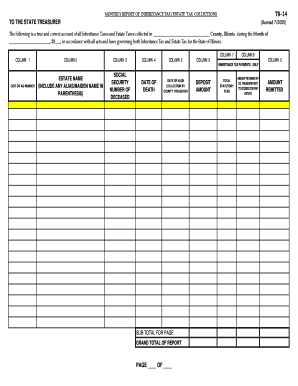

Monthly Report of Estate Tax Collections Illinois State Treasurer Form

Understanding the Monthly Report of Estate Tax Collections

The Monthly Report of Estate Tax Collections is a crucial document prepared by the Illinois State Treasurer. It provides detailed information on the estate taxes collected within the state. This report is essential for tracking revenue generated from estate taxes, which can impact state funding and budgeting decisions. The report typically includes figures on total collections, comparisons to previous months, and insights into trends that may affect future collections.

How to Use the Monthly Report of Estate Tax Collections

This report serves multiple purposes for various stakeholders, including policymakers, financial analysts, and estate planners. Users can leverage the data to assess the financial health of the state, understand the impact of estate tax policies, and make informed decisions regarding estate planning. For estate planners, the report can highlight trends that may influence tax strategies for clients, ensuring compliance and optimal financial outcomes.

Obtaining the Monthly Report of Estate Tax Collections

Key Elements of the Monthly Report of Estate Tax Collections

The report generally includes several key components: total estate tax collections for the month, year-to-date figures, comparisons to previous years, and detailed breakdowns by county or region. Additional notes may provide context on any significant changes or anomalies in the data, such as legislative changes affecting tax rates or collection methods. These elements are vital for understanding the broader implications of estate tax collection trends.

Filing Deadlines and Important Dates

While the Monthly Report of Estate Tax Collections itself does not have a filing deadline, it is essential for stakeholders to be aware of related deadlines for estate tax returns and payments. Typically, estate taxes must be filed within nine months of the decedent's death, with potential extensions available. Keeping track of these dates ensures compliance and helps avoid penalties associated with late filings.

Legal Use of the Monthly Report of Estate Tax Collections

The Monthly Report serves as an official record of estate tax collections and can be used in various legal contexts. For example, it may be referenced in legislative discussions regarding tax policy or in legal proceedings related to estate disputes. Understanding the legal implications of the report helps stakeholders navigate the complexities of estate taxation and compliance.

Quick guide on how to complete monthly report of estate tax collections illinois state treasurer

Prepare [SKS] effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional hard copies that require printing and signing, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize relevant sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a standard wet ink signature.

- Verify all the details and press the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Modify and eSign [SKS] to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Monthly Report Of Estate Tax Collections Illinois State Treasurer

Create this form in 5 minutes!

How to create an eSignature for the monthly report of estate tax collections illinois state treasurer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Monthly Report Of Estate Tax Collections Illinois State Treasurer?

The Monthly Report Of Estate Tax Collections Illinois State Treasurer provides a detailed overview of estate tax revenues collected by the state. This report is essential for understanding the financial health of estate tax collections and helps stakeholders make informed decisions.

-

How can airSlate SignNow assist with the Monthly Report Of Estate Tax Collections Illinois State Treasurer?

airSlate SignNow offers a streamlined solution for managing and eSigning documents related to the Monthly Report Of Estate Tax Collections Illinois State Treasurer. Our platform simplifies the process, ensuring that all necessary documents are signed and submitted efficiently.

-

What features does airSlate SignNow provide for estate tax reporting?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are crucial for preparing the Monthly Report Of Estate Tax Collections Illinois State Treasurer. These tools enhance accuracy and save time in the reporting process.

-

Is airSlate SignNow cost-effective for businesses handling estate tax documents?

Yes, airSlate SignNow is a cost-effective solution for businesses managing estate tax documents, including the Monthly Report Of Estate Tax Collections Illinois State Treasurer. Our pricing plans are designed to accommodate various business sizes, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for estate tax management?

Absolutely! airSlate SignNow offers integrations with various software applications that can enhance your workflow for the Monthly Report Of Estate Tax Collections Illinois State Treasurer. This allows for seamless data transfer and improved efficiency in managing estate tax documents.

-

What are the benefits of using airSlate SignNow for estate tax collections?

Using airSlate SignNow for the Monthly Report Of Estate Tax Collections Illinois State Treasurer provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and compliance.

-

How secure is airSlate SignNow for handling sensitive estate tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to the Monthly Report Of Estate Tax Collections Illinois State Treasurer. You can trust that your data is safe with us.

Get more for Monthly Report Of Estate Tax Collections Illinois State Treasurer

- 6 professional certification track gateway 2 doc duq form

- Business administration internship form

- The leading teacher program form

- Gpsy 618 personality assessment for intervention 2 credit hours form

- Instruction manual for 113 psychology pdf ebook download duq form

- Flex automatic orthodontia request form docx duq

- Forms forney tx official website city of forney

- Nsdar 1000 daughters of the american revolution form

Find out other Monthly Report Of Estate Tax Collections Illinois State Treasurer

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy