IRSForm2848InteractiveKSCEditable PDF

What is the IRS Form 2848 Interactive KSC Editable PDF

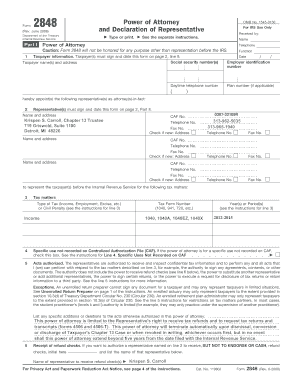

The IRS Form 2848, known as the Power of Attorney and Declaration of Representative, allows taxpayers to authorize an individual to represent them before the IRS. This interactive version is designed for ease of use, enabling users to fill out the form digitally. The editable PDF format allows for easy completion and submission, ensuring that all necessary information is accurately captured. This form is essential for individuals or businesses seeking to have someone act on their behalf regarding tax matters.

How to Use the IRS Form 2848 Interactive KSC Editable PDF

Using the IRS Form 2848 Interactive KSC Editable PDF is straightforward. Begin by downloading the form from a reliable source. Open the PDF in a compatible reader that supports form filling. Enter the required information, including taxpayer details, representative information, and the specific tax matters for which representation is granted. After completing the form, review it for accuracy before signing. The interactive features allow for easy navigation and data entry, making the process efficient.

Steps to Complete the IRS Form 2848 Interactive KSC Editable PDF

Completing the IRS Form 2848 involves several key steps:

- Download the IRS Form 2848 Interactive KSC Editable PDF.

- Open the form in a PDF reader that supports editing.

- Fill in the taxpayer's name, address, and identification number.

- Provide the representative's details, including their name and contact information.

- Specify the tax matters and years for which the power of attorney is granted.

- Sign and date the form to validate it.

- Save the completed form and submit it as required.

Legal Use of the IRS Form 2848 Interactive KSC Editable PDF

The IRS Form 2848 is legally binding once properly completed and signed. It grants the designated representative the authority to act on behalf of the taxpayer in dealings with the IRS. This includes the ability to receive confidential tax information and make decisions regarding tax matters. It is crucial to ensure that the form is filled out accurately and submitted in accordance with IRS guidelines to avoid any legal complications.

Filing Deadlines / Important Dates

When using the IRS Form 2848, it is important to be aware of relevant deadlines. The form should be submitted in a timely manner, especially when it pertains to specific tax matters or disputes. Typically, the form should be filed before the representative engages with the IRS on behalf of the taxpayer. Keeping track of important dates related to tax filings and disputes can help ensure that the power of attorney remains effective throughout the process.

Examples of Using the IRS Form 2848 Interactive KSC Editable PDF

There are various scenarios where the IRS Form 2848 can be utilized effectively:

- A taxpayer may need to authorize a tax professional to represent them during an audit.

- Business owners can use the form to allow accountants to handle tax filings and communications with the IRS.

- Individuals seeking assistance with tax disputes may designate a representative to negotiate on their behalf.

Quick guide on how to complete irsform2848interactiveksceditable pdf

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to edit and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRSForm2848InteractiveKSCEditable pdf

Create this form in 5 minutes!

How to create an eSignature for the irsform2848interactiveksceditable pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 2848 Interactive KSC Editable PDF?

The IRS Form 2848 Interactive KSC Editable PDF is a digital version of the IRS power of attorney form that allows users to fill out and submit the document electronically. This format simplifies the process of granting authority to another individual to act on your behalf regarding tax matters.

-

How can I access the IRS Form 2848 Interactive KSC Editable PDF?

You can easily access the IRS Form 2848 Interactive KSC Editable PDF through the airSlate SignNow platform. Simply sign up for an account, and you will have the ability to download, fill out, and eSign the form directly within the application.

-

Is there a cost associated with using the IRS Form 2848 Interactive KSC Editable PDF?

Yes, there is a subscription fee for using the airSlate SignNow platform, which includes access to the IRS Form 2848 Interactive KSC Editable PDF. However, the pricing is competitive and offers a cost-effective solution for businesses needing to manage their document signing and eSigning needs.

-

What features does the IRS Form 2848 Interactive KSC Editable PDF offer?

The IRS Form 2848 Interactive KSC Editable PDF includes features such as easy editing, electronic signatures, and secure storage. These features streamline the process of completing and submitting the form, making it more efficient for users.

-

Can I integrate the IRS Form 2848 Interactive KSC Editable PDF with other applications?

Yes, airSlate SignNow allows for seamless integration with various applications, enhancing the functionality of the IRS Form 2848 Interactive KSC Editable PDF. This means you can connect it with your existing software tools for a more streamlined workflow.

-

What are the benefits of using the IRS Form 2848 Interactive KSC Editable PDF?

Using the IRS Form 2848 Interactive KSC Editable PDF offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. The interactive features help ensure that all necessary information is filled out correctly, minimizing the risk of errors.

-

Is the IRS Form 2848 Interactive KSC Editable PDF secure?

Absolutely! The IRS Form 2848 Interactive KSC Editable PDF is processed through airSlate SignNow's secure platform, which employs advanced encryption and security measures. This ensures that your sensitive information remains protected throughout the signing process.

Get more for IRSForm2848InteractiveKSCEditable pdf

- International institute language fellowship iilf form

- Angel in vesting university of michigan umich form

- Cjs course development seed grant application form

- Seah form pdf university of michigan

- Complaint form umich

- Hud feedback to minimize the risk of cellular phone use and number entry while driving nissan hud iv interim report umich form

- Media accreditation adac zurich 24h rennen 24 stunden form

- Financial data processing system form

Find out other IRSForm2848InteractiveKSCEditable pdf

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure