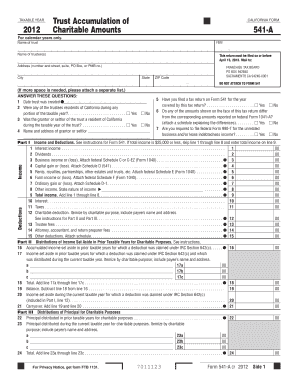

TAXABLE YEAR Trust Accumulation of Charitable Amounts CALIFORNIA FORM 541 a for Calendar Years Only

What is the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only

The TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A is a specific tax form used in California for reporting the income and deductions of trusts that accumulate charitable amounts. This form is applicable for calendar years only and is essential for ensuring compliance with state tax regulations. It allows trusts to report their taxable income while also detailing any amounts set aside for charitable purposes, which may qualify for deductions under California tax law.

Key elements of the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only

This form includes several critical components that must be accurately completed. Key elements include:

- Identification Information: This section requires details about the trust, including its name, address, and taxpayer identification number.

- Income Reporting: Trusts must report their total income, including interest, dividends, and capital gains.

- Deductions for Charitable Contributions: This allows trusts to deduct amounts that have been set aside for charitable purposes, which can reduce taxable income.

- Tax Calculation: The form includes a section for calculating the total tax owed based on the reported income and deductions.

Steps to complete the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only

Completing the form involves several steps to ensure accuracy and compliance:

- Gather all necessary documentation, including financial statements and records of charitable contributions.

- Fill out the identification section with the trust's details.

- Report total income in the designated section, ensuring all sources are included.

- Document any charitable contributions made during the taxable year.

- Calculate the total tax owed based on the provided information.

- Review the completed form for accuracy before submission.

Legal use of the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only

The legal use of this form is essential for trusts that wish to comply with California tax laws. It must be filed accurately to avoid penalties and ensure that any deductions for charitable contributions are recognized by the state. Trusts that fail to file this form may face legal consequences, including fines or increased scrutiny from tax authorities.

Filing Deadlines / Important Dates

Trusts must adhere to specific filing deadlines to remain compliant. The TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A is typically due on the fifteenth day of the fourth month following the end of the taxable year. For calendar year filers, this means the form is usually due by April 15 of the following year. It is important to keep track of any changes to deadlines that may occur due to state regulations or holidays.

Form Submission Methods (Online / Mail / In-Person)

This form can be submitted through various methods to accommodate different preferences. Trusts may choose to file the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A electronically through the California Franchise Tax Board's online portal. Alternatively, trusts can print the completed form and mail it to the appropriate tax office. In-person submissions are also accepted at designated tax offices, providing flexibility for those who prefer face-to-face interactions.

Quick guide on how to complete taxable year trust accumulation of charitable amounts california form 541 a for calendar years only

Complete [SKS] seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only

Create this form in 5 minutes!

How to create an eSignature for the taxable year trust accumulation of charitable amounts california form 541 a for calendar years only

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only?

The TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only is a tax form used by trusts in California to report accumulated charitable amounts for a specific taxable year. This form ensures compliance with state tax regulations and helps in accurately calculating the tax obligations of the trust.

-

How can airSlate SignNow assist with the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only?

airSlate SignNow provides an efficient platform for preparing and eSigning the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only. Our user-friendly interface simplifies document management, allowing you to focus on compliance and accuracy.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only. You can choose from monthly or annual subscriptions, ensuring you get the best value for your document management needs.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only. These features streamline the process of filling out and submitting tax forms, making it easier for users to stay organized and compliant.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, enhancing your ability to manage the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only alongside your financial records. This integration helps ensure that all your documents are synchronized and easily accessible.

-

What benefits does airSlate SignNow provide for businesses handling tax forms?

Using airSlate SignNow for handling tax forms like the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform allows for quick eSigning and document sharing, ensuring a smooth workflow.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including the TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only. You can trust our platform to keep your information safe and confidential.

Get more for TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only

- Licensing agreement for nfl football trading cards form

- United states ski association ussa us ski ampamp snowboard form

- Cosmetology salon license application instructions tdlr form

- 2014 sag aftra basic agreement form

- Verification job applicant education form

- Enclosed herewith is a notice from form

- Registration and title guide dmv form

- Release and waiver of liability given in favor of owner of form

Find out other TAXABLE YEAR Trust Accumulation Of Charitable Amounts CALIFORNIA FORM 541 A For Calendar Years Only

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation