to process a Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income?

The processing time for a Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income can vary, but it typically takes several weeks. Factors such as the volume of requests and the completeness of your submission can influence the timeline.

-

Are there any fees associated with the Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income?

Generally, there are no fees to submit a Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income. However, it is advisable to check with your local tax authority for any specific regulations or potential costs involved in the process.

-

Can I track the status of my Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income?

Yes, many tax authorities provide online tracking for Refund Requests For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income. You can usually check the status using your reference number or personal information on the tax authority's website.

-

What should I do if my Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income is denied?

If your Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income is denied, you should review the denial notice for specific reasons. You may have the option to appeal the decision or reapply with additional documentation.

Get more for Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income Refund Reques

- 4496 federal register vol gpo form

- International priority airmail service pdf u s government gpo form

- 64 fr 17056 union pacific railroad companyabandonment and gpo form

- 64 fr 24221 approved motor fuel distribution terminals gpo form

- 64 fr 51331 nofa for resident opportunities and gpo form

- 65 fr 1227 quarterly irs interest rates used u s government gpo form

- Notice of business meeting pdf u s government printing office gpo form

- 65 fr 40008 public housing assessment system financial gpo form

Find out other Refund Request For B&O Tax Paid On Civilian Health And Medical Program Of The Uniformed ServicesTRICARE Income Refund Reques

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast