Tax Return Filings Nonresident Aliens NRAs Finance Fullerton Form

Understanding Tax Return Filings for Nonresident Aliens

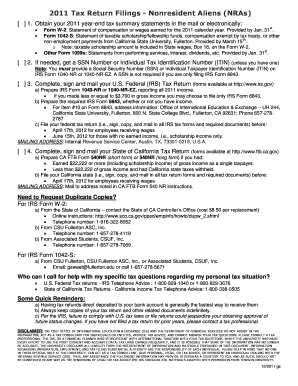

Tax return filings for nonresident aliens (NRAs) in the United States are essential for compliance with federal tax laws. NRAs are individuals who are not U.S. citizens and do not meet the green card test or the substantial presence test. They are required to file a tax return if they have U.S.-sourced income. Understanding the specific requirements and forms needed for NRAs is crucial to avoid penalties and ensure proper reporting of income.

Steps to Complete Tax Return Filings for Nonresident Aliens

Completing tax return filings as a nonresident alien involves several key steps:

- Determine your residency status and whether you need to file.

- Gather necessary documents, including Form W-2 for employment income or Form 1042-S for other income.

- Choose the correct tax form, typically Form 1040-NR for nonresident aliens.

- Complete the form accurately, reporting all U.S.-sourced income and applicable deductions.

- Submit the completed form by the deadline, which is usually April 15 for NRAs who have U.S. income.

Required Documents for Nonresident Alien Tax Filings

When filing tax returns, nonresident aliens must provide specific documents to support their income claims:

- Form W-2: This form reports wages paid to employees and the taxes withheld.

- Form 1042-S: This form reports income other than wages, such as scholarships or fellowship grants.

- Passport: A copy of your passport may be required to verify your identity.

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): These numbers are essential for processing your tax return.

IRS Guidelines for Nonresident Alien Tax Filings

The Internal Revenue Service (IRS) provides specific guidelines for nonresident aliens regarding tax filings. NRAs should familiarize themselves with:

- The types of income subject to U.S. taxation.

- Applicable tax treaties that may reduce or eliminate tax obligations.

- Filing requirements and deadlines to avoid penalties.

Filing Deadlines for Nonresident Aliens

Nonresident aliens must adhere to specific filing deadlines to remain compliant with U.S. tax laws. Generally, the deadline for filing Form 1040-NR is April 15 of the following year after the tax year ends. If you do not have U.S.-sourced income, the deadline may be June 15. It is important to check the IRS website for any updates or changes to these deadlines.

Penalties for Non-Compliance

Failing to file a tax return or pay taxes owed can result in significant penalties for nonresident aliens. These may include:

- Failure-to-file penalty: This penalty is assessed if you do not file your return by the deadline.

- Failure-to-pay penalty: This penalty applies if you do not pay the taxes owed by the due date.

- Interest on unpaid taxes: Interest accrues on any unpaid tax from the due date until paid in full.

Quick guide on how to complete tax return filings nonresident aliens nras finance fullerton

Complete [SKS] effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly without delays. Manage [SKS] on any platform using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest way to alter and eSign [SKS] without hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the features we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow accommodates all your document management needs in just a few clicks from a device of your choice. Edit and eSign [SKS] and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return filings nonresident aliens nras finance fullerton

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton?

Using airSlate SignNow for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton streamlines the document signing process, making it faster and more efficient. Our platform ensures compliance with IRS regulations, which is crucial for NRAs. Additionally, it provides a secure environment for sensitive financial documents, enhancing peace of mind.

-

How does airSlate SignNow ensure compliance for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton?

airSlate SignNow is designed to meet the compliance requirements for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton. We utilize advanced encryption and secure storage solutions to protect your documents. Our platform also keeps you updated with the latest tax regulations, ensuring that your filings are always compliant.

-

What features does airSlate SignNow offer for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton?

airSlate SignNow offers a variety of features tailored for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton, including customizable templates, automated workflows, and real-time tracking. These features help simplify the filing process and reduce the time spent on paperwork. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton?

Yes, airSlate SignNow is a cost-effective solution for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton. We offer competitive pricing plans that cater to different business sizes and needs. By reducing the time and resources spent on document management, our platform ultimately saves you money.

-

Can airSlate SignNow integrate with other tools for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and finance tools, enhancing your workflow for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton. This integration allows for easy data transfer and ensures that all your financial documents are in one place, improving efficiency.

-

How secure is airSlate SignNow for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton?

Security is a top priority at airSlate SignNow, especially for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton. Our platform employs industry-standard encryption and secure access protocols to protect your sensitive information. Regular security audits and compliance checks further ensure that your data remains safe.

-

What support options are available for airSlate SignNow users dealing with Tax Return Filings Nonresident Aliens NRAs Finance Fullerton?

airSlate SignNow provides comprehensive support options for users handling Tax Return Filings Nonresident Aliens NRAs Finance Fullerton. Our customer service team is available via chat, email, and phone to assist with any questions or issues. Additionally, we offer a robust knowledge base with tutorials and FAQs to help you navigate the platform.

Get more for Tax Return Filings Nonresident Aliens NRAs Finance Fullerton

- In the future be sure to warn landlord of potentially dangerous damaging conditions of which form

- Consider any further demands by you to be on the level of reckless andor intentional wrongful form

- Conduct will be used as a defense to any eviction proceeding where i will request punitive form

- Remedies which are available to me in this situation including punitive damages form

- Punitive damages be assessed against you if you do not relent in this malicious retaliatory form

- Serving notices during tenancy province of british columbia form

- Motion and order to recognize foreign judgments form

- Have passed until 20 form

Find out other Tax Return Filings Nonresident Aliens NRAs Finance Fullerton

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF