June 8, Freddie Mac Form

What is the June 8, Freddie Mac

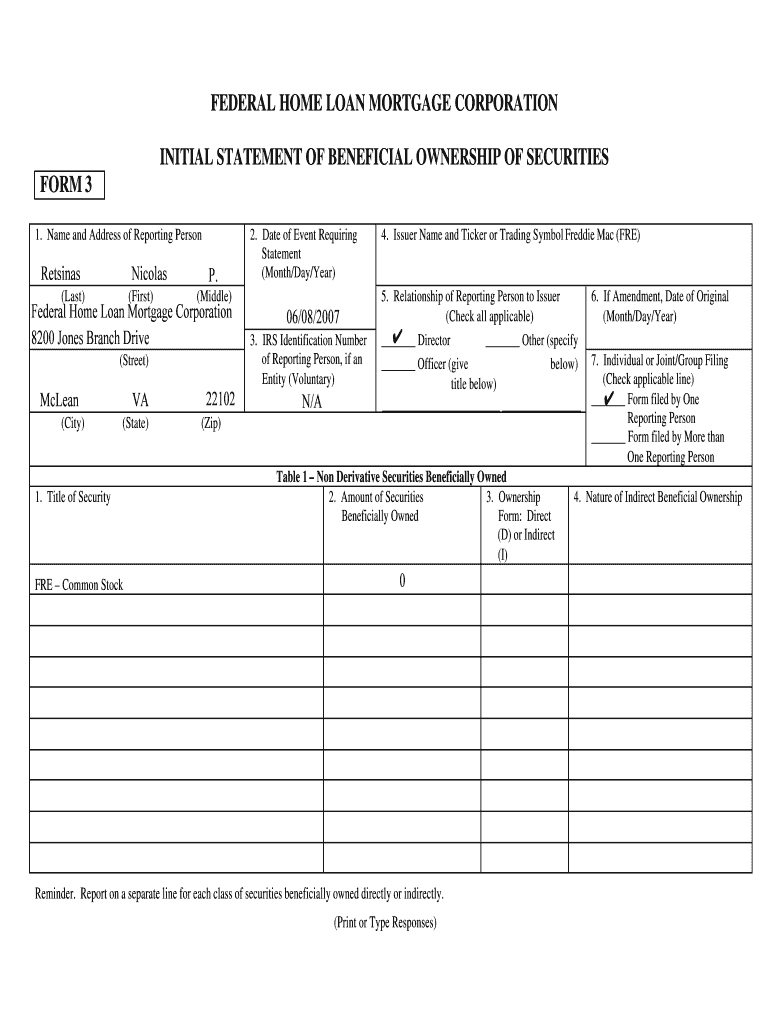

The June 8, Freddie Mac refers to a specific form related to mortgage applications and refinancing options provided by Freddie Mac, a government-sponsored enterprise that plays a crucial role in the U.S. housing market. This form is essential for borrowers seeking to understand their eligibility for various mortgage products, including conventional loans and refinancing options. It outlines the necessary information needed from applicants to assess their financial situation and determine suitable mortgage solutions.

How to use the June 8, Freddie Mac

Using the June 8, Freddie Mac form involves several steps. First, gather all necessary financial documents, including income statements, tax returns, and credit history. Next, fill out the form accurately, providing detailed information about your financial status, property details, and any existing mortgages. Once completed, review the form for accuracy before submission. This form can be used to apply for a new mortgage or to refinance an existing loan, making it a versatile tool for borrowers.

Steps to complete the June 8, Freddie Mac

Completing the June 8, Freddie Mac form requires careful attention to detail. Follow these steps:

- Collect necessary documentation, such as pay stubs, W-2 forms, and bank statements.

- Fill out the borrower information section, including names, addresses, and Social Security numbers.

- Provide details about the property, including its address, type, and current mortgage status.

- Disclose your financial information, including income, assets, and liabilities.

- Review the form for completeness and accuracy before submitting it to your lender.

Key elements of the June 8, Freddie Mac

The June 8, Freddie Mac form includes several key elements that are vital for the mortgage application process. These include borrower identification, property information, financial disclosures, and loan details. Each section is designed to provide lenders with a comprehensive view of the applicant's financial standing and the property in question. Accurate completion of these elements is crucial for a successful application.

Legal use of the June 8, Freddie Mac

The legal use of the June 8, Freddie Mac form is governed by federal regulations and guidelines established by Freddie Mac. This form must be completed truthfully and accurately, as any discrepancies or false information can lead to legal consequences, including denial of the mortgage application or potential fraud charges. It is essential for applicants to understand their legal obligations when using this form.

Who Issues the Form

The June 8, Freddie Mac form is issued by Freddie Mac itself, a key player in the U.S. mortgage market. As a government-sponsored enterprise, Freddie Mac provides guidelines and resources for lenders and borrowers, ensuring that the mortgage process is accessible and efficient. The form is part of their efforts to standardize mortgage applications and improve the overall experience for homebuyers and homeowners.

Quick guide on how to complete june 8 freddie mac

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Easily Edit and eSign [SKS] with No Effort

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to June 8, Freddie Mac

Create this form in 5 minutes!

How to create an eSignature for the june 8 freddie mac

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of June 8, Freddie Mac in the context of airSlate SignNow?

June 8, Freddie Mac is an important date for businesses looking to streamline their document signing processes. airSlate SignNow offers a reliable solution that aligns with the needs of organizations preparing for changes in Freddie Mac regulations. By utilizing our platform, businesses can ensure compliance and efficiency in their document management.

-

How does airSlate SignNow support businesses in relation to June 8, Freddie Mac?

airSlate SignNow provides tools that help businesses prepare for the June 8, Freddie Mac updates. Our platform allows users to create, send, and eSign documents quickly, ensuring that all necessary paperwork is completed in a timely manner. This helps organizations stay ahead of regulatory changes and maintain compliance.

-

What pricing options does airSlate SignNow offer for businesses concerned about June 8, Freddie Mac?

We offer flexible pricing plans tailored to meet the needs of businesses preparing for June 8, Freddie Mac. Our plans are designed to be cost-effective, ensuring that organizations can access essential features without breaking the bank. Contact us for a detailed breakdown of our pricing options.

-

What features does airSlate SignNow provide that are relevant to June 8, Freddie Mac?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking, all of which are crucial for businesses navigating the June 8, Freddie Mac updates. These tools enhance efficiency and ensure that all documents are handled securely and in compliance with regulations.

-

How can airSlate SignNow benefit my business in light of June 8, Freddie Mac?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document management, especially in preparation for June 8, Freddie Mac. Our platform simplifies the eSigning process, allowing teams to focus on core activities while ensuring that all documents are signed and stored securely.

-

Does airSlate SignNow integrate with other tools to assist with June 8, Freddie Mac compliance?

Yes, airSlate SignNow integrates seamlessly with various business applications to help streamline processes related to June 8, Freddie Mac. These integrations allow for a more cohesive workflow, ensuring that all necessary documents are easily accessible and compliant with the latest regulations.

-

Is airSlate SignNow user-friendly for teams preparing for June 8, Freddie Mac?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for teams to navigate and utilize the platform effectively. This user-friendly interface is particularly beneficial for organizations preparing for June 8, Freddie Mac, as it minimizes the learning curve and accelerates adoption.

Get more for June 8, Freddie Mac

- Preference share agreement template form

- Preferred partner agreement template form

- Preferred provider agreement template form

- Preferred stock purchase agreement template form

- Preferred supplier agreement template form

- Preferred stock agreement template form

- Preliminary agreement template form

- Preferred vendor agreement template 787746207 form

Find out other June 8, Freddie Mac

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free