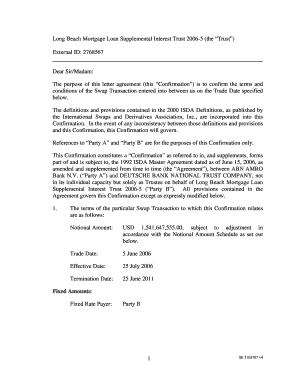

Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec Form

What is the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec

The Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec is a financial instrument designed to manage and facilitate mortgage loans. This trust is part of a series of supplemental interest trusts that provide a structured approach to mortgage financing. It typically involves pooling various mortgage loans and managing them under a trust structure, allowing for efficient distribution of interest payments to investors. This setup is particularly useful for investors seeking stable income through mortgage-backed securities.

How to use the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec

Using the Long Beach Mortgage Loan Supplemental Interest Trust involves understanding its structure and the specific terms outlined in the trust documents. Investors can participate by purchasing shares or interests in the trust, which entitles them to a portion of the income generated from the underlying mortgage loans. It is essential to review the trust's offering documents for details on payment schedules, interest rates, and any associated fees. Additionally, maintaining communication with the trust administrator can provide insights into performance and any changes in management strategies.

Steps to complete the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec

Completing transactions related to the Long Beach Mortgage Loan Supplemental Interest Trust generally involves several key steps:

- Review the trust documentation to understand the terms and conditions.

- Determine the amount of investment you wish to make in the trust.

- Fill out any required subscription agreements or investment forms.

- Submit the necessary documents along with your investment funds.

- Receive confirmation of your investment and any associated documentation.

Legal use of the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec

The legal use of the Long Beach Mortgage Loan Supplemental Interest Trust is governed by federal and state securities laws. Investors must ensure compliance with regulations regarding the sale and distribution of securities. The trust must also adhere to guidelines set forth by the Securities and Exchange Commission (SEC) and any applicable state regulatory bodies. Proper legal counsel can assist in navigating these requirements to ensure that all transactions are conducted lawfully and transparently.

Key elements of the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec

Key elements of the Long Beach Mortgage Loan Supplemental Interest Trust include:

- Trust Structure: A defined legal framework that outlines the management of the mortgage loans.

- Investment Terms: Specifics regarding interest rates, payment schedules, and investor rights.

- Management Team: Information about the individuals or entities responsible for overseeing the trust's operations.

- Risk Factors: Disclosure of potential risks associated with investing in the trust.

Required Documents

To participate in the Long Beach Mortgage Loan Supplemental Interest Trust, certain documents are typically required:

- Subscription agreement or investment application.

- Proof of identity and accreditation, if applicable.

- Financial statements or other documentation that may be requested by the trust administrator.

Quick guide on how to complete long beach mortgage loan supplemental interest trust 5 the trust edgar sec

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Highlight key sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for these tasks.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to preserve your changes.

- Decide how you would prefer to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign [SKS] to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the long beach mortgage loan supplemental interest trust 5 the trust edgar sec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec.?

The Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. is a financial instrument designed to manage mortgage loans effectively. It provides investors with a structured way to invest in mortgage-backed securities, ensuring a steady income stream. Understanding this trust can help you make informed decisions regarding your investments.

-

How does the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. benefit investors?

Investors in the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. can benefit from predictable cash flows and diversification of their investment portfolio. This trust is structured to minimize risk while maximizing returns, making it an attractive option for those looking to invest in real estate-backed securities.

-

What are the pricing options for the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec.?

Pricing for the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. varies based on market conditions and the specific terms of the investment. It is advisable to consult with a financial advisor to understand the costs associated with investing in this trust and to find the best pricing options available.

-

What features does the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. offer?

The Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. offers features such as regular income distributions, transparency in investment performance, and a structured approach to managing mortgage loans. These features make it easier for investors to track their investments and understand their returns.

-

How can I integrate the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. into my investment strategy?

Integrating the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. into your investment strategy involves assessing your financial goals and risk tolerance. By including this trust in a diversified portfolio, you can enhance your investment strategy with stable returns from mortgage-backed securities.

-

What are the risks associated with the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec.?

Like any investment, the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. carries certain risks, including market fluctuations and changes in interest rates. It's important to conduct thorough research and consider these risks before investing to ensure that it aligns with your financial objectives.

-

Can I access detailed reports on the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec.?

Yes, investors can access detailed reports on the Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec. These reports provide insights into the performance of the trust, including income distributions and asset management, helping you stay informed about your investment.

Get more for Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children north dakota form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure north 497317524 form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497317525 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497317526 form

- North dakota landlord 497317527 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497317528 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497317529 form

- Trash violation notice template form

Find out other Long Beach Mortgage Loan Supplemental Interest Trust 5 the Trust Edgar Sec

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free