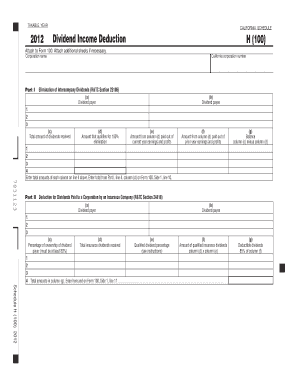

Schedule H 100 Dividend Income Deduction California Form

What is the Schedule H 100 Dividend Income Deduction California

The Schedule H 100 Dividend Income Deduction is a specific tax form used in California to report dividend income and claim deductions related to it. This form is primarily utilized by corporations and certain business entities to document their dividend income and determine the allowable deductions under California tax law. Understanding this form is crucial for ensuring compliance with state tax regulations and optimizing tax liabilities.

Key elements of the Schedule H 100 Dividend Income Deduction California

Several key elements are essential when completing the Schedule H 100 Dividend Income Deduction. These include:

- Dividend Income Reporting: Taxpayers must accurately report all dividend income received during the tax year.

- Deductions: The form allows for specific deductions that can reduce taxable income, including deductions for dividends paid to shareholders.

- Entity Type: The form is primarily for corporations, including C-corporations and S-corporations, which must adhere to different reporting requirements.

- Filing Requirements: Taxpayers must ensure they meet all filing requirements and deadlines to avoid penalties.

Steps to complete the Schedule H 100 Dividend Income Deduction California

Completing the Schedule H 100 requires a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather all relevant financial documents, including records of dividend income and any related expenses.

- Fill out the taxpayer information section, including the entity name, address, and identification number.

- Report all dividend income received during the tax year in the designated sections of the form.

- Calculate allowable deductions based on the dividends paid to shareholders and any other applicable deductions.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form by the appropriate deadline, either electronically or by mail, as per California tax regulations.

Legal use of the Schedule H 100 Dividend Income Deduction California

The Schedule H 100 is legally recognized by the California Franchise Tax Board as the official form for reporting dividend income and claiming associated deductions. Proper use of this form is essential for compliance with state tax laws. Failing to use the form correctly can result in penalties or additional taxes owed. Taxpayers should ensure they are familiar with the legal requirements and guidelines surrounding the use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule H 100 Dividend Income Deduction are critical for compliance. Generally, the form must be submitted by the due date of the corporation's tax return, which is typically the fifteenth day of the fourth month following the end of the taxable year. For corporations operating on a calendar year, this means the deadline is April 15. It is advisable to check for any changes or extensions that may apply to specific tax years.

Eligibility Criteria

To use the Schedule H 100, certain eligibility criteria must be met. Primarily, the form is intended for corporations and business entities that receive dividend income. Eligible entities include:

- C-Corporations

- S-Corporations

- Limited Liability Companies (LLCs) that elect to be treated as corporations for tax purposes

Entities must also be compliant with California tax laws and regulations to qualify for the deductions available on this form.

Quick guide on how to complete schedule h 100 dividend income deduction california

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the right template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your papers quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and bears the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] and guarantee effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule H 100 Dividend Income Deduction California

Create this form in 5 minutes!

How to create an eSignature for the schedule h 100 dividend income deduction california

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule H 100 Dividend Income Deduction California?

The Schedule H 100 Dividend Income Deduction California is a tax form used by corporations to report dividend income and claim deductions. This form helps businesses reduce their taxable income by allowing them to deduct certain dividends received. Understanding this deduction is crucial for maximizing tax benefits.

-

How can airSlate SignNow help with Schedule H 100 Dividend Income Deduction California?

airSlate SignNow streamlines the process of preparing and submitting the Schedule H 100 Dividend Income Deduction California. With our eSigning capabilities, you can easily send, sign, and manage your tax documents securely. This efficiency saves time and reduces the risk of errors in your submissions.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Schedule H 100 Dividend Income Deduction California. These tools ensure that your documents are organized and accessible, making tax season less stressful.

-

Is airSlate SignNow cost-effective for small businesses handling Schedule H 100?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing the Schedule H 100 Dividend Income Deduction California. Our pricing plans are flexible, allowing businesses to choose options that fit their budget while still accessing powerful document management features.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Schedule H 100 Dividend Income Deduction California. This integration allows for smooth data transfer and ensures that your financial records are up-to-date and accurate.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Schedule H 100 Dividend Income Deduction California, offers numerous benefits. These include enhanced security, faster processing times, and improved collaboration among team members, all of which contribute to a more efficient tax filing process.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information, such as that found in the Schedule H 100 Dividend Income Deduction California. You can trust that your documents are safe and secure while using our platform.

Get more for Schedule H 100 Dividend Income Deduction California

- Umd student services fee committee application d umn form

- Chapter 3 objectives form

- Internship application for extension grade of x d umn form

- To download a conference sponsorship flier university of minnesota d umn form

- To download an exhibitor registration form university of d umn

- Background questionnaire university of minnesota duluth form

- Completed national reports and national strategies for the social dimension form

- Prudentis baltic fund lhv form

Find out other Schedule H 100 Dividend Income Deduction California

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself