Form it 252 ATTEmployment Incentive Credit for the

What is the Form IT 252 ATTEmployment Incentive Credit For The

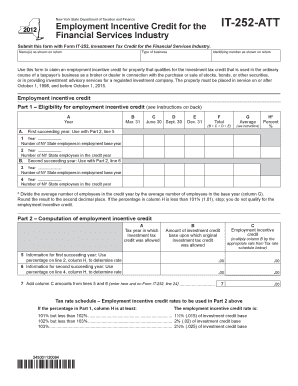

The Form IT 252 ATTEmployment Incentive Credit is a tax form used in the United States to claim a credit for hiring eligible employees. This form is specifically designed for employers who wish to take advantage of the Employment Incentive Credit, which aims to encourage job creation and support workforce development. The credit can significantly reduce the employer's tax liability, making it an important tool for businesses looking to expand their workforce while benefiting from tax savings.

How to use the Form IT 252 ATTEmployment Incentive Credit For The

Using the Form IT 252 ATTEmployment Incentive Credit involves several key steps. First, employers must determine their eligibility for the credit based on the type of employees they hire. Next, the form must be filled out accurately, providing details about the eligible employees and the wages paid. After completing the form, it should be submitted with the employer's tax return to ensure that the credit is applied appropriately. It is crucial to keep records of all relevant documentation to support the claims made on the form.

Steps to complete the Form IT 252 ATTEmployment Incentive Credit For The

Completing the Form IT 252 ATTEmployment Incentive Credit involves a series of methodical steps:

- Gather necessary information about eligible employees, including their names, Social Security numbers, and employment dates.

- Calculate the total wages paid to these employees during the qualifying period.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Attach the completed form to your tax return and submit it by the designated deadline.

Eligibility Criteria

To qualify for the Employment Incentive Credit using Form IT 252, employers must meet specific eligibility criteria. This typically includes hiring individuals from targeted groups, such as veterans, long-term unemployed individuals, or those receiving certain government assistance. Additionally, the employees must work a minimum number of hours and be paid above a specified wage threshold. Employers should review the guidelines carefully to ensure compliance and maximize their potential credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 252 ATTEmployment Incentive Credit align with the general tax filing deadlines for employers. Typically, businesses must submit their tax returns by April fifteenth of each year. However, it is essential to confirm any specific deadlines related to the Employment Incentive Credit, as these may vary based on state regulations or changes in tax law. Employers should stay informed about any updates to ensure timely filing.

Required Documents

When completing the Form IT 252 ATTEmployment Incentive Credit, employers should prepare several supporting documents. These may include:

- Payroll records that detail wages paid to eligible employees.

- Documentation proving the employees' eligibility, such as forms or letters from government agencies.

- Any previous tax returns that may provide context for the current claim.

Having these documents on hand can streamline the process and help substantiate the claims made on the form.

Quick guide on how to complete form it 252 attemployment incentive credit for the

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

The simplest way to modify and eSign [SKS] seamlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight necessary parts of your documents or obscure sensitive information with tools specially provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages your document management needs in just a few clicks from your preferred device. Alter and eSign [SKS] and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 252 attemployment incentive credit for the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 252 ATTEmployment Incentive Credit For The?

Form IT 252 ATTEmployment Incentive Credit For The is a tax form used to claim employment incentive credits in certain jurisdictions. This form helps businesses reduce their tax liabilities by providing credits for hiring eligible employees. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with Form IT 252 ATTEmployment Incentive Credit For The?

airSlate SignNow simplifies the process of preparing and submitting Form IT 252 ATTEmployment Incentive Credit For The. Our platform allows you to easily fill out, sign, and send the form electronically, ensuring compliance and efficiency. This streamlines your workflow and saves valuable time.

-

What features does airSlate SignNow offer for managing Form IT 252 ATTEmployment Incentive Credit For The?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and secure document storage for managing Form IT 252 ATTEmployment Incentive Credit For The. These tools enhance your document management process, making it easier to track submissions and maintain records. Our user-friendly interface ensures a smooth experience.

-

Is there a cost associated with using airSlate SignNow for Form IT 252 ATTEmployment Incentive Credit For The?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs when managing Form IT 252 ATTEmployment Incentive Credit For The. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best fits your budget and requirements.

-

What are the benefits of using airSlate SignNow for Form IT 252 ATTEmployment Incentive Credit For The?

Using airSlate SignNow for Form IT 252 ATTEmployment Incentive Credit For The provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and submitted quickly, helping you meet deadlines. Additionally, the electronic format reduces the risk of lost paperwork.

-

Can I integrate airSlate SignNow with other software for Form IT 252 ATTEmployment Incentive Credit For The?

Yes, airSlate SignNow offers integrations with various software applications to streamline your workflow for Form IT 252 ATTEmployment Incentive Credit For The. This allows you to connect with your existing tools, enhancing productivity and collaboration. Our API makes it easy to integrate with your preferred systems.

-

How secure is airSlate SignNow when handling Form IT 252 ATTEmployment Incentive Credit For The?

airSlate SignNow prioritizes security when handling Form IT 252 ATTEmployment Incentive Credit For The. We utilize advanced encryption and secure cloud storage to protect your sensitive information. Our compliance with industry standards ensures that your documents are safe and secure throughout the signing process.

Get more for Form IT 252 ATTEmployment Incentive Credit For The

- Rush hour karting waiver form

- Www affordableconnectivity gov wp contentaffordable connectivity program application fcc form 5645

- Sample form o motion to augment record on california courts

- Schedule ca 540 california adjustments residents schedule ca 540 california adjustments residents form

- Form 206 certificate of formation professional limited liability company

- Name address and telephone number sfsuperiorcourt 395300588 form

- Form w 9 sp rev march request for taxpayer identification number and certification spanish version

- 530 1 student accident report form

Find out other Form IT 252 ATTEmployment Incentive Credit For The

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online