Co Borrower Information Must Also Be Provided and the Appropriate Box Checked When the Income or Assets of a Person Other Than T

Understanding Co-Borrower Information Requirements

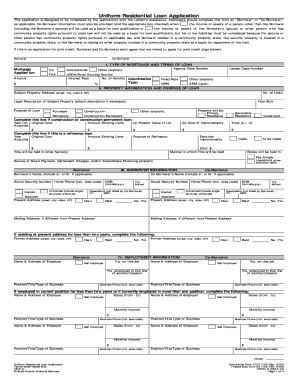

The co-borrower information must be accurately provided when the income or assets of a person other than the borrower are involved. This includes the borrower's spouse or any other individual whose financial details are relevant to the loan application. Ensuring that this information is complete and correct is vital for the processing of the loan. In many cases, lenders require this data to assess the overall financial stability of the borrowing party, which can influence loan terms and approval.

Steps to Complete Co-Borrower Information

Completing the co-borrower information involves several key steps:

- Gather necessary financial documentation for the co-borrower, including income statements and asset records.

- Fill out the designated sections of the loan application, ensuring that all required fields related to the co-borrower are completed.

- Check the appropriate box indicating that co-borrower information has been provided. This step is crucial for compliance with lender requirements.

- Review the application for accuracy before submission to avoid delays in processing.

Legal Considerations for Co-Borrower Information

Providing co-borrower information is not just a procedural step; it has legal implications. Lenders must adhere to regulations that govern the collection and use of personal financial information. This includes ensuring that all parties involved are aware of how their information will be used and stored. Additionally, failing to provide accurate co-borrower information can result in complications during the loan approval process, including potential legal repercussions for misrepresentation.

Examples of Co-Borrower Information Scenarios

Several scenarios illustrate the importance of co-borrower information:

- A married couple applying for a mortgage may need to include both incomes to qualify for a higher loan amount.

- A parent co-signing a student loan will need to provide their financial details to assist the student in securing the necessary funds.

- Business partners seeking a loan may need to disclose each partner's financial contributions and liabilities.

Required Documentation for Co-Borrower Information

When submitting co-borrower information, specific documentation is typically required. This may include:

- Recent pay stubs or proof of income for the co-borrower.

- Bank statements to verify assets.

- Tax returns from the previous year to provide a comprehensive view of financial standing.

State-Specific Rules for Co-Borrower Information

Different states may have unique regulations regarding the submission of co-borrower information. It is essential to be aware of these rules, as they can affect the loan application process. Some states may require additional disclosures or documentation, while others might have specific forms that need to be filled out. Understanding these requirements can help ensure compliance and facilitate a smoother loan approval process.

Quick guide on how to complete co borrower information must also be provided and the appropriate box checked when the income or assets of a person other than

Complete [SKS] effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The simplest method to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify your information and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the co borrower information must also be provided and the appropriate box checked when the income or assets of a person other than

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of providing Co Borrower Information?

Co Borrower Information Must Also Be Provided and The Appropriate Box Checked When The Income Or Assets Of A Person Other Than The Borrower The Income Or Assets Of The Borrower's Spouse Or Other Person Who Has including The Borrower's. This ensures that all relevant financial information is considered during the loan approval process, which can signNowly impact the outcome.

-

How does airSlate SignNow facilitate the collection of Co Borrower Information?

airSlate SignNow allows users to create customizable templates that include fields for Co Borrower Information. This feature ensures that all necessary details are captured efficiently, making it easier for users to comply with requirements that Co Borrower Information Must Also Be Provided and The Appropriate Box Checked When The Income Or Assets Of A Person Other Than The Borrower The Income Or Assets Of The Borrower's Spouse Or Other Person Who Has including The Borrower's.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features that help ensure Co Borrower Information Must Also Be Provided and The Appropriate Box Checked When The Income Or Assets Of A Person Other Than The Borrower The Income Or Assets Of The Borrower's Spouse Or Other Person Who Has including The Borrower's, making it a cost-effective solution for document management.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing its functionality. These integrations support the process where Co Borrower Information Must Also Be Provided and The Appropriate Box Checked When The Income Or Assets Of A Person Other Than The Borrower The Income Or Assets Of The Borrower's Spouse Or Other Person Who Has including The Borrower's, streamlining workflows across platforms.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a range of features including eSigning, document templates, and real-time tracking. These features ensure that Co Borrower Information Must Also Be Provided and The Appropriate Box Checked When The Income Or Assets Of A Person Other Than The Borrower The Income Or Assets Of The Borrower's Spouse Or Other Person Who Has including The Borrower's is accurately captured and processed.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority for airSlate SignNow, which employs advanced encryption and compliance measures. This ensures that all data, including Co Borrower Information Must Also Be Provided and The Appropriate Box Checked When The Income Or Assets Of A Person Other Than The Borrower The Income Or Assets Of The Borrower's Spouse Or Other Person Who Has including The Borrower's, is protected against unauthorized access.

-

What benefits can businesses expect from using airSlate SignNow?

Businesses can expect increased efficiency, reduced paperwork, and improved compliance when using airSlate SignNow. By ensuring that Co Borrower Information Must Also Be Provided and The Appropriate Box Checked When The Income Or Assets Of A Person Other Than The Borrower The Income Or Assets Of The Borrower's Spouse Or Other Person Who Has including The Borrower's, the platform helps streamline the document signing process.

Get more for Co Borrower Information Must Also Be Provided and The Appropriate Box Checked When The Income Or Assets Of A Person Other Than T

- Mil prf 25567e form

- Protocol of merger tmb x viv290509 english doc form

- Flo rite temp instantaneous water heater sizing instructions form

- 6 k 1 golcvm358jan6k form

- File servidor sec edgar unibanco 06 jun 20 f form20f demonstra o de cap tulos

- Pilots manual form

- Towards the establishment of a registration authority for environmental assessment practitioners in south africa form

- New representative application form psg asset management psgam co

Find out other Co Borrower Information Must Also Be Provided and The Appropriate Box Checked When The Income Or Assets Of A Person Other Than T

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement