Consolidated Reports of Condition and Income for a Bank with Domestic of Ces Only FFIEC 041 Report at the Close of Business Marc Form

Understanding the Consolidated Reports of Condition and Income

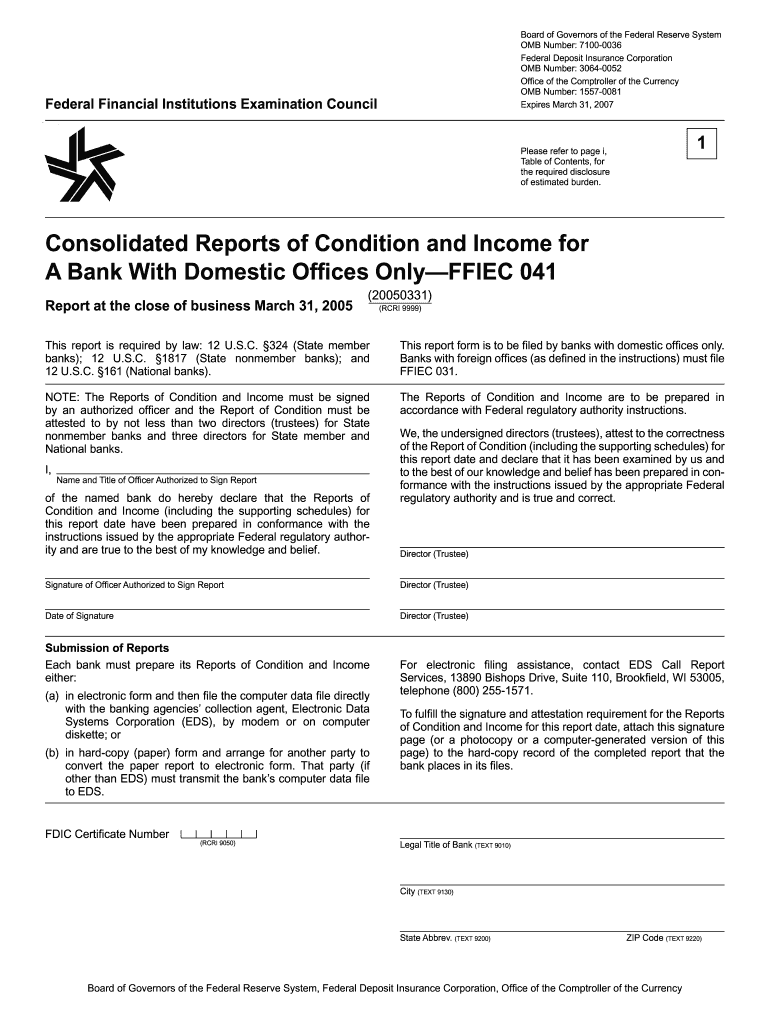

The Consolidated Reports of Condition and Income for a Bank with Domestic Offices Only, commonly referred to as the FFIEC 041 report, is a critical document required by law under 12 U.S.C. This report provides a comprehensive overview of a bank's financial condition at the close of business on March 31, 2005. It includes detailed information on assets, liabilities, and income, which are essential for regulatory compliance and financial transparency.

How to Use the FFIEC 041 Report

Utilizing the FFIEC 041 report effectively involves understanding its structure and the information it contains. Financial institutions use this report to assess their performance and compliance with regulatory standards. Stakeholders, including investors and regulatory bodies, analyze the data to gauge the bank's financial health and operational efficiency. Proper interpretation of this report can aid in strategic decision-making and risk management.

Obtaining the FFIEC 041 Report

To obtain the FFIEC 041 report, banks must complete the required documentation and submit it to the appropriate regulatory authorities. Typically, this involves accessing the reporting platform provided by the Federal Financial Institutions Examination Council (FFIEC). Banks can also find historical reports through the FFIEC's online database, which archives submissions for public access.

Steps to Complete the FFIEC 041 Report

Completing the FFIEC 041 report involves several key steps:

- Gather necessary financial data, including balance sheets and income statements.

- Follow the specific guidelines provided by the FFIEC for data entry.

- Review the report for accuracy and completeness before submission.

- Submit the report electronically through the FFIEC's designated platform.

Legal Use of the FFIEC 041 Report

The FFIEC 041 report is legally mandated for banks operating in the United States. Compliance with the reporting requirements is essential to avoid penalties and ensure transparency in banking operations. The report serves as a tool for regulators to monitor the financial stability of banks and protect consumers.

Key Elements of the FFIEC 041 Report

Key elements of the FFIEC 041 report include:

- Assets: Total assets held by the bank, including cash, loans, and investments.

- Liabilities: Total liabilities, which encompass deposits and borrowed funds.

- Income: Detailed breakdown of income sources, including interest and non-interest income.

- Capital: Information on the bank's capital structure and ratios.

Filing Deadlines and Important Dates

Filing deadlines for the FFIEC 041 report are established by the FFIEC and must be adhered to by all reporting banks. Typically, the report is due quarterly, with specific dates set for each reporting period. Staying informed about these deadlines is crucial for compliance and avoiding late submission penalties.

Quick guide on how to complete consolidated reports of condition and income for a bank with domestic of ces only ffiec 041 report at the close of business

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily access the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without holdups. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools available to fill out your document.

- Mark important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details carefully and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and electronically sign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Consolidated Reports Of Condition And Income For A Bank With Domestic Of Ces Only FFIEC 041 Report At The Close Of Business Marc

Create this form in 5 minutes!

How to create an eSignature for the consolidated reports of condition and income for a bank with domestic of ces only ffiec 041 report at the close of business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Consolidated Reports Of Condition And Income For A Bank With Domestic Of Ces Only FFIEC 041?

Consolidated Reports Of Condition And Income For A Bank With Domestic Of Ces Only FFIEC 041 are essential financial documents that banks must file to comply with federal regulations. These reports provide a comprehensive overview of a bank's financial status at the close of business on March 31, 20050331. Understanding these reports is crucial for stakeholders to assess the bank's performance and compliance.

-

Why is the FFIEC 041 Report required by law?

The FFIEC 041 Report is mandated by law to ensure transparency and accountability in the banking sector. It helps regulators monitor the financial health of banks and ensures they adhere to safety and soundness standards. Compliance with this requirement is critical for maintaining public trust and regulatory approval.

-

How can airSlate SignNow assist in preparing the FFIEC 041 Report?

airSlate SignNow offers a streamlined solution for preparing and eSigning the FFIEC 041 Report. With its user-friendly interface, businesses can easily gather necessary data, collaborate with team members, and ensure that all required signatures are obtained efficiently. This simplifies the process of generating Consolidated Reports Of Condition And Income for compliance.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time collaboration tools. These features enhance the document management process, making it easier to create and manage Consolidated Reports Of Condition And Income For A Bank With Domestic Of Ces Only FFIEC 041. Additionally, the platform ensures that all documents are securely stored and easily accessible.

-

Is airSlate SignNow cost-effective for small banks?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small banks. With flexible pricing plans, it allows institutions to manage their document signing needs without incurring high costs. This affordability makes it an ideal choice for preparing Consolidated Reports Of Condition And Income efficiently.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with various applications, including CRM systems, cloud storage services, and accounting software. These integrations facilitate the smooth transfer of data needed for generating Consolidated Reports Of Condition And Income For A Bank With Domestic Of Ces Only FFIEC 041. This connectivity enhances workflow efficiency and reduces manual data entry.

-

How secure is airSlate SignNow for handling sensitive banking documents?

Security is a top priority for airSlate SignNow, which employs advanced encryption and compliance measures to protect sensitive banking documents. The platform ensures that all data, including Consolidated Reports Of Condition And Income For A Bank With Domestic Of Ces Only FFIEC 041, is securely stored and transmitted. This commitment to security helps banks maintain compliance with regulatory standards.

Get more for Consolidated Reports Of Condition And Income For A Bank With Domestic Of Ces Only FFIEC 041 Report At The Close Of Business Marc

- Company loan to employee agreement template form

- Company merger agreement template form

- Company mobile phone agreement template form

- Company non compete agreement template form

- Company non disclosure agreement template form

- Company owned cell phone agreement template form

- Company ownership agreement template form

- Company phone agreement template form

Find out other Consolidated Reports Of Condition And Income For A Bank With Domestic Of Ces Only FFIEC 041 Report At The Close Of Business Marc

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online