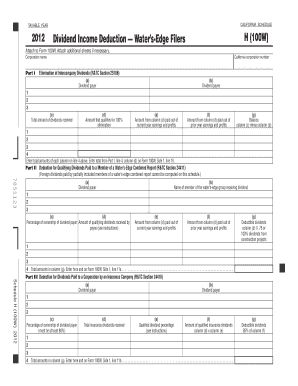

Schedule H 100W Dividend Income Deduction Water's Edge Filers Form

Understanding the Schedule H 100W Dividend Income Deduction for Water's Edge Filers

The Schedule H 100W Dividend Income Deduction is a specific tax form designed for Water's Edge Filers, allowing certain corporations to deduct dividend income received from their subsidiaries. This deduction is particularly relevant for businesses that operate in multiple states or have foreign subsidiaries. By utilizing this form, companies can effectively reduce their taxable income, leading to potential tax savings.

Steps to Complete the Schedule H 100W Dividend Income Deduction

Completing the Schedule H 100W requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and dividend records.

- Identify the subsidiaries from which dividends were received.

- Complete the form by accurately reporting the dividend income and any applicable deductions.

- Review the completed form for accuracy to avoid potential penalties.

- Submit the form by the designated filing deadline.

Eligibility Criteria for Using the Schedule H 100W Dividend Income Deduction

To qualify for the Schedule H 100W Dividend Income Deduction, filers must meet specific eligibility criteria. Primarily, the filer must be a corporation that is part of a Water's Edge election, which allows for the exclusion of certain income from taxation. Additionally, the dividends must be received from subsidiaries that are also part of this election. Understanding these criteria is crucial to ensure compliance and maximize potential deductions.

Required Documents for Filing the Schedule H 100W Dividend Income Deduction

When preparing to file the Schedule H 100W, it is essential to have the following documents ready:

- Financial statements from the corporation and its subsidiaries.

- Records of dividend payments received during the tax year.

- Any previous tax returns that may be relevant for reference.

- Documentation supporting the Water's Edge election status.

IRS Guidelines for the Schedule H 100W Dividend Income Deduction

The IRS provides specific guidelines regarding the use of the Schedule H 100W. These guidelines outline the eligibility requirements, filing procedures, and documentation needed to support the deduction. It is important for filers to review these guidelines thoroughly to ensure compliance with federal tax regulations and to avoid any potential issues during the filing process.

Filing Deadlines for the Schedule H 100W Dividend Income Deduction

Filing deadlines for the Schedule H 100W are typically aligned with the corporate tax return deadlines. Corporations must ensure that they submit the form by the due date of their tax return to avoid penalties. It is advisable to keep track of these deadlines and plan accordingly to ensure timely submission.

Quick guide on how to complete schedule h 100w dividend income deduction waters edge filers

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute to traditional printed and signed paperwork, as you can find the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign [SKS] effortlessly

- Access [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools offered specifically by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule H 100W Dividend Income Deduction Water's Edge Filers

Create this form in 5 minutes!

How to create an eSignature for the schedule h 100w dividend income deduction waters edge filers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule H 100W Dividend Income Deduction for Water's Edge Filers?

The Schedule H 100W Dividend Income Deduction is a tax provision that allows Water's Edge Filers to deduct certain dividend income from their taxable income. This deduction is designed to encourage investment and support businesses operating in multiple states. Understanding this deduction can help you optimize your tax strategy effectively.

-

How can airSlate SignNow assist with managing Schedule H 100W Dividend Income Deduction for Water's Edge Filers?

airSlate SignNow provides an efficient platform for managing documents related to the Schedule H 100W Dividend Income Deduction for Water's Edge Filers. With our eSigning capabilities, you can easily send, sign, and store important tax documents securely. This streamlines your workflow and ensures compliance with tax regulations.

-

What features does airSlate SignNow offer for Water's Edge Filers?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for Water's Edge Filers. These tools help you manage your tax documents efficiently, ensuring that you can focus on maximizing your Schedule H 100W Dividend Income Deduction. Our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for businesses filing Schedule H 100W Dividend Income Deduction?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage their Schedule H 100W Dividend Income Deduction. Our pricing plans are designed to accommodate various business sizes and needs, ensuring you get the best value for your investment. By streamlining your document processes, you can save both time and money.

-

Can airSlate SignNow integrate with accounting software for Water's Edge Filers?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier for Water's Edge Filers to manage their financial documents. This integration allows you to synchronize your data, ensuring that your Schedule H 100W Dividend Income Deduction calculations are accurate and up-to-date. Simplifying your workflow has never been easier.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for Schedule H 100W Dividend Income Deduction, offers numerous benefits. You gain access to secure storage, easy sharing, and real-time collaboration features. This enhances your efficiency and ensures that all stakeholders are on the same page during the tax filing process.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information. When dealing with Schedule H 100W Dividend Income Deduction documents, you can trust that your data is safe. Our platform is designed to meet industry standards, ensuring peace of mind for Water's Edge Filers.

Get more for Schedule H 100W Dividend Income Deduction Water's Edge Filers

- Teacher work sample proficiency verification university of form

- Policy 3 1 university of colorado boulder form

- How is the energy we use in buildings like fruit canvas instructure form

- Camp smart grid metering form

- Uu399 ldentification number and certification university of colorado form

- Eike best amp elke wilkeit theoretica informatik uni oldenburg

- A counterexample to the modularity of unicity of normal forms for webdoc sub gwdg

- System and method for determining a world wide name for use with books google form

Find out other Schedule H 100W Dividend Income Deduction Water's Edge Filers

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast