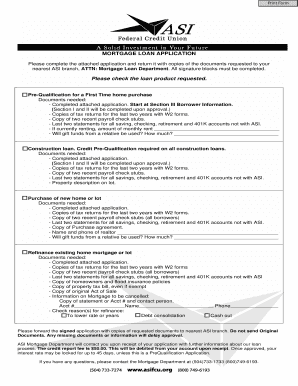

MORTGAGE LOAN APPLICATION Please Check the Loan Product Form

What is the MORTGAGE LOAN APPLICATION Please Check The Loan Product

The MORTGAGE LOAN APPLICATION is a formal document that individuals complete to request a mortgage loan from a financial institution. This application collects essential information about the applicant's financial status, employment history, and the property being financed. It serves as a critical first step in the mortgage process, allowing lenders to assess the borrower's eligibility for various loan products. Understanding this application is vital for anyone looking to secure a mortgage, as it lays the groundwork for the approval process.

Key elements of the MORTGAGE LOAN APPLICATION Please Check The Loan Product

Several key elements are crucial in the MORTGAGE LOAN APPLICATION. These include:

- Personal Information: Applicants must provide their name, address, Social Security number, and contact details.

- Employment Details: Information about current and past employment, including job titles and income levels, is required.

- Financial Information: This section covers assets, liabilities, and credit history, which help lenders evaluate the applicant's financial health.

- Property Information: Details about the property being purchased or refinanced, including its address, value, and type, are necessary.

Steps to complete the MORTGAGE LOAN APPLICATION Please Check The Loan Product

Completing the MORTGAGE LOAN APPLICATION involves several steps:

- Gather necessary documentation, such as proof of income, tax returns, and credit reports.

- Fill out the application form accurately, ensuring all information is current and truthful.

- Review the completed application for any errors or omissions.

- Submit the application to the lender, either online or in person, along with any required documentation.

How to obtain the MORTGAGE LOAN APPLICATION Please Check The Loan Product

The MORTGAGE LOAN APPLICATION can typically be obtained directly from lenders, such as banks or mortgage companies. Many lenders offer the application online, allowing applicants to fill it out digitally. Additionally, physical copies may be available at local branches. It’s essential to choose a lender that offers the loan products most suitable for your needs.

Eligibility Criteria

Eligibility for the MORTGAGE LOAN APPLICATION varies by lender but generally includes:

- Minimum credit score requirements.

- Proof of steady income and employment.

- A debt-to-income ratio within acceptable limits.

- Verification of assets and financial stability.

Required Documents

When completing the MORTGAGE LOAN APPLICATION, applicants must provide several documents, including:

- Recent pay stubs or proof of income.

- Tax returns for the last two years.

- Bank statements showing assets.

- Identification, such as a driver's license or passport.

Quick guide on how to complete mortgage loan application please check the loan product

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from your preferred device. Change and eSign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MORTGAGE LOAN APPLICATION Please Check The Loan Product

Create this form in 5 minutes!

How to create an eSignature for the mortgage loan application please check the loan product

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for completing a MORTGAGE LOAN APPLICATION Please Check The Loan Product?

The process for completing a MORTGAGE LOAN APPLICATION Please Check The Loan Product is straightforward. You can start by filling out the online application form, which will guide you through the necessary steps. Once submitted, our team will review your application and provide you with updates on the next steps.

-

What documents do I need for the MORTGAGE LOAN APPLICATION Please Check The Loan Product?

To complete the MORTGAGE LOAN APPLICATION Please Check The Loan Product, you typically need to provide proof of income, credit history, and identification. Additional documents may include tax returns and bank statements. Ensuring you have these documents ready can expedite the application process.

-

Are there any fees associated with the MORTGAGE LOAN APPLICATION Please Check The Loan Product?

Yes, there may be fees associated with the MORTGAGE LOAN APPLICATION Please Check The Loan Product, such as application fees or processing fees. It's important to review these costs upfront to understand the total expenses involved. We strive to keep our fees transparent and competitive.

-

What are the benefits of using airSlate SignNow for my MORTGAGE LOAN APPLICATION Please Check The Loan Product?

Using airSlate SignNow for your MORTGAGE LOAN APPLICATION Please Check The Loan Product offers several benefits, including a user-friendly interface and secure eSigning capabilities. This ensures that your documents are processed quickly and safely. Additionally, our platform is cost-effective, making it accessible for all users.

-

Can I track the status of my MORTGAGE LOAN APPLICATION Please Check The Loan Product?

Absolutely! With airSlate SignNow, you can easily track the status of your MORTGAGE LOAN APPLICATION Please Check The Loan Product in real-time. Our platform provides updates and notifications, so you are always informed about where your application stands in the process.

-

What integrations does airSlate SignNow offer for the MORTGAGE LOAN APPLICATION Please Check The Loan Product?

airSlate SignNow offers various integrations that enhance the MORTGAGE LOAN APPLICATION Please Check The Loan Product experience. You can connect with popular CRM systems, cloud storage services, and other business tools to streamline your workflow. These integrations help you manage your documents more efficiently.

-

Is customer support available for questions about the MORTGAGE LOAN APPLICATION Please Check The Loan Product?

Yes, we provide dedicated customer support for any inquiries regarding the MORTGAGE LOAN APPLICATION Please Check The Loan Product. Our team is available via phone, email, or live chat to assist you with any questions or concerns. We are committed to ensuring a smooth application process for all our users.

Get more for MORTGAGE LOAN APPLICATION Please Check The Loan Product

- Mast re d39ing nierie isige mines paristech form

- A adresser au service des ressources humaines srh de votre dlgation form

- Investors guide review this prospectus to decide if the fund meets your investment needs the prospectus details the funds form

- Investment advisors section form

- Vanguard windsor ii fund form

- Vanguard market neutral fund form

- Capital region standard form contract for purchase and

- Maine residential purchase and sale agreement form

Find out other MORTGAGE LOAN APPLICATION Please Check The Loan Product

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form