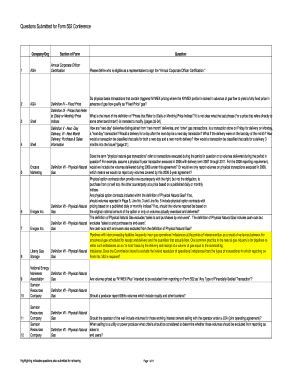

Question Submitted for Form 552 Technical Conference Form No 552

Understanding the Question Submitted For Form 552 Technical Conference Form No 552

The Question Submitted For Form 552 Technical Conference Form No 552 is a specialized document used primarily in tax-related matters. This form allows taxpayers to submit inquiries or questions regarding technical issues that may arise during the filing process. It serves as a formal channel for communication with tax authorities, ensuring that taxpayers can seek clarification on complex topics or disputes related to their filings.

Steps to Complete the Question Submitted For Form 552 Technical Conference Form No 552

Completing the Question Submitted For Form 552 involves several key steps:

- Gather necessary information: Collect all relevant details about your inquiry, including your tax identification number and any supporting documents.

- Fill out the form: Clearly articulate your question in the designated section of the form. Be concise yet thorough to ensure your query is understood.

- Review the form: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Submit the form: Follow the specified submission method, whether online, by mail, or in person, as indicated in the form instructions.

Legal Use of the Question Submitted For Form 552 Technical Conference Form No 552

This form is legally recognized as a means for taxpayers to seek guidance on technical issues related to their tax filings. It is essential for ensuring compliance with tax regulations and for obtaining official responses from tax authorities. Utilizing this form appropriately can help mitigate potential disputes and clarify obligations under U.S. tax law.

Key Elements of the Question Submitted For Form 552 Technical Conference Form No 552

Key elements of the form include:

- Taxpayer Identification: Essential for identifying the individual or entity submitting the inquiry.

- Inquiry Description: A detailed explanation of the question or issue at hand.

- Supporting Documentation: Any relevant documents that may assist in clarifying the inquiry.

- Contact Information: Necessary for tax authorities to respond to the inquiry effectively.

Filing Deadlines / Important Dates

It is crucial to be aware of any filing deadlines associated with the Question Submitted For Form 552. Typically, these deadlines align with the tax calendar, and timely submission is essential to ensure that inquiries are addressed promptly. Staying informed about important dates can help taxpayers avoid unnecessary complications.

Form Submission Methods

The Question Submitted For Form 552 can be submitted through various methods, including:

- Online Submission: Many taxpayers prefer this method for its convenience and speed.

- Mail: Physical submission is still an option, but it may take longer for processing.

- In-Person Submission: For those who require immediate assistance, submitting the form in person may be beneficial.

Quick guide on how to complete question submitted for form 552 technical conference form no 552

Complete [SKS] effortlessly on any device

Digital document management has gained traction with companies and individuals. It offers a sustainable alternative to traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without interruptions. Handle [SKS] across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to commence.

- Utilize the tools we offer to finish your document.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and eSign [SKS] to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Question Submitted For Form 552 Technical Conference Form No 552

Create this form in 5 minutes!

How to create an eSignature for the question submitted for form 552 technical conference form no 552

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Question Submitted For Form 552 Technical Conference Form No 552?

The Question Submitted For Form 552 Technical Conference Form No 552 is a specific document used to submit inquiries related to technical conferences. This form helps streamline communication and ensures that all questions are addressed efficiently during the conference.

-

How can airSlate SignNow help with the Question Submitted For Form 552 Technical Conference Form No 552?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the Question Submitted For Form 552 Technical Conference Form No 552. With its intuitive interface, you can easily manage submissions and track responses, enhancing your conference experience.

-

What are the pricing options for using airSlate SignNow for the Question Submitted For Form 552 Technical Conference Form No 552?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from various subscription options that allow you to efficiently manage the Question Submitted For Form 552 Technical Conference Form No 552 without breaking the bank.

-

What features does airSlate SignNow offer for managing the Question Submitted For Form 552 Technical Conference Form No 552?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning capabilities. These features ensure that your Question Submitted For Form 552 Technical Conference Form No 552 is handled efficiently and securely.

-

Can I integrate airSlate SignNow with other tools for the Question Submitted For Form 552 Technical Conference Form No 552?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to enhance your workflow for the Question Submitted For Form 552 Technical Conference Form No 552. This integration capability ensures that you can connect with your existing tools effortlessly.

-

What are the benefits of using airSlate SignNow for the Question Submitted For Form 552 Technical Conference Form No 552?

Using airSlate SignNow for the Question Submitted For Form 552 Technical Conference Form No 552 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. This solution empowers your team to focus on what matters most during the conference.

-

Is airSlate SignNow secure for handling the Question Submitted For Form 552 Technical Conference Form No 552?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Question Submitted For Form 552 Technical Conference Form No 552 is protected. With advanced encryption and secure storage, you can trust that your data is safe.

Get more for Question Submitted For Form 552 Technical Conference Form No 552

- Behavior agreement template form

- Behaviour agreement template form

- Beneficial ownership agreement template form

- Beneficiary agreement template form

- Benefit sharing agreement template form

- Between co signer and borrower agreement template form

- Between employer and employee agreement template form

- Betting agreement template form

Find out other Question Submitted For Form 552 Technical Conference Form No 552

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document