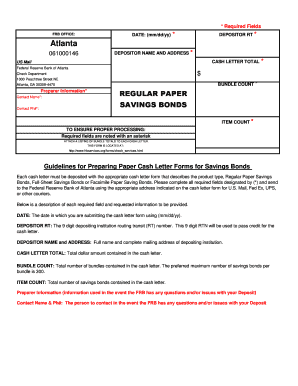

Regular Paper Savings Bonds Federal Reserve Bank Services Form

What are Regular Paper Savings Bonds?

Regular Paper Savings Bonds are a type of savings bond issued by the U.S. Department of the Treasury. These bonds are a low-risk investment option designed to encourage saving among individuals. They can be purchased at face value and earn interest over time, which is compounded semiannually. The interest is exempt from state and local taxes, making them an attractive option for many investors. Regular Paper Savings Bonds can be redeemed after a minimum holding period of one year, and they continue to earn interest for up to 30 years.

How to Obtain Regular Paper Savings Bonds

To obtain Regular Paper Savings Bonds, individuals can purchase them directly from the U.S. Department of the Treasury. They are available for purchase at financial institutions, such as banks and credit unions, or through the TreasuryDirect website. When buying these bonds, it is essential to provide personal identification and the necessary funds for the purchase. The bonds can be bought in denominations ranging from $25 to $10,000, allowing for flexibility based on individual savings goals.

Steps to Complete the Purchase of Regular Paper Savings Bonds

Purchasing Regular Paper Savings Bonds involves several straightforward steps:

- Select a financial institution or visit the TreasuryDirect website.

- Choose the desired denomination for the bond.

- Provide the required personal information, including Social Security number and identification.

- Complete the purchase transaction by submitting payment.

- Receive confirmation of the purchase, which will include details about the bond.

Key Elements of Regular Paper Savings Bonds

Understanding the key elements of Regular Paper Savings Bonds is crucial for investors. These bonds feature:

- Interest Rate: The rate is set at the time of purchase and is fixed for the life of the bond.

- Maturity Period: Bonds mature after 30 years, but they can be redeemed after one year.

- Tax Benefits: Interest earned is exempt from state and local taxes, and federal tax can be deferred until redemption.

- Ownership: Bonds can be registered in the name of one or more individuals, or as a gift to another person.

Legal Use of Regular Paper Savings Bonds

Regular Paper Savings Bonds are legally recognized as a valid form of investment in the United States. They can be used as collateral for loans and can be transferred to beneficiaries upon the owner's death. However, it is important to adhere to the regulations set forth by the U.S. Department of the Treasury regarding ownership, redemption, and transfer of these bonds. Misuse or fraudulent activities involving savings bonds can lead to penalties and legal repercussions.

IRS Guidelines for Regular Paper Savings Bonds

The Internal Revenue Service (IRS) provides specific guidelines regarding the taxation of Regular Paper Savings Bonds. Interest earned on these bonds is subject to federal income tax but can be deferred until the bond is redeemed. Additionally, if the bonds are used for qualified education expenses, tax benefits may apply. It is advisable for bondholders to keep accurate records of their purchases and any interest earned to ensure compliance with IRS regulations.

Quick guide on how to complete regular paper savings bonds federal reserve bank services

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Regular Paper Savings Bonds Federal Reserve Bank Services

Create this form in 5 minutes!

How to create an eSignature for the regular paper savings bonds federal reserve bank services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Regular Paper Savings Bonds offered by the Federal Reserve Bank Services?

Regular Paper Savings Bonds are a secure investment option provided by the Federal Reserve Bank Services. They allow individuals to save money while earning interest over time. These bonds are easy to purchase and can be a great addition to your financial portfolio.

-

How can I purchase Regular Paper Savings Bonds through Federal Reserve Bank Services?

You can purchase Regular Paper Savings Bonds through the Federal Reserve Bank Services by visiting their official website or contacting your local bank. The process is straightforward, and you can choose the amount you wish to invest. This makes it accessible for everyone looking to save.

-

What are the benefits of investing in Regular Paper Savings Bonds?

Investing in Regular Paper Savings Bonds through Federal Reserve Bank Services offers several benefits, including guaranteed returns and tax advantages. These bonds are backed by the U.S. government, making them a low-risk investment. Additionally, they can help you save for future goals.

-

Are there any fees associated with Regular Paper Savings Bonds from Federal Reserve Bank Services?

There are no fees associated with purchasing Regular Paper Savings Bonds through Federal Reserve Bank Services. This makes them a cost-effective option for savers. You only pay for the bonds themselves, allowing you to maximize your investment.

-

How do Regular Paper Savings Bonds earn interest?

Regular Paper Savings Bonds earn interest based on a fixed rate set by the U.S. Treasury. The interest compounds semiannually, which means your investment grows over time. This feature makes them an attractive option for long-term savings through Federal Reserve Bank Services.

-

Can I redeem my Regular Paper Savings Bonds at any time?

Yes, you can redeem your Regular Paper Savings Bonds at any time after they have matured. However, it's important to note that if you redeem them before five years, you may forfeit some interest. Federal Reserve Bank Services provides guidance on the redemption process.

-

What is the minimum investment for Regular Paper Savings Bonds?

The minimum investment for Regular Paper Savings Bonds through Federal Reserve Bank Services is typically $25. This low entry point makes it accessible for individuals looking to start saving. You can purchase bonds in increments of $25 thereafter.

Get more for Regular Paper Savings Bonds Federal Reserve Bank Services

- East carolina university office of student financial aid student additional information worksheet please complete sign print 12208224

- Coe facultystaff handbook east carolina university form

- 12 13 request to consider additional costs east carolina university form

- Great decisions ecu form

- Ecuahec department of nursing guide for the nursing student ecok form

- East central university organization registration application form

- West virginia university east central university ecok form

- Petition to waive univ 1001 andor 3001 ecok form

Find out other Regular Paper Savings Bonds Federal Reserve Bank Services

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF