Get Instructions for 540A Form &quot

What is the Get Instructions For 540A Form

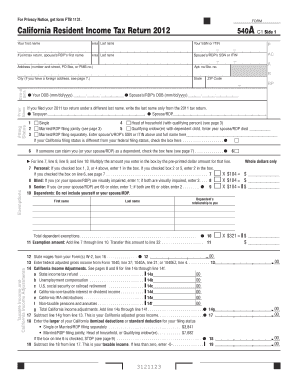

The Get Instructions For 540A Form is a document provided by the California Franchise Tax Board (FTB) that offers guidance on how to complete the California Resident Income Tax Return, specifically for individuals using the 540A form. This form is designed for taxpayers who have a straightforward tax situation, allowing them to report income, claim deductions, and calculate their tax liability efficiently. The instructions detail eligibility criteria, filing requirements, and important information necessary for accurate completion.

Steps to complete the Get Instructions For 540A Form

Completing the Get Instructions For 540A Form involves several key steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Review the eligibility criteria to ensure that you qualify to use the 540A form.

- Follow the step-by-step instructions provided in the form to accurately fill out each section.

- Double-check your entries for accuracy, ensuring all calculations are correct.

- Submit the completed form by the designated deadline, either electronically or by mail.

Required Documents

To complete the Get Instructions For 540A Form, you will need several documents. These typically include:

- W-2 forms from employers that report your annual wages.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Records of any deductions or credits you plan to claim, such as mortgage interest or education expenses.

- Identification numbers, including your Social Security number and those of any dependents.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Get Instructions For 540A Form is crucial to avoid penalties. Typically, the deadline for filing your California state tax return is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check for any updates or changes to the tax calendar each year.

Form Submission Methods

There are several methods available for submitting the Get Instructions For 540A Form:

- Online: You can file electronically through the California Franchise Tax Board's website, which is often the fastest method.

- Mail: If you prefer to file a paper form, you can print the completed 540A form and send it to the appropriate address provided in the instructions.

- In-Person: Some taxpayers may choose to file in person at designated FTB offices, though this option may vary by location.

IRS Guidelines

While the Get Instructions For 540A Form is specific to California, it is essential to be aware of how it aligns with IRS guidelines. Taxpayers should ensure that their state filing is consistent with federal tax regulations. This includes reporting all income accurately and claiming deductions that are permissible under both state and federal law. Familiarity with IRS guidelines can help prevent discrepancies and potential audits.

Quick guide on how to complete get instructions for 540a form ampquot

Accomplish [SKS] effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to generate, alter, and eSign your documents swiftly without delays. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The most effective method to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools provided by airSlate SignNow specifically for that aim.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and press the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form scanning, or errors that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your preference. Modify and eSign [SKS] and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Get Instructions For 540A Form &quot

Create this form in 5 minutes!

How to create an eSignature for the get instructions for 540a form ampquot

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 540A Form and why do I need it?

The 540A Form is a California income tax return form for individuals. You need it to report your income and calculate your tax liability. To simplify this process, you can get instructions for the 540A Form through our platform, ensuring you complete it accurately and efficiently.

-

How can I get instructions for the 540A Form using airSlate SignNow?

To get instructions for the 540A Form, simply visit our website and navigate to the resources section. We provide comprehensive guides and templates that will help you fill out the form correctly. Our user-friendly interface makes it easy to access the information you need.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a range of features including eSigning, document templates, and real-time collaboration. These tools are designed to streamline your workflow and enhance productivity. By using our service, you can easily get instructions for the 540A Form and manage your documents efficiently.

-

Is airSlate SignNow a cost-effective solution for businesses?

Yes, airSlate SignNow is a cost-effective solution for businesses of all sizes. We offer flexible pricing plans that cater to different needs, ensuring you only pay for what you use. By choosing our platform, you can save time and resources while getting instructions for the 540A Form.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM systems and cloud storage services. This integration allows you to streamline your document management processes and easily get instructions for the 540A Form within your existing workflows.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including enhanced security, compliance with legal standards, and improved turnaround times. Our platform ensures that your documents are signed quickly and securely. Plus, you can easily get instructions for the 540A Form to ensure compliance.

-

How secure is my data with airSlate SignNow?

Your data security is our top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your information. When you get instructions for the 540A Form or any other document, you can trust that your data is safe with us.

Get more for Get Instructions For 540A Form &quot

- Bill of sale form mississippi sublease agreement form

- Contact the governors office state of south dakota form

- Information on change of name adult

- South dakota legal formslegal documentsus legal forms

- Return to south dakota secretary of state form

- Sdlrc codified law 15 26a sd legislature form

- State of south dakota in circuit court ss 490219195 form

- Sdlrc codified law 23a a sd legislature form

Find out other Get Instructions For 540A Form &quot

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter