Vat1c Form

What is the Vat1c Form

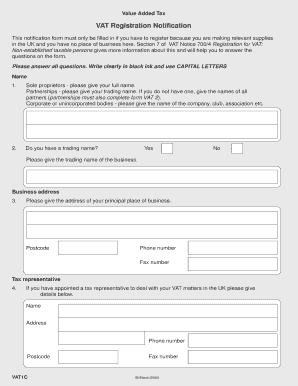

The Vat1c Form is a specific document used primarily for tax purposes in the United States. It is designed to facilitate the reporting of certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses who need to disclose their income, deductions, and other relevant financial data. Understanding the purpose and requirements of the Vat1c Form is crucial for compliance with federal tax regulations.

How to use the Vat1c Form

Using the Vat1c Form involves several steps that ensure accurate reporting of financial information. First, gather all necessary documents, such as income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to double-check for any errors before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements outlined by the IRS.

Steps to complete the Vat1c Form

Completing the Vat1c Form requires attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents, including income statements and expense receipts.

- Download the Vat1c Form from the IRS website or obtain a physical copy.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that the figures match your financial documents.

- Include any applicable deductions and credits, following IRS guidelines.

- Review the entire form for accuracy and completeness.

- Submit the form by the deadline specified by the IRS.

Key elements of the Vat1c Form

The Vat1c Form contains several key elements that are vital for accurate reporting. These elements include:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: All sources of income must be reported, including wages, interest, and dividends.

- Deductions and Credits: This section allows taxpayers to claim eligible deductions and credits to reduce their taxable income.

- Signature: The form must be signed and dated to validate the information provided.

Legal use of the Vat1c Form

The Vat1c Form is legally recognized by the IRS and must be used in accordance with federal tax laws. It is important to ensure that the information reported is truthful and accurate, as providing false information can lead to penalties. Taxpayers should familiarize themselves with the legal requirements surrounding the use of this form to avoid any compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the Vat1c Form are crucial for compliance. Typically, the form must be submitted by April fifteenth of each year, unless an extension is filed. It is essential to keep track of any changes to deadlines announced by the IRS, as these can affect your filing obligations. Missing the deadline may result in penalties or interest on unpaid taxes.

Quick guide on how to complete vat1c form

Effortlessly prepare Vat1c Form on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage Vat1c Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Vat1c Form with ease

- Locate Vat1c Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for those tasks.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes necessitating the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Alter and eSign Vat1c Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat1c form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Vat1c Form and how is it used?

The Vat1c Form is a document used for VAT registration in certain jurisdictions. It allows businesses to apply for VAT registration and ensures compliance with tax regulations. Using airSlate SignNow, you can easily fill out and eSign the Vat1c Form, streamlining the registration process.

-

How can airSlate SignNow help with the Vat1c Form?

airSlate SignNow provides a user-friendly platform to create, edit, and eSign the Vat1c Form. With its intuitive interface, you can quickly complete the form and send it securely to the relevant authorities. This saves time and reduces the risk of errors in your VAT registration.

-

Is there a cost associated with using airSlate SignNow for the Vat1c Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features that facilitate the completion and eSigning of documents like the Vat1c Form. You can choose a plan that fits your budget while ensuring compliance with VAT regulations.

-

What features does airSlate SignNow offer for managing the Vat1c Form?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure eSigning for the Vat1c Form. These tools enhance efficiency and ensure that all stakeholders can contribute to the document seamlessly. Additionally, you can track the status of your form in real-time.

-

Can I integrate airSlate SignNow with other software for the Vat1c Form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Vat1c Form alongside your existing tools. Whether you use CRM systems or accounting software, you can streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for the Vat1c Form?

Using airSlate SignNow for the Vat1c Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and sharing of documents, ensuring that your VAT registration process is smooth and compliant. Plus, you can access your forms anytime, anywhere.

-

Is airSlate SignNow secure for handling the Vat1c Form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the Vat1c Form. The platform employs advanced encryption and authentication measures to protect your sensitive information. You can trust that your VAT registration documents are secure and confidential.

Get more for Vat1c Form

- Idaho parental consent to name change minor form

- Idaho petition for name change minor form

- Cao d 1 6 petition for divorce no children form

- Free colorado last will and testament template pdf form

- Full name of party filing this document mailing address pdffiller form

- Duct leakage affidavit kootenai county form

- Idaho letter requesting publication form

- Idaho motion and affidavit for fee waiver form

Find out other Vat1c Form

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe