FinCEN FORM 104 Rev 12 FFIEC Ffiec

What is the FinCEN FORM 104 Rev 12 FFIEC Ffiec

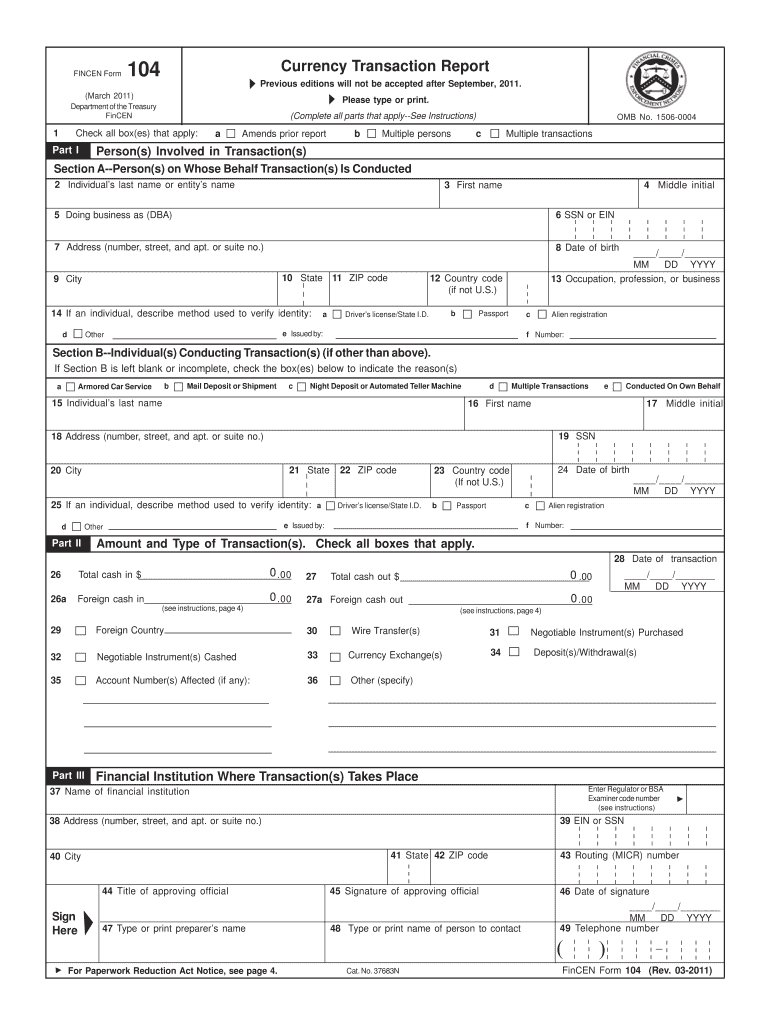

The FinCEN FORM 104 Rev 12 is a critical document used in the financial sector, specifically for reporting suspicious activity. It is part of the Financial Crimes Enforcement Network (FinCEN) requirements, which aim to combat money laundering and other financial crimes. This form is essential for financial institutions and certain businesses that must report transactions that may indicate illegal activities. Understanding this form is vital for compliance with U.S. regulations and ensuring that organizations fulfill their legal obligations.

Steps to Complete the FinCEN FORM 104 Rev 12 FFIEC Ffiec

Completing the FinCEN FORM 104 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including details about the suspicious activity, the individuals involved, and any relevant transaction data. Next, fill out the form accurately, paying close attention to each section, as incomplete or incorrect submissions can lead to penalties. After completing the form, review it for any errors before submission. Finally, ensure that the form is submitted within the required timeframe to avoid any compliance issues.

Legal Use of the FinCEN FORM 104 Rev 12 FFIEC Ffiec

The legal use of the FinCEN FORM 104 is strictly defined by federal regulations. Organizations must use this form to report any suspicious transactions that could indicate money laundering or other financial crimes. Failure to report such activities can lead to severe penalties, including fines and legal repercussions. It is crucial for businesses to understand the legal implications of this form and ensure that they are compliant with all reporting requirements established by FinCEN.

Required Documents for FinCEN FORM 104 Rev 12 FFIEC Ffiec

To complete the FinCEN FORM 104, certain documents and information are necessary. These typically include identification details of the individuals involved in the suspicious activity, transaction records, and any supporting documentation that can substantiate the report. Having these documents ready will facilitate a smoother completion process and help ensure that all required information is accurately reported.

Filing Deadlines for FinCEN FORM 104 Rev 12 FFIEC Ffiec

Timely filing of the FinCEN FORM 104 is crucial for compliance. Financial institutions and businesses must submit the form within 30 days of identifying suspicious activity. This deadline helps ensure that authorities can investigate potential financial crimes promptly. Missing this deadline can result in penalties, so it is essential to stay informed about filing requirements and deadlines.

Form Submission Methods for FinCEN FORM 104 Rev 12 FFIEC Ffiec

The FinCEN FORM 104 can be submitted through various methods. Organizations can file the form electronically via the FinCEN's BSA E-Filing System, which is the preferred method due to its efficiency and tracking capabilities. Alternatively, businesses may submit the form by mail; however, this method may result in delays. It is advisable to choose the electronic submission option to ensure timely processing and compliance with reporting requirements.

Quick guide on how to complete fincen form 104 rev 12 ffiec ffiec

Finalize [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally conscious substitute for conventional printed and signed documents, allowing you to easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to draft, amend, and electronically sign your documents swiftly without hindrances. Oversee [SKS] on any device using airSlate SignNow apps for Android or iOS and streamline any document-related procedure today.

Steps to edit and electronically sign [SKS] effortlessly

- Acquire [SKS] and click on Get Form to initiate the process.

- Make use of our available tools to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure excellent communication at every step of your document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FinCEN FORM 104 Rev 12 FFIEC Ffiec

Create this form in 5 minutes!

How to create an eSignature for the fincen form 104 rev 12 ffiec ffiec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FinCEN FORM 104 Rev 12 FFIEC Ffiec?

The FinCEN FORM 104 Rev 12 FFIEC Ffiec is a crucial document used for reporting suspicious activities to the Financial Crimes Enforcement Network. It is essential for compliance with federal regulations and helps financial institutions maintain transparency in their operations.

-

How can airSlate SignNow assist with the FinCEN FORM 104 Rev 12 FFIEC Ffiec?

airSlate SignNow provides an efficient platform for electronically signing and sending the FinCEN FORM 104 Rev 12 FFIEC Ffiec. Our solution streamlines the process, ensuring that your documents are securely signed and easily accessible for compliance purposes.

-

What are the pricing options for using airSlate SignNow for the FinCEN FORM 104 Rev 12 FFIEC Ffiec?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution ensures that you can efficiently manage the FinCEN FORM 104 Rev 12 FFIEC Ffiec without breaking your budget.

-

What features does airSlate SignNow offer for managing the FinCEN FORM 104 Rev 12 FFIEC Ffiec?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to simplify the management of the FinCEN FORM 104 Rev 12 FFIEC Ffiec. These tools enhance efficiency and ensure compliance with regulatory requirements.

-

Are there any integrations available with airSlate SignNow for the FinCEN FORM 104 Rev 12 FFIEC Ffiec?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, allowing you to manage the FinCEN FORM 104 Rev 12 FFIEC Ffiec alongside your existing workflows. This integration capability enhances productivity and ensures a smooth user experience.

-

What are the benefits of using airSlate SignNow for the FinCEN FORM 104 Rev 12 FFIEC Ffiec?

Using airSlate SignNow for the FinCEN FORM 104 Rev 12 FFIEC Ffiec offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution helps businesses stay compliant while saving time and resources.

-

Is airSlate SignNow secure for handling the FinCEN FORM 104 Rev 12 FFIEC Ffiec?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the FinCEN FORM 104 Rev 12 FFIEC Ffiec. You can trust our platform to keep your sensitive information safe.

Get more for FinCEN FORM 104 Rev 12 FFIEC Ffiec

- Child notarized custody agreement template form

- Child relocation agreement template form

- Child support agreement template form

- Child support custody agreement template form

- Child support modification agreement template form

- Child support letter agreement template form

- Child support between parents agreement template form

- Child support mutual agreement template form

Find out other FinCEN FORM 104 Rev 12 FFIEC Ffiec

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer