West Virginia Tax Division WV Gov 2023-2026

Understanding the West Virginia Tax Division

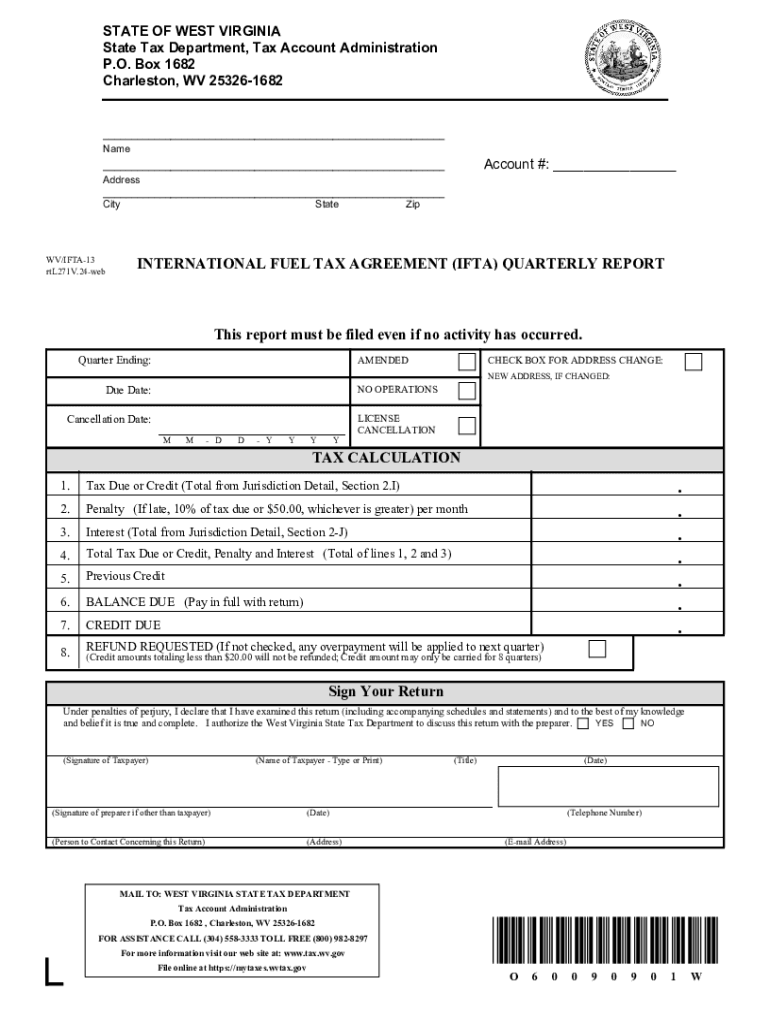

The West Virginia Tax Division is a vital part of the state's government, responsible for administering tax laws and ensuring compliance among businesses and individuals. It oversees various tax programs, including the International Fuel Tax Agreement (IFTA), which is crucial for interstate transportation companies. The division provides resources and support to help taxpayers understand their obligations and navigate the tax system effectively.

Steps to Complete the Fuel Tax Agreement Quarterly Report

Completing the fuel tax agreement quarterly report involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including fuel purchase receipts and mileage records. Next, calculate the total miles driven in each jurisdiction during the quarter. This includes both taxable and non-taxable miles. Afterward, determine the fuel consumption for the reporting period and apply the appropriate tax rates based on the jurisdictions traveled. Finally, fill out the report accurately, ensuring all figures are correct before submission.

Required Documents for Filing

To file the fuel tax agreement quarterly report, certain documents are essential. These include:

- Fuel purchase receipts

- Mileage logs detailing distances traveled in each state

- Previous quarterly reports for reference

- Any relevant correspondence from the West Virginia Tax Division

Having these documents ready will streamline the reporting process and help avoid potential errors.

Filing Deadlines and Important Dates

Timely submission of the fuel tax agreement quarterly report is crucial to avoid penalties. The deadlines for filing typically occur on the last day of the month following the end of each quarter. For instance, reports for the first quarter must be submitted by April 30, while those for the second quarter are due by July 31. Keeping track of these dates ensures compliance and helps maintain good standing with the West Virginia Tax Division.

Penalties for Non-Compliance

Failure to file the fuel tax agreement quarterly report on time or inaccuracies in the report can result in penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential for businesses to understand these consequences and prioritize accurate and timely reporting to avoid complications with the West Virginia Tax Division.

Form Submission Methods

Submitting the fuel tax agreement quarterly report can be done through various methods. Taxpayers can file online through the West Virginia Tax Division's website, which offers a streamlined process for electronic submission. Alternatively, forms can be mailed to the appropriate address specified by the division or submitted in person at designated offices. Each method has its benefits, and choosing the right one can enhance efficiency and ensure proper handling of the report.

Quick guide on how to complete west virginia tax division wv gov

Effortlessly prepare West Virginia Tax Division WV gov on any device

Managing documents online has gained popularity among businesses and individuals. It presents an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Process West Virginia Tax Division WV gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign West Virginia Tax Division WV gov without stress

- Find West Virginia Tax Division WV gov and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight essential sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting searches for forms, or mistakes that necessitate the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign West Virginia Tax Division WV gov and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the west virginia tax division wv gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fuel tax agreement quarterly report?

A fuel tax agreement quarterly report is a document that summarizes fuel tax liabilities and payments for a specific quarter. It helps businesses comply with tax regulations and provides a clear overview of fuel usage and taxes owed. Using airSlate SignNow, you can easily create and eSign these reports to streamline your compliance process.

-

How can airSlate SignNow help with fuel tax agreement quarterly reports?

airSlate SignNow simplifies the process of creating and signing fuel tax agreement quarterly reports. Our platform allows you to generate customizable templates, ensuring that all necessary information is included. Additionally, the eSigning feature speeds up the approval process, making compliance more efficient.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans include features specifically designed for managing documents like fuel tax agreement quarterly reports. You can choose a plan that fits your budget and needs, ensuring you get the best value for your investment.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect it with accounting software, CRM systems, and other tools to automate the process of generating fuel tax agreement quarterly reports. This integration helps save time and reduces the risk of errors.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for effective document management, including customizable templates, eSigning, and secure cloud storage. These features are particularly useful for managing fuel tax agreement quarterly reports, ensuring that your documents are organized and easily accessible. Additionally, you can track document status and receive notifications for timely follow-ups.

-

How secure is airSlate SignNow for handling sensitive documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your sensitive documents, including fuel tax agreement quarterly reports. Our platform complies with industry standards, ensuring that your data remains safe and confidential throughout the signing process.

-

Can I access my fuel tax agreement quarterly reports from any device?

Absolutely! airSlate SignNow is a cloud-based solution, allowing you to access your fuel tax agreement quarterly reports from any device with internet connectivity. Whether you're in the office or on the go, you can manage your documents efficiently and ensure compliance without any hassle.

Get more for West Virginia Tax Division WV gov

Find out other West Virginia Tax Division WV gov

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement