Case 10 60500 Form

What is the Case 10 60500

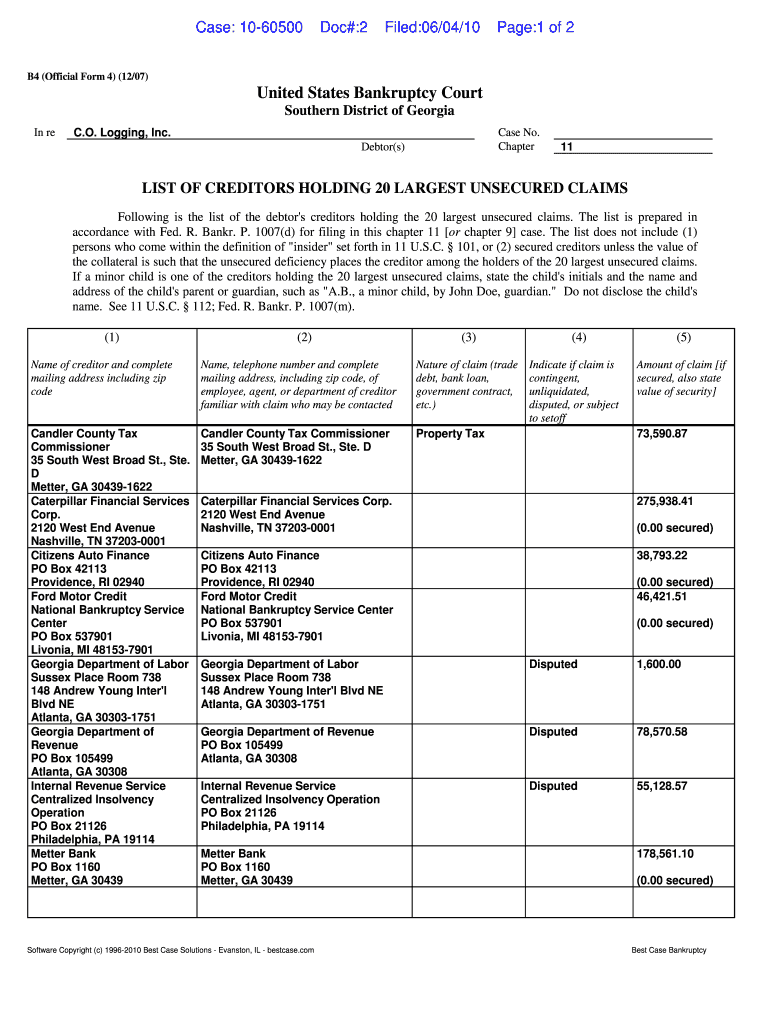

The Case 10 60500 is a specific form used in various legal and administrative processes within the United States. It typically serves as a formal document that outlines essential information required for compliance with certain regulations or procedures. Understanding the purpose and implications of this form is crucial for individuals and businesses alike, as it can affect legal standing and operational compliance.

How to use the Case 10 60500

Using the Case 10 60500 involves several steps to ensure accurate completion and submission. First, gather all necessary information and documents that pertain to the case. This may include identification, financial records, or any relevant correspondence. Next, carefully fill out the form, ensuring that all fields are completed accurately to avoid delays or rejections. Once completed, review the form for any errors before submission.

Steps to complete the Case 10 60500

Completing the Case 10 60500 requires a systematic approach:

- Begin by obtaining the latest version of the form from an official source.

- Read the instructions thoroughly to understand the requirements.

- Fill in personal or business information as required, ensuring accuracy.

- Attach any necessary supporting documents that validate the information provided.

- Review the entire form for completeness and correctness.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal use of the Case 10 60500

The Case 10 60500 has specific legal applications, often related to compliance with state or federal regulations. It may be used in contexts such as tax filings, business registrations, or legal proceedings. Understanding the legal implications of this form is essential, as improper use can lead to penalties or legal challenges. Consulting with a legal professional can provide clarity on its appropriate use.

Required Documents

When preparing to submit the Case 10 60500, several documents may be required to support your application. Commonly needed documents include:

- Identification proof, such as a driver's license or passport.

- Financial statements or tax returns, depending on the context.

- Any prior correspondence related to the case.

- Supporting documents that validate claims made in the form.

Filing Deadlines / Important Dates

Filing deadlines for the Case 10 60500 can vary based on the specific context in which it is used. It is important to be aware of these dates to ensure timely submission. Missing a deadline can result in penalties or complications. Generally, deadlines may align with fiscal year-end dates or specific regulatory timelines, so checking the relevant guidelines is advisable.

Examples of using the Case 10 60500

The Case 10 60500 can be utilized in various scenarios, such as:

- Filing for business licenses or permits.

- Submitting tax-related documents to the IRS.

- Responding to legal inquiries or requests for information.

- Applying for grants or funding that require formal documentation.

Quick guide on how to complete case 10 60500

Effortlessly Prepare [SKS] on Any Gadget

Digital document administration has become increasingly favored by enterprises and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any gadget using the airSlate SignNow apps for Android or iOS, and simplify any document-related tasks today.

How to Alter and eSign [SKS] With Ease

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with the features airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] to facilitate outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the case 10 60500

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Case 10 60500 and how does it work?

Case 10 60500 refers to a specific document management solution offered by airSlate SignNow. It allows users to easily send, sign, and manage documents electronically, streamlining the workflow and enhancing productivity for businesses.

-

What are the pricing options for Case 10 60500?

airSlate SignNow offers competitive pricing for Case 10 60500, with various plans tailored to meet different business needs. You can choose from monthly or annual subscriptions, ensuring that you find a cost-effective solution that fits your budget.

-

What features are included in Case 10 60500?

Case 10 60500 includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance the eSigning experience and improve document management efficiency.

-

How can Case 10 60500 benefit my business?

By implementing Case 10 60500, your business can signNowly reduce the time spent on document processing. This solution not only speeds up the signing process but also minimizes errors, leading to improved overall productivity.

-

Is Case 10 60500 easy to integrate with other software?

Yes, Case 10 60500 is designed to seamlessly integrate with various software applications, including CRM and project management tools. This flexibility allows businesses to enhance their existing workflows without disruption.

-

What security measures are in place for Case 10 60500?

Case 10 60500 prioritizes security with features such as encryption, secure access controls, and compliance with industry standards. This ensures that your documents are protected throughout the signing process.

-

Can I customize documents using Case 10 60500?

Absolutely! Case 10 60500 allows users to create and customize document templates to suit their specific needs. This feature helps businesses maintain brand consistency while streamlining the document creation process.

Get more for Case 10 60500

Find out other Case 10 60500

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe