Form it 399New York Depreciation ScheduleIT399

What is the Form IT-399 New York Depreciation Schedule?

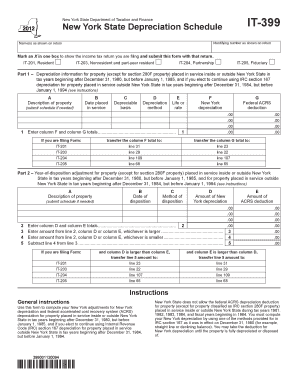

The Form IT-399, also known as the New York Depreciation Schedule, is a tax form used by individuals and businesses to calculate and report depreciation for property used in New York State. This form allows taxpayers to claim deductions for the wear and tear on their assets, which can significantly reduce taxable income. It is particularly important for those who own property, machinery, or equipment that is subject to depreciation under state tax laws.

How to Use the Form IT-399 New York Depreciation Schedule

To effectively use the Form IT-399, taxpayers must first gather all necessary information regarding their depreciable assets. This includes the purchase price, date of acquisition, and the expected useful life of each asset. The form requires detailed entries for each asset, including the type of property, the depreciation method used, and the total depreciation claimed for the tax year. After completing the form, it should be submitted along with the New York State tax return.

Steps to Complete the Form IT-399 New York Depreciation Schedule

Completing the Form IT-399 involves several key steps:

- Gather all relevant documentation for your depreciable assets.

- List each asset on the form, including its type and acquisition details.

- Determine the appropriate depreciation method (e.g., straight-line, declining balance).

- Calculate the depreciation amount for each asset based on the method chosen.

- Complete the form by entering total depreciation and any other required information.

- Review the form for accuracy before submission.

Key Elements of the Form IT-399 New York Depreciation Schedule

The Form IT-399 includes several key elements that taxpayers must complete:

- Asset Information: Details about each depreciable asset, including type and acquisition date.

- Depreciation Method: The method used to calculate depreciation for each asset.

- Total Depreciation: The total amount of depreciation claimed for the tax year.

- Signatures: Required signatures to validate the form.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form IT-399. Typically, the form must be submitted by the same deadline as the New York State personal income tax return. This is usually on or before April fifteenth of the following tax year. If an extension is filed for the tax return, the same extension applies to the Form IT-399.

Legal Use of the Form IT-399 New York Depreciation Schedule

The Form IT-399 is legally recognized by the New York State Department of Taxation and Finance. Taxpayers are required to use this form to report depreciation for state tax purposes accurately. Failure to complete and submit the form correctly can result in penalties or disallowance of claimed deductions. Therefore, it is essential to adhere to all guidelines and ensure compliance with state tax regulations.

Quick guide on how to complete form it 399new york depreciation scheduleit399

Effortlessly manage [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IT 399New York Depreciation ScheduleIT399

Create this form in 5 minutes!

How to create an eSignature for the form it 399new york depreciation scheduleit399

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 399 New York Depreciation Schedule IT399?

Form IT 399 New York Depreciation Schedule IT399 is a tax form used by businesses in New York to report depreciation on their assets. This form helps in calculating the allowable depreciation deductions for state tax purposes, ensuring compliance with New York tax regulations.

-

How can airSlate SignNow help with Form IT 399 New York Depreciation Schedule IT399?

airSlate SignNow streamlines the process of completing and eSigning Form IT 399 New York Depreciation Schedule IT399. With our user-friendly interface, you can easily fill out the form, add necessary signatures, and send it securely, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for Form IT 399?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have access to features that simplify the completion of Form IT 399 New York Depreciation Schedule IT399.

-

Are there any integrations available with airSlate SignNow for Form IT 399?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when dealing with Form IT 399 New York Depreciation Schedule IT399. You can connect with popular tools like Google Drive, Dropbox, and more to manage your documents efficiently.

-

What features does airSlate SignNow offer for managing Form IT 399?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning to help you manage Form IT 399 New York Depreciation Schedule IT399 effectively. These features ensure that your documentation process is efficient and compliant with state regulations.

-

Can I track the status of my Form IT 399 submissions with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Form IT 399 New York Depreciation Schedule IT399 submissions in real-time. You will receive notifications when your documents are viewed, signed, or completed, giving you peace of mind throughout the process.

-

Is airSlate SignNow secure for handling sensitive information on Form IT 399?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive information related to Form IT 399 New York Depreciation Schedule IT399 is protected. We use advanced encryption and security protocols to safeguard your data during transmission and storage.

Get more for Form IT 399New York Depreciation ScheduleIT399

- The person executing this instrument is the present holder of the above described mortgage form

- News ampamp announcements new york state unified court form

- Rule 31385 duty to notify court and others of settlement of form

- I am a member of the bar of this court and am associated with the firm of form

- Categoryjudges of the united states district court for the form

- Control number ny sdeed 7 form

- For use by an executorexecutrix form

- New york state board of law examiners course form

Find out other Form IT 399New York Depreciation ScheduleIT399

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT