Freddie Mac Relief Refinance MortgagesSM Eligibility Requirements Form

Understanding Freddie Mac Relief Refinance MortgagesSM Eligibility Requirements

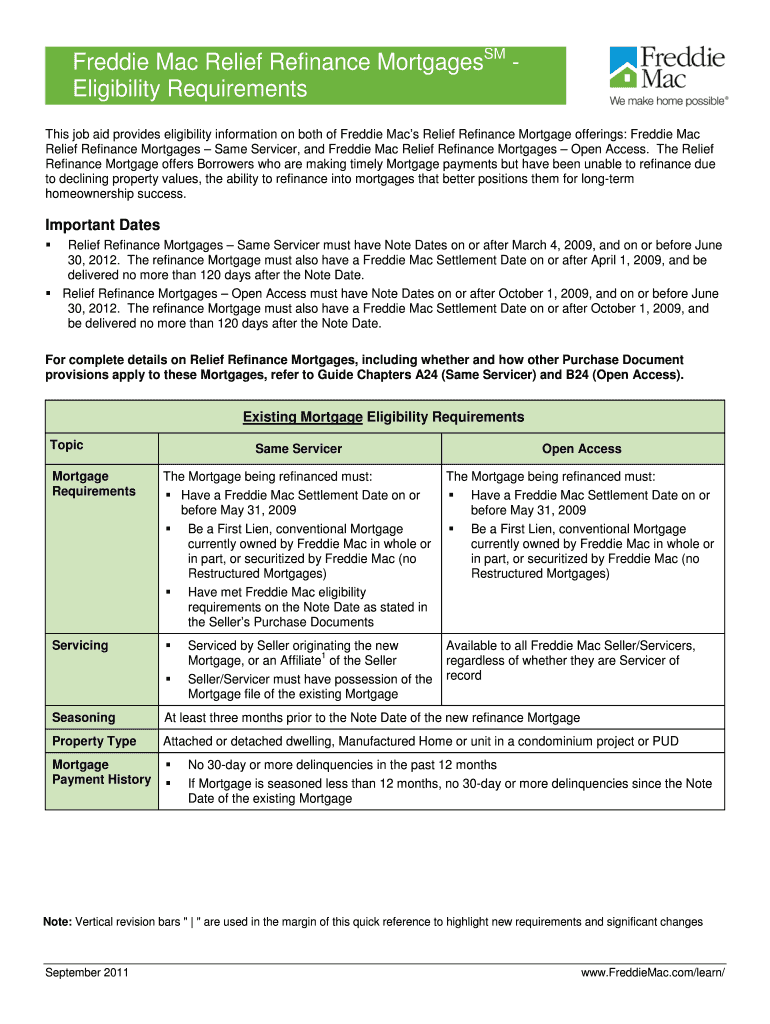

The Freddie Mac Relief Refinance MortgagesSM program is designed to assist homeowners in refinancing their existing mortgages under specific eligibility criteria. To qualify, borrowers typically need to have a mortgage owned or guaranteed by Freddie Mac, which must have been originated on or before a specific date. Additionally, the mortgage should not be in default, and the borrower must demonstrate an ability to make the new mortgage payments.

Furthermore, the program aims to help borrowers reduce their monthly payments or transition from an adjustable-rate mortgage to a fixed-rate mortgage. It is crucial for potential applicants to review their current mortgage details and ensure they meet the program's requirements before proceeding with the application process.

Eligibility Criteria for Freddie Mac Relief Refinance MortgagesSM

To be eligible for the Freddie Mac Relief Refinance MortgagesSM, borrowers must meet several criteria. First, the existing mortgage must be a Freddie Mac loan. Second, the borrower should have a satisfactory payment history, typically defined as making no more than one late payment in the past twelve months. Additionally, the loan-to-value ratio must not exceed a specified threshold, which can vary based on the borrower's circumstances and the type of refinance being pursued.

Lastly, borrowers must provide documentation that verifies their income and assets. This may include pay stubs, tax returns, and bank statements. Understanding these eligibility criteria is essential for homeowners considering refinancing options through this program.

Steps to Complete the Freddie Mac Relief Refinance MortgagesSM Application

Completing the application for the Freddie Mac Relief Refinance MortgagesSM involves several key steps. First, homeowners should gather all necessary documentation, including proof of income, asset verification, and details of the current mortgage. Next, borrowers can contact their lender to express interest in the program and confirm eligibility.

Once eligibility is confirmed, the lender will guide the borrower through the application process, which may include filling out specific forms and providing additional documentation. After submission, the lender will review the application and notify the borrower of the approval status. It is important for borrowers to stay in communication with their lender throughout this process to ensure a smooth experience.

Required Documents for Freddie Mac Relief Refinance MortgagesSM

When applying for the Freddie Mac Relief Refinance MortgagesSM, borrowers must prepare several documents to support their application. These typically include:

- Proof of income, such as recent pay stubs or tax returns

- Current mortgage statement detailing the existing loan

- Documentation of assets, including bank statements

- Identification documents, such as a driver's license or Social Security card

Having these documents ready can expedite the application process and help ensure that all eligibility requirements are met. It is advisable for borrowers to consult with their lender for a complete list of required documents specific to their situation.

Application Process and Approval Time for Freddie Mac Relief Refinance MortgagesSM

The application process for the Freddie Mac Relief Refinance MortgagesSM typically begins with the borrower contacting their lender to express interest in the program. After confirming eligibility, the borrower submits the required documents for review. The lender then processes the application, which may involve an appraisal of the property and verification of the borrower's financial situation.

The approval time can vary based on the lender's workload and the completeness of the submitted documentation. Generally, borrowers can expect a response within a few weeks, but it is essential to maintain open communication with the lender for updates throughout the process.

Quick guide on how to complete freddie mac relief refinance mortgagessm eligibility requirements

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without any hold-ups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign [SKS] With Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Freddie Mac Relief Refinance MortgagesSM Eligibility Requirements

Create this form in 5 minutes!

How to create an eSignature for the freddie mac relief refinance mortgagessm eligibility requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Freddie Mac Relief Refinance MortgagesSM eligibility requirements?

The Freddie Mac Relief Refinance MortgagesSM eligibility requirements include having an existing mortgage that is owned or guaranteed by Freddie Mac. Borrowers must also demonstrate a stable income and meet specific credit score criteria. Additionally, the refinance must result in a lower monthly payment or a more stable loan structure.

-

How can I determine if I qualify for Freddie Mac Relief Refinance MortgagesSM?

To determine if you qualify for Freddie Mac Relief Refinance MortgagesSM, you should review your current mortgage details and check if it is backed by Freddie Mac. You can also consult with a mortgage lender who can help assess your financial situation and guide you through the eligibility requirements.

-

What benefits do Freddie Mac Relief Refinance MortgagesSM offer?

Freddie Mac Relief Refinance MortgagesSM offer several benefits, including the potential for lower monthly payments and reduced interest rates. They also provide options for borrowers who may have experienced financial hardships, allowing for a streamlined refinancing process. This program aims to enhance affordability and stability for homeowners.

-

Are there any fees associated with Freddie Mac Relief Refinance MortgagesSM?

While Freddie Mac Relief Refinance MortgagesSM aim to minimize costs, there may still be some fees involved, such as closing costs or appraisal fees. It's essential to discuss these potential fees with your lender to understand the total cost of refinancing. Overall, the program is designed to be cost-effective for eligible borrowers.

-

Can I use Freddie Mac Relief Refinance MortgagesSM for investment properties?

Freddie Mac Relief Refinance MortgagesSM are primarily designed for primary residences, and eligibility requirements typically do not extend to investment properties. However, it's advisable to consult with a mortgage professional to explore other refinancing options that may be available for investment properties.

-

What documentation is needed to apply for Freddie Mac Relief Refinance MortgagesSM?

To apply for Freddie Mac Relief Refinance MortgagesSM, you will need to provide documentation such as proof of income, tax returns, and details of your current mortgage. Your lender may also require additional information to verify your eligibility. Being prepared with these documents can streamline the application process.

-

How long does the refinancing process take with Freddie Mac Relief Refinance MortgagesSM?

The refinancing process with Freddie Mac Relief Refinance MortgagesSM can vary, but it typically takes between 30 to 45 days from application to closing. Factors such as the completeness of your documentation and lender processing times can influence this timeline. Staying in close communication with your lender can help expedite the process.

Get more for Freddie Mac Relief Refinance MortgagesSM Eligibility Requirements

- Ambulance request form

- Insert real name of entity form

- N y s department of state division of form

- Sweden new work permit application process form

- Iuclangref doc form

- Princess house login form

- Accommodation request medical inquiry form faculty and staff uhr rutgers

- Accommodation request medical inquiry form 00209596 2 docx

Find out other Freddie Mac Relief Refinance MortgagesSM Eligibility Requirements

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip