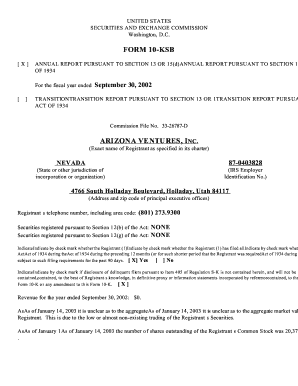

ANNUAL REPO RT PURSUANT to SECTION 13 or 15dANNUAL REPORT PURSUANT to SECTION 1 Sec Form

Understanding the Annual Report Pursuant to Section 13 or 15(d)

The Annual Report Pursuant to Section 13 or 15(d) is a crucial document for publicly traded companies in the United States. This report provides a comprehensive overview of a company's financial performance, including its income statement, balance sheet, and cash flow statement. It is designed to keep investors informed about the company's operations and financial health. The report must be filed with the Securities and Exchange Commission (SEC) and is typically due within a specified timeframe following the end of the fiscal year.

Steps to Complete the Annual Report Pursuant to Section 13 or 15(d)

Completing the Annual Report involves several key steps:

- Gather financial data, including revenue, expenses, and assets.

- Prepare the income statement, balance sheet, and cash flow statement.

- Ensure compliance with SEC regulations and accounting standards.

- Review the report for accuracy and completeness.

- File the report electronically through the SEC's EDGAR system.

Required Documents for the Annual Report Pursuant to Section 13 or 15(d)

To successfully file the Annual Report, companies must compile several documents:

- Financial statements for the fiscal year.

- Management discussion and analysis (MD&A) of financial condition.

- Disclosure of executive compensation.

- Information about internal controls and risk factors.

Filing Deadlines for the Annual Report Pursuant to Section 13 or 15(d)

Filing deadlines for the Annual Report can vary based on the company's size and reporting status:

- Large accelerated filers must file within 60 days after the end of the fiscal year.

- Accelerated filers have 75 days to file.

- Non-accelerated filers are required to file within 90 days.

Legal Use of the Annual Report Pursuant to Section 13 or 15(d)

The Annual Report serves several legal purposes, including:

- Providing transparency to investors and stakeholders.

- Meeting regulatory requirements set forth by the SEC.

- Facilitating informed decision-making by investors.

Penalties for Non-Compliance with the Annual Report Requirements

Failure to file the Annual Report on time can result in significant penalties, including:

- Fines imposed by the SEC.

- Potential legal action from investors.

- Loss of investor trust and market reputation.

Quick guide on how to complete annual repo rt pursuant to section 13 or 15dannual report pursuant to section 1 sec

Complete [SKS] effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without any delays. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to submit your form: by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ANNUAL REPO RT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec

Create this form in 5 minutes!

How to create an eSignature for the annual repo rt pursuant to section 13 or 15dannual report pursuant to section 1 sec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an ANNUAL REPORT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec.?

An ANNUAL REPORT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec. is a comprehensive report that publicly traded companies must file with the SEC. This report provides a detailed overview of the company's financial performance, including income statements, balance sheets, and cash flow statements.

-

How can airSlate SignNow help with filing an ANNUAL REPORT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec.?

airSlate SignNow streamlines the process of preparing and submitting your ANNUAL REPORT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec. by allowing you to eSign documents securely and efficiently. Our platform ensures compliance and provides templates to simplify your reporting process.

-

What features does airSlate SignNow offer for managing ANNUAL REPORTS?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your ANNUAL REPORT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec. These tools help ensure that your reports are completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses needing to file ANNUAL REPORTS?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are flexible, allowing small businesses to access the necessary tools to manage their ANNUAL REPORT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec. without breaking the bank.

-

Can I integrate airSlate SignNow with other software for my ANNUAL REPORTS?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate our eSigning capabilities into your existing workflow. This ensures that your ANNUAL REPORT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec. process is seamless and efficient.

-

What are the benefits of using airSlate SignNow for ANNUAL REPORTS?

Using airSlate SignNow for your ANNUAL REPORT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec. provides numerous benefits, including enhanced security, faster turnaround times, and improved compliance. Our platform simplifies the eSigning process, allowing you to focus on your business.

-

How secure is airSlate SignNow for handling ANNUAL REPORTS?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your documents, ensuring that your ANNUAL REPORT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec. is safe from unauthorized access and tampering.

Get more for ANNUAL REPO RT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec

- Home loan form nri_a42_210607qxd

- Grant application da davidson amp co form

- Pistons custom form

- Class registration form community scholar university of virginia scps virginia

- Transcript request form owens community college owens

- Fl 683 form

- Subcontractor prequalification form schmid construction

- This renewal is due on or before december 1 illinois form

Find out other ANNUAL REPO RT PURSUANT TO SECTION 13 OR 15dANNUAL REPORT PURSUANT TO SECTION 1 Sec

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word