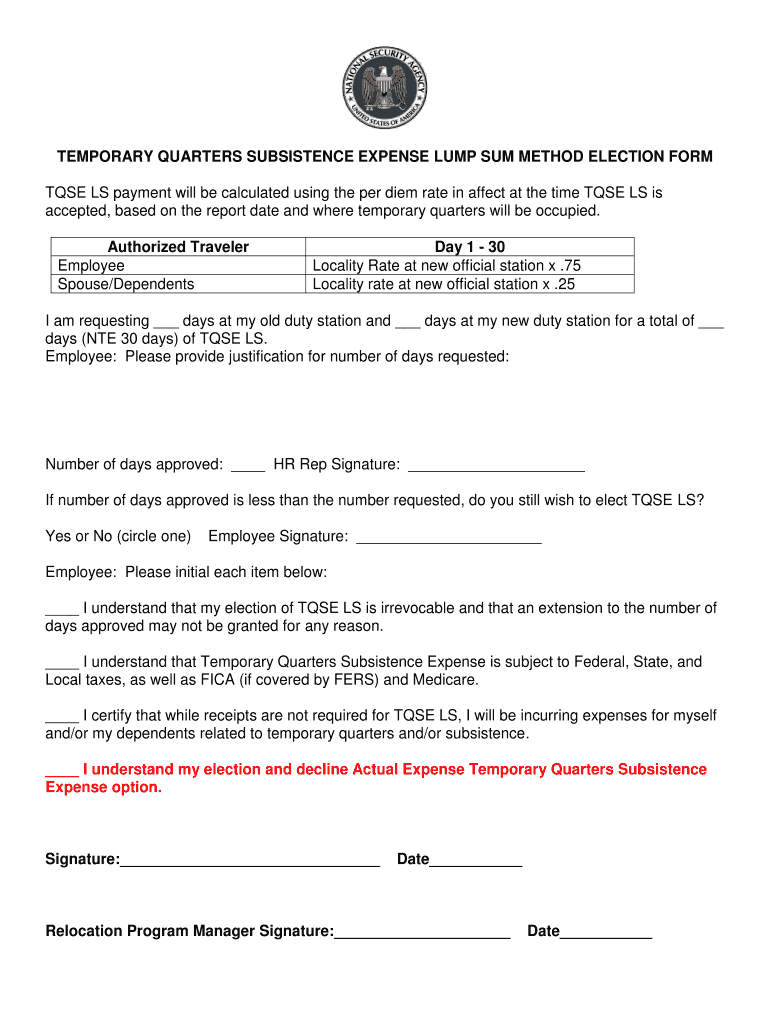

Lump Sum Method Nsa Form

What is the Lump Sum Method Nsa

The Lump Sum Method Nsa refers to a specific approach used in various financial and tax contexts, particularly for calculating benefits or payments. This method allows individuals or businesses to receive a single payment instead of multiple smaller payments over time. It is often utilized in scenarios involving retirement plans, settlements, or other financial agreements. Understanding this method is crucial for ensuring compliance with applicable regulations and maximizing financial outcomes.

How to use the Lump Sum Method Nsa

Using the Lump Sum Method Nsa involves several steps to ensure accurate calculations and compliance. First, gather all necessary financial documents, including previous tax returns and any relevant contracts or agreements. Next, determine the total amount to be paid in a lump sum. This may involve consulting with a financial advisor or tax professional to ensure that all variables are accounted for. Once the total is established, you can proceed with the necessary paperwork or forms required for submission.

Steps to complete the Lump Sum Method Nsa

Completing the Lump Sum Method Nsa requires a systematic approach:

- Identify the source of the lump sum payment.

- Gather all relevant documentation, including financial records and agreements.

- Calculate the total amount to be received in the lump sum.

- Complete the required forms, ensuring all information is accurate.

- Submit the forms through the appropriate channels, whether online, by mail, or in person.

Legal use of the Lump Sum Method Nsa

The legal use of the Lump Sum Method Nsa is governed by specific regulations that vary by state and context. It is essential to understand the legal implications of opting for a lump sum payment, as there may be tax consequences or eligibility requirements. Consulting with a legal expert or tax professional can help clarify these aspects and ensure compliance with federal and state laws.

Key elements of the Lump Sum Method Nsa

Several key elements define the Lump Sum Method Nsa:

- Payment Amount: The total sum to be received must be clearly defined and documented.

- Eligibility Criteria: Specific criteria must be met to qualify for the lump sum payment.

- Documentation: Proper documentation is essential for both legal and tax purposes.

- Submission Process: Understanding how to submit the necessary forms is crucial for compliance.

IRS Guidelines

The IRS provides specific guidelines regarding the Lump Sum Method Nsa, particularly concerning tax implications. It is important to refer to the latest IRS publications or consult with a tax professional to ensure that all requirements are met. This includes understanding how the lump sum payment will be taxed and any potential deductions or credits that may apply.

Quick guide on how to complete lump sum method nsa

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without issues. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] without exertion

- Find [SKS] and then click Get Form to commence.

- Employ the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Lump Sum Method Nsa

Create this form in 5 minutes!

How to create an eSignature for the lump sum method nsa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Lump Sum Method Nsa?

The Lump Sum Method Nsa is a financial approach used to calculate the total cost of a project or service in a single payment. This method simplifies budgeting and financial planning for businesses by providing a clear, upfront cost. By utilizing the Lump Sum Method Nsa, companies can avoid unexpected expenses and streamline their financial processes.

-

How does airSlate SignNow support the Lump Sum Method Nsa?

airSlate SignNow offers features that facilitate the implementation of the Lump Sum Method Nsa by allowing businesses to create, send, and eSign documents efficiently. With its user-friendly interface, companies can easily manage contracts and agreements related to lump sum payments. This ensures that all parties are aligned on costs and terms, enhancing transparency and trust.

-

What are the benefits of using the Lump Sum Method Nsa?

Using the Lump Sum Method Nsa provides several benefits, including predictable budgeting and reduced financial risk. It allows businesses to have a clear understanding of their expenses upfront, which aids in better financial planning. Additionally, this method can improve cash flow management by consolidating costs into a single payment.

-

Is airSlate SignNow cost-effective for implementing the Lump Sum Method Nsa?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to implement the Lump Sum Method Nsa. With competitive pricing plans, companies can access powerful eSigning features without breaking the bank. This affordability makes it easier for businesses of all sizes to adopt the Lump Sum Method Nsa in their operations.

-

Can I integrate airSlate SignNow with other tools for the Lump Sum Method Nsa?

Absolutely! airSlate SignNow offers seamless integrations with various business tools and software, enhancing the effectiveness of the Lump Sum Method Nsa. Whether you use project management software or accounting tools, integrating SignNow can streamline your workflow and improve document management related to lump sum agreements.

-

How secure is airSlate SignNow when using the Lump Sum Method Nsa?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents related to the Lump Sum Method Nsa. The platform employs advanced encryption and security protocols to protect your data. This ensures that all transactions and agreements are safe, giving you peace of mind while managing your financial commitments.

-

What types of documents can I manage with the Lump Sum Method Nsa using airSlate SignNow?

With airSlate SignNow, you can manage a variety of documents related to the Lump Sum Method Nsa, including contracts, invoices, and agreements. The platform allows you to create, edit, and eSign these documents easily. This versatility helps businesses maintain organized records and ensures compliance with financial agreements.

Get more for Lump Sum Method Nsa

Find out other Lump Sum Method Nsa

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy