Tax Return Engagement Letter Service Agreement Crane and Bell Form

What is the Tax Return Engagement Letter Service Agreement Crane And Bell

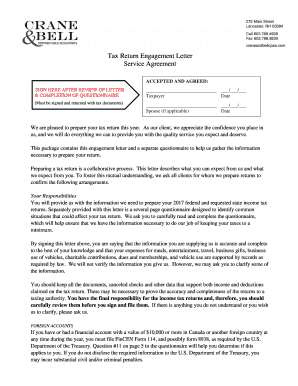

The Tax Return Engagement Letter Service Agreement Crane And Bell is a formal document that outlines the terms and conditions under which a tax professional will prepare and file tax returns on behalf of a client. This agreement serves to clarify the responsibilities of both the tax preparer and the client, ensuring that both parties understand their obligations in the tax preparation process. It typically includes details regarding the scope of services, fees, confidentiality, and the timeline for completion.

Key elements of the Tax Return Engagement Letter Service Agreement Crane And Bell

Several critical components are essential in the Tax Return Engagement Letter Service Agreement Crane And Bell. These elements include:

- Scope of Services: A clear description of the services provided, including tax preparation, filing, and any additional consultations.

- Fees and Payment Terms: Information about the cost of services, payment methods, and any applicable deadlines.

- Client Responsibilities: An outline of the information and documentation the client must provide to facilitate the tax preparation process.

- Confidentiality Clause: Assurance that the client’s financial information will be kept confidential and secure.

- Dispute Resolution: Procedures for resolving any disagreements that may arise during the engagement.

How to use the Tax Return Engagement Letter Service Agreement Crane And Bell

Using the Tax Return Engagement Letter Service Agreement Crane And Bell involves several steps to ensure clarity and compliance. First, both the tax professional and the client should review the agreement thoroughly. It’s important to discuss any questions or concerns before signing. Once both parties agree to the terms, they should sign and date the document. This signed agreement serves as a reference throughout the tax preparation process, helping to ensure that both parties adhere to the agreed-upon terms.

Steps to complete the Tax Return Engagement Letter Service Agreement Crane And Bell

Completing the Tax Return Engagement Letter Service Agreement Crane And Bell requires attention to detail. The following steps outline the process:

- Gather necessary information, including client details and the scope of services.

- Draft the engagement letter, incorporating all key elements such as fees and responsibilities.

- Review the draft with the client, ensuring all terms are clear and acceptable.

- Make any necessary revisions based on client feedback.

- Obtain signatures from both parties to finalize the agreement.

Legal use of the Tax Return Engagement Letter Service Agreement Crane And Bell

The Tax Return Engagement Letter Service Agreement Crane And Bell is legally binding once signed by both parties. It is essential for tax professionals to use this agreement to establish a formal relationship with their clients, protecting both parties’ rights and outlining expectations. This agreement helps mitigate potential disputes and provides a clear framework for the engagement, ensuring compliance with applicable laws and regulations governing tax preparation services.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for both tax professionals and clients. The Tax Return Engagement Letter Service Agreement Crane And Bell should specify relevant dates, including:

- Initial consultation date

- Deadline for submitting necessary documents

- Tax filing deadline, typically April fifteenth for individual returns

- Extensions, if applicable, and their respective deadlines

Quick guide on how to complete tax return engagement letter service agreement crane and bell

Effortlessly prepare Tax Return Engagement Letter Service Agreement Crane And Bell on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, enabling you to access the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage Tax Return Engagement Letter Service Agreement Crane And Bell on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Tax Return Engagement Letter Service Agreement Crane And Bell with ease

- Find Tax Return Engagement Letter Service Agreement Crane And Bell and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Tax Return Engagement Letter Service Agreement Crane And Bell and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return engagement letter service agreement crane and bell

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Return Engagement Letter Service Agreement Crane And Bell?

The Tax Return Engagement Letter Service Agreement Crane And Bell is a formal document that outlines the terms and conditions between a tax preparer and their client. This agreement ensures clarity on the services provided, fees, and responsibilities, making it essential for both parties.

-

How much does the Tax Return Engagement Letter Service Agreement Crane And Bell cost?

Pricing for the Tax Return Engagement Letter Service Agreement Crane And Bell varies based on the complexity of the services required. However, airSlate SignNow offers competitive rates that are designed to be cost-effective for businesses of all sizes, ensuring you get value for your investment.

-

What features are included in the Tax Return Engagement Letter Service Agreement Crane And Bell?

The Tax Return Engagement Letter Service Agreement Crane And Bell includes features such as customizable templates, eSignature capabilities, and secure document storage. These features streamline the process, making it easier for tax preparers and clients to manage their agreements efficiently.

-

How can the Tax Return Engagement Letter Service Agreement Crane And Bell benefit my business?

Utilizing the Tax Return Engagement Letter Service Agreement Crane And Bell can enhance your business's professionalism and client trust. By clearly defining expectations and responsibilities, you can reduce misunderstandings and foster better client relationships.

-

Is the Tax Return Engagement Letter Service Agreement Crane And Bell easy to use?

Yes, the Tax Return Engagement Letter Service Agreement Crane And Bell is designed to be user-friendly. With airSlate SignNow's intuitive interface, you can easily create, send, and manage your agreements without any technical expertise.

-

Can I integrate the Tax Return Engagement Letter Service Agreement Crane And Bell with other software?

Absolutely! The Tax Return Engagement Letter Service Agreement Crane And Bell can be integrated with various accounting and tax software solutions. This integration helps streamline your workflow and ensures that all your documents are in sync.

-

What security measures are in place for the Tax Return Engagement Letter Service Agreement Crane And Bell?

airSlate SignNow prioritizes security for the Tax Return Engagement Letter Service Agreement Crane And Bell. We implement advanced encryption and secure access protocols to protect your sensitive information, ensuring that your documents remain confidential.

Get more for Tax Return Engagement Letter Service Agreement Crane And Bell

Find out other Tax Return Engagement Letter Service Agreement Crane And Bell

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation