The Earned Income Tax Credit What it Does for CT, and How it Could Do Much More Ctvoices Form

What is the Earned Income Tax Credit?

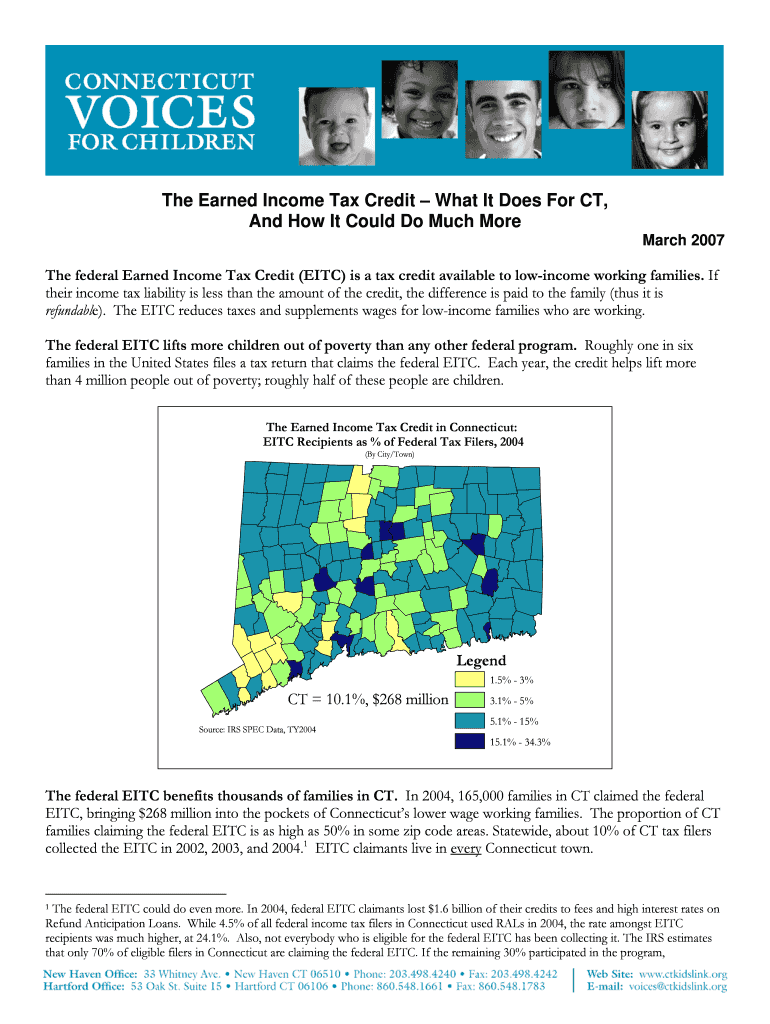

The Earned Income Tax Credit (EITC) is a federal tax benefit designed to assist low- to moderate-income working individuals and families. In Connecticut, this credit can significantly reduce the amount of tax owed and potentially increase the taxpayer's refund. The EITC aims to encourage and reward work while providing financial relief to those who qualify. Eligibility is primarily based on income, family size, and filing status, making it a crucial support system for many residents in Connecticut.

Eligibility Criteria for the Earned Income Tax Credit

To qualify for the Earned Income Tax Credit, taxpayers must meet specific criteria. These include:

- Having earned income from employment or self-employment.

- Meeting income limits, which vary based on filing status and number of qualifying children.

- Filing a federal tax return, even if no tax is owed.

- Being a U.S. citizen or a resident alien for the entire year.

Understanding these criteria is essential for maximizing potential benefits from the EITC.

Steps to Complete the Earned Income Tax Credit Application

Filing for the Earned Income Tax Credit involves several steps:

- Gather necessary documents, including income statements and Social Security numbers for all family members.

- Complete the federal tax return using the appropriate forms, such as the 1040 or 1040A.

- Calculate the EITC using the IRS guidelines or tax preparation software.

- Submit the tax return electronically or via mail, ensuring all required information is included.

Following these steps can help ensure a smooth application process for the EITC.

Key Elements of the Earned Income Tax Credit

Several key elements define the Earned Income Tax Credit:

- The amount of credit varies depending on income, filing status, and the number of qualifying children.

- The credit is refundable, meaning if it exceeds the tax owed, the taxpayer may receive the difference as a refund.

- Taxpayers can claim the EITC for up to three qualifying children, with increasing credit amounts for each additional child.

These elements highlight the EITC's role in providing financial support to working families.

State-Specific Rules for the Earned Income Tax Credit in Connecticut

Connecticut has its own version of the Earned Income Tax Credit, which complements the federal EITC. Key points include:

- The state credit is a percentage of the federal EITC, enhancing the benefit for Connecticut residents.

- Eligibility requirements align closely with federal guidelines, ensuring consistency for taxpayers.

- Connecticut residents must apply for the state credit when filing their state tax return.

Understanding these state-specific rules can help taxpayers maximize their benefits.

Required Documents for the Earned Income Tax Credit

When applying for the Earned Income Tax Credit, certain documents are essential:

- W-2 forms from employers, showing earned income.

- Form 1099 if self-employed, detailing income earned.

- Social Security cards for all family members included in the claim.

- Proof of residency and any other documentation that supports the claim.

Having these documents ready can streamline the application process and ensure compliance with IRS requirements.

Quick guide on how to complete the earned income tax credit what it does for ct and how it could do much more ctvoices

Complete The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to generate, modify, and eSign your documents promptly without interruptions. Manage The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices on any device using the airSlate SignNow apps for Android or iOS and enhance any document-focused workflow today.

The optimal method to modify and eSign The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices effortlessly

- Locate The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Alter and eSign The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices and guarantee seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the earned income tax credit what it does for ct and how it could do much more ctvoices

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The Earned Income Tax Credit and how does it benefit residents of CT?

The Earned Income Tax Credit (EITC) is a federal tax credit designed to assist low to moderate-income working individuals and families. For residents of CT, it can signNowly reduce tax liability and increase refunds, providing essential financial support. Understanding The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices is crucial for maximizing benefits.

-

How can I apply for The Earned Income Tax Credit in Connecticut?

To apply for The Earned Income Tax Credit in Connecticut, you must file your federal tax return and claim the credit on your tax form. It's important to ensure that you meet the eligibility requirements, including income limits and filing status. Knowing The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices can help you navigate the application process effectively.

-

What are the eligibility requirements for The Earned Income Tax Credit in CT?

Eligibility for The Earned Income Tax Credit in CT generally includes having earned income from employment or self-employment, meeting specific income thresholds, and having a valid Social Security number. Additionally, you must be a resident of Connecticut and meet other criteria based on your filing status. Understanding The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices can help you determine your eligibility.

-

How does The Earned Income Tax Credit impact my tax refund?

The Earned Income Tax Credit can signNowly increase your tax refund, especially for low to moderate-income earners. By reducing your overall tax liability, it allows you to receive a larger refund, which can be used for essential expenses. Learning about The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices can help you maximize your refund potential.

-

Are there any changes to The Earned Income Tax Credit for the upcoming tax year?

Changes to The Earned Income Tax Credit can occur annually, including adjustments to income limits and credit amounts. It's essential to stay informed about these changes to ensure you receive the maximum benefit. Understanding The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices will keep you updated on any relevant modifications.

-

Can I claim The Earned Income Tax Credit if I am self-employed in CT?

Yes, self-employed individuals in CT can claim The Earned Income Tax Credit if they meet the eligibility criteria, including income limits. It's important to accurately report your earnings and expenses to qualify for the credit. Knowing The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices can help self-employed individuals maximize their benefits.

-

What resources are available to help me understand The Earned Income Tax Credit in CT?

Various resources are available to help you understand The Earned Income Tax Credit in CT, including state tax websites, community organizations, and tax preparation services. These resources can provide guidance on eligibility, application processes, and maximizing your credit. Familiarizing yourself with The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices can enhance your understanding.

Get more for The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices

Find out other The Earned Income Tax Credit What It Does For CT, And How It Could Do Much More Ctvoices

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later