INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION of FOREIGN STATUS for ALL NON US CITIZENS Daytonastate Form

What is the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate

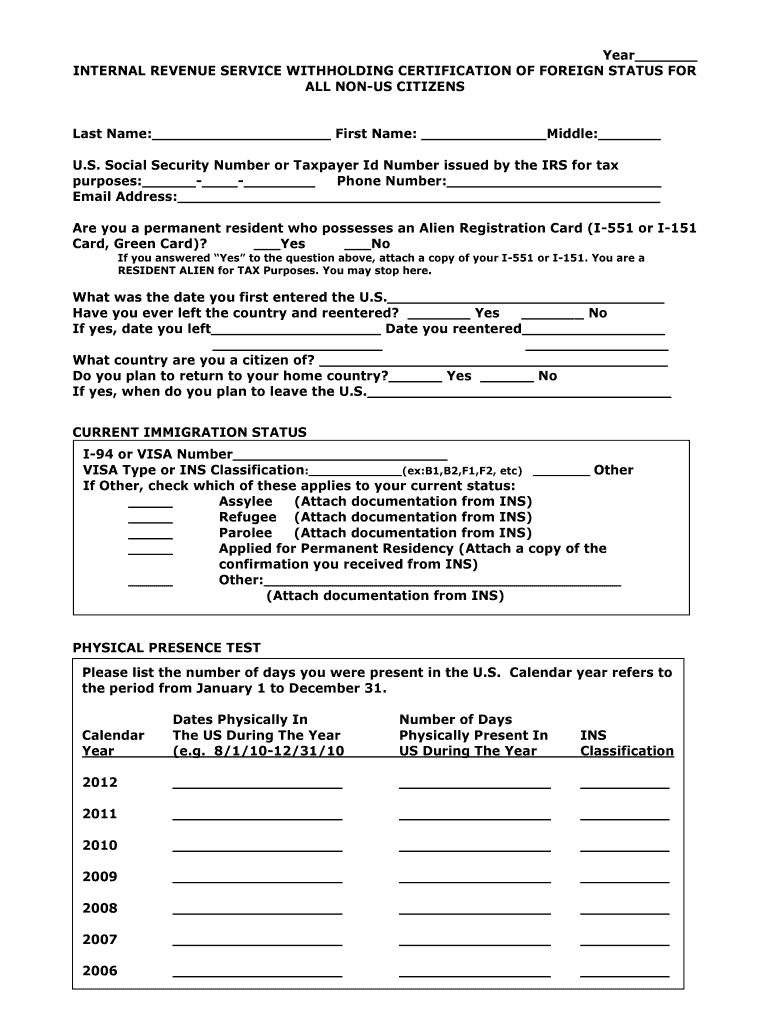

The INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS is a crucial document required by the IRS for individuals who are not U.S. citizens. This form certifies the foreign status of the individual, allowing them to claim tax treaty benefits and potentially reduce or eliminate withholding tax on certain types of income. It is essential for non-resident aliens receiving income from U.S. sources, as it helps ensure compliance with U.S. tax laws while allowing for appropriate tax treatment based on international agreements.

Steps to complete the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate

Completing the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS involves several key steps:

- Gather necessary personal information, including your name, address, and taxpayer identification number.

- Determine your eligibility for tax treaty benefits by reviewing applicable treaties between the U.S. and your country of residence.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Sign and date the form to certify that the information provided is true and correct.

- Submit the completed form to the appropriate withholding agent or financial institution responsible for processing your income payments.

Key elements of the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate

Several key elements must be included when completing the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS:

- Identification: Your full name and address must be clearly stated.

- Tax Identification Number: Provide your foreign tax identification number or U.S. taxpayer identification number.

- Claim for Tax Treaty Benefits: Specify the treaty article that applies to your situation.

- Signature: Your signature is required to validate the information provided.

Legal use of the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate

The legal use of the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS is essential for non-U.S. citizens receiving income from U.S. sources. This form allows individuals to assert their foreign status and claim any applicable tax treaty benefits, which can significantly reduce the tax withholding rate on income such as dividends, interest, and royalties. Proper completion and submission of this form help ensure compliance with U.S. tax regulations and protect against potential penalties for incorrect withholding.

Required Documents

To successfully complete the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS, certain documents may be required:

- Proof of foreign status, such as a passport or national identification card.

- Documentation supporting your claim for tax treaty benefits, including any relevant tax treaties.

- Any prior correspondence with the IRS regarding your tax status, if applicable.

Eligibility Criteria

Eligibility for using the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS primarily depends on your residency status and the type of income you receive. Non-resident aliens who earn income from U.S. sources may qualify for this certification. Additionally, individuals must meet specific criteria outlined in applicable tax treaties, which can vary by country. It is important to review these criteria carefully to ensure compliance and maximize potential benefits.

Quick guide on how to complete internal revenue service withholding certification of foreign status for all non us citizens daytonastate

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without hassle. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to modify and eSign [SKS] without any hassle

- Locate [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method for sending your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service withholding certification of foreign status for all non us citizens daytonastate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate?

The INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate is a crucial document that certifies the foreign status of non-US citizens for tax purposes. It helps ensure compliance with IRS regulations and can prevent unnecessary withholding on payments. Understanding this certification is essential for businesses working with foreign entities.

-

How does airSlate SignNow facilitate the process of obtaining the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION?

airSlate SignNow streamlines the process of obtaining the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate by providing an intuitive platform for document management. Users can easily create, send, and eSign necessary documents, ensuring that all certifications are completed efficiently and securely. This reduces the time and effort required to manage compliance.

-

What are the pricing options for using airSlate SignNow for the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it affordable for companies seeking the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate. Plans are designed to accommodate different volumes of document processing and eSigning, ensuring that you only pay for what you need. Contact our sales team for detailed pricing information.

-

What features does airSlate SignNow offer for managing the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION?

airSlate SignNow provides a range of features to manage the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate effectively. These include customizable templates, automated workflows, and real-time tracking of document status. Additionally, the platform ensures secure storage and compliance with legal standards.

-

Can airSlate SignNow integrate with other software for handling the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate. Whether you use CRM systems, accounting software, or other business tools, our platform can connect to streamline your workflows and improve efficiency.

-

What benefits does airSlate SignNow provide for businesses dealing with foreign clients?

Using airSlate SignNow for the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate offers numerous benefits, including increased efficiency and reduced paperwork. The platform simplifies the eSigning process, allowing businesses to focus on their core operations while ensuring compliance with IRS regulations. This ultimately leads to better client relationships and smoother transactions.

-

Is airSlate SignNow secure for handling sensitive documents like the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION?

Absolutely, airSlate SignNow prioritizes security and compliance when handling sensitive documents such as the INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate. Our platform employs advanced encryption and security protocols to protect your data, ensuring that all transactions are safe and confidential. You can trust us to safeguard your important information.

Get more for INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate

- All member arts and sciences council from fordham university fordham form

- Surprise celebrations fordham university form

- 1999applicationword6 pdf fordham form

- 137gssapplication form03 fordham university

- Gsas research support grants dissertation grant application deadline november 16 and april 15 for doctoral students at the form

- Here fordham university form

- Fidelis careprior authorization request form prior authorization request form

- Self direction enrollment procedure manual form

Find out other INTERNAL REVENUE SERVICE WITHHOLDING CERTIFICATION OF FOREIGN STATUS FOR ALL NON US CITIZENS Daytonastate

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now